Hedging the Cost of Lumber in Real Estate

Disclaimer: This article is only meant to provoke thought. This is not investment advice. This case study is hazardous if you aren't an expert. Always consult with an investment professional before enacting any hedging techniques.

Lumber prices are on the rise, and it's making homebuilding a challenge. The coronavirus pandemic, sawmill shutdowns, low mortgage rates, and a red-hot housing market have created a ton of volatility in lumber costs and other building materials. In addition, lumber tariffs on Canada's imports enacted in 2018 by the Trump administration are also thought to impact real-time prices (although they were reduced during COVID). The Biden Administration may increase tariffs on Canadian lumber to jumpstart the domestic lumber mills. Nobody can predict how this would affect backlogged orders, lumber supply chains, or consumer prices.

I've spoken with a handful of multifamily home developers about their strategy in the current environment. Most are perplexed at the price of lumber and either wait for more clarity or speculate that the lumber markets will stabilize by the time they break ground on their project (often a year or two out). Per the National Association of Home Builders (NAHB), the current spike in lumber costs alone has increased the average price of a new construction home by $36,000 and $13,000 per unit for multifamily.

It got me thinking: what if builders didn't need to roll the dice? What if they could hedge the price of lumber and lock in a fixed price for the future price of materials using the financial markets? Why aren't more people doing this?

Lumber Futures

My first thought was entering the lumber futures markets. When people quote lumber costing "$1,400 or $1,650," it is the future contract they are referring to. Specifically, they mention the "random lengths" of the July 2021 contract for 1,000 board feet. The pricing information is on the Chicago Mercantile Exchange website (CME).

I am savvy with the financial markets and effortlessly navigate my stock trading application. But, for the life of me, I couldn't figure out how to:

Gain access to the lumber futures markets

Trade the futures if I did have access (specifically trade a call option on the July contract)

Every YouTube video explaining how to hedge commodity futures sounds foolproof, but in real life, I didn't know where to start when it came to time executing a strategy.

I also read horror stories about speculators forgetting to close their trade before expiration and being forced to take physical delivery of their trading commodity. It's unlikely the type of timber and the quantity will align perfectly with the actual project specs, so taking inventory would not be ideal (or cheap).

The other issue with lumber futures is that the "hedger" would see no upside (cost savings) if prices began to fall. For round numbers purposes, if lumber today costs $1,400 and a general contractor locks in the $1,400 six months from now and the price increases to $1,600, the general contractor saves $200. However, if prices dropped to $1,200, they would still pay $1,400. Thus, in the second scenario, the homebuilder who didn't hedge would have reaped ample cost savings while the general contractor would still be locked in at $1,400.

Is there an option out there where you could hedge the price increase but reap the rewards of falling lumber prices?

Call Options

Options trading gets an awful rap. We mostly hear about them in the news as an 18-year-old with no investment experience opening up a Robinhood account, beginning trading options, and racking up thousands of dollars in margin interest they can't pay back.

Believe it or not, options exist for...HEDGING. They weren't invented this past year, so young adults could entertain themselves during quarantine to replace sports betting and live gaming. But, they can be a potent business tool when volatility in cost outputs makes future operations uncertain.

Simple Terms

What could a call option do for you?

You pay a sum in the present that acts as an insurance policy for rising lumber prices.

You would still benefit if prices decrease, and your call option would reimburse you if there are continued price increases.

The Execution

Finding a stock or ETF mirroring the lumber futures would take some serious research. As I mentioned earlier, trading the actual futures contract didn't seem feasible for an average Joe/Jane with a brokerage account.

For the sake of example, I settled on an imaginary company, Tactica Real Estate Solutions Lumber — a lumber manufacturer located in Minneapolis, MN.

Ticker: TRES-L

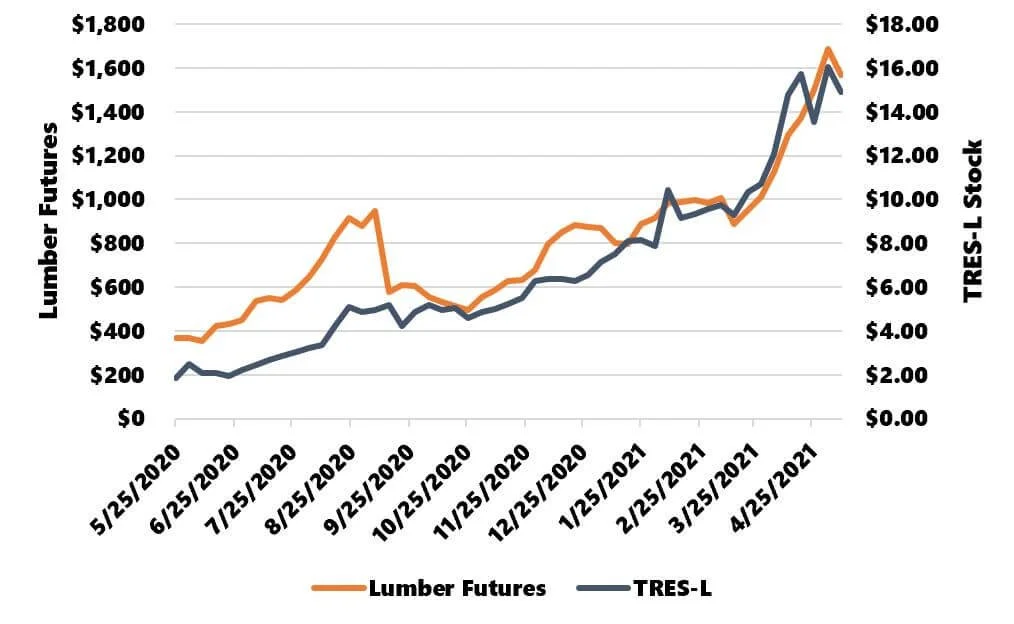

I compared their trailing one-year stock prices to the one-year futures contract of lumber. The correlation is not perfect, but it is solid.

Correlation = .93

Stated differently, if the lumber futures increase, there's an excellent chance that the stock TRES-L will increase. Again, you can see how they have closely mirrored each other over the past year.

This is essential. If lumber continues to rise but the stock tanks, the hedge could be disastrous. Both instruments (the futures contracts and the stock ) must move close to lockstep to be effective for the call option hedge.

Lumber Future Prices

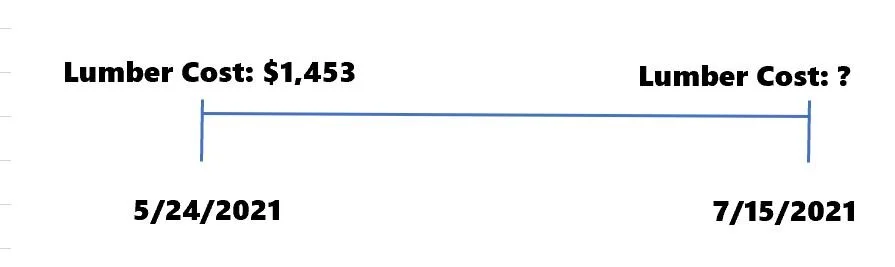

Current Lumber Future: $1,453

Current Date: 5/24/2021

Projected Lumber Purchase Date: 7/15/2021

Construction Project Scenario

Smaller numbers are more straightforward to conceptualize, so let's keep the lumber dollars small to focus on the role of the call option.

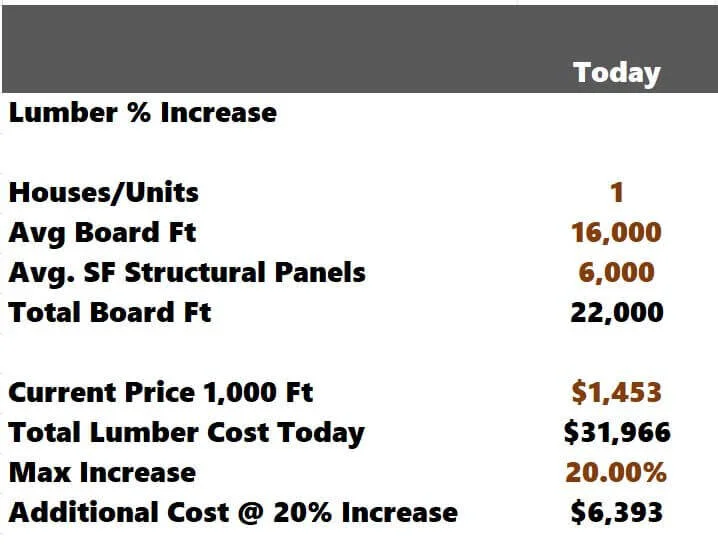

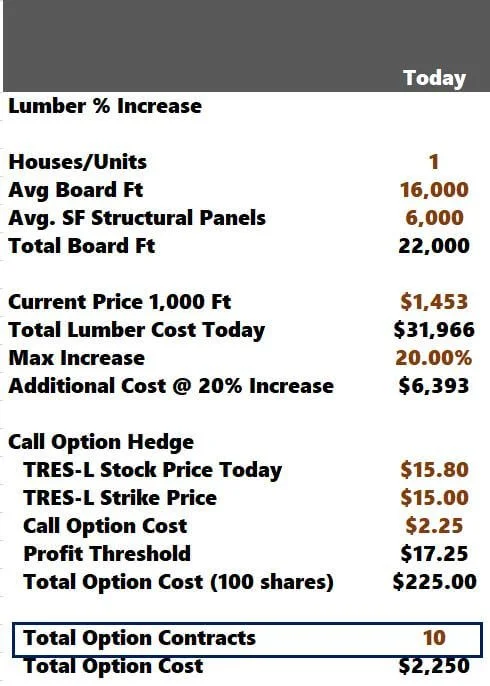

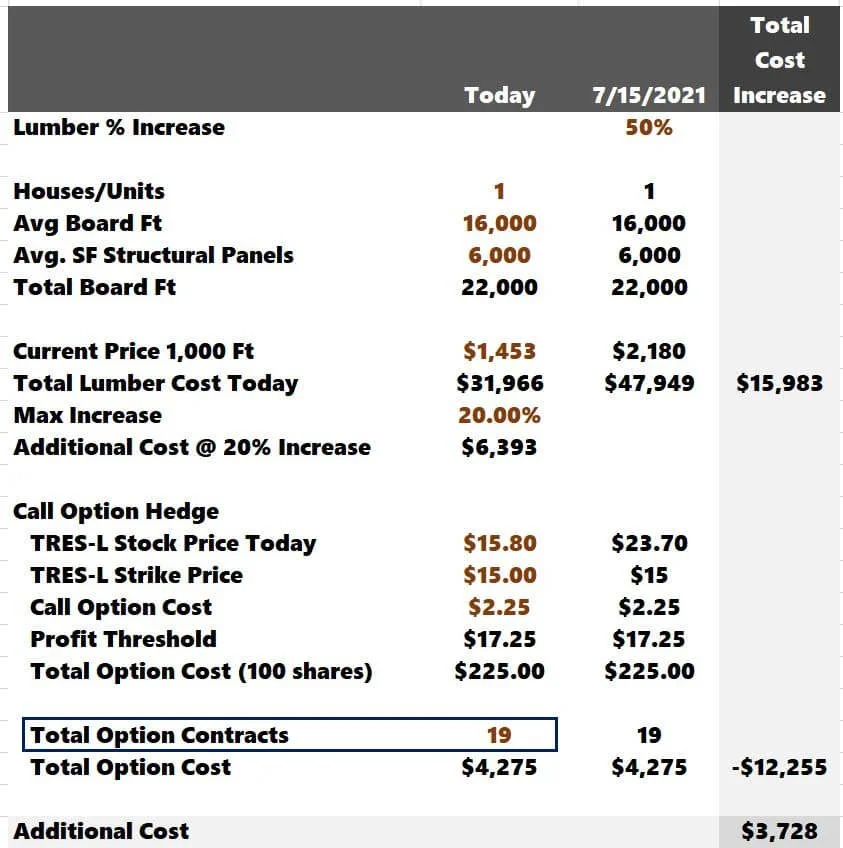

The plan is to build one house with 16,000 board feet and 6,000 square feet of structural panels. The total board/square feet is 22,000. The current price per 1,000 board feet is $1,453. We'll estimate the total lumber cost to be $31,966.

($1,453 * 22,000) / 1,000 =$31,966

I created a little Excel tool to do most of the analysis. First, I need to enter the prevalent data.

You decide you can absorb a maximum of a 20% increase in lumber. If the cost of lumber goes any higher than 20% more than today's spot rate, the project won't be financially feasible.

A 20% increase in lumber costs equals $6,393 more in gross cost.

Purchasing Call Options

If you need a refresher on the theory of call options, I will defer to Investopedia. They do a great job explaining them concisely with simple examples that will give you all the background you need to understand the rest of the analysis.

I will give a simplified definition of call options for those who don't feel like going back to Finance 201 - Advanced Trading Strategies.

I mentioned earlier that a call option is like insurance. Let's take car insurance, for example. Instead of insuring yourself against loss from an accident, you are insuring yourself from losing profits from increasing lumber prices: the more lumber climbs, the higher your payout. You can then use this payout as a rebate to offset your project's increased cost of lumber.

Option Expiration

Just like insurance, you need to pick the dates of your coverage. You will choose an option with an expiration date that aligns with your project. I would pick an option expiration that expires slightly after purchasing the lumber. In the example I will get into shortly, we assume you will buy lumber on 7/15/2021. There is a call option on "TRES-L" that expires on 7/16/2021. This would be an appropriate selection (it almost aligns perfectly). I would err on caution and pick an option expiration later than the projected lumber purchase date. You can (and likely will) sell your option before expiration. If your option expires before buying the lumber, you will expose yourself to price volatility.

Option Strike Price

The stock we use, "TRES-L," is currently priced at $15.86. Let's say we purchase the $15 strike price "policy." The higher the stock price climbs above $15, the more our insurance policy will pay out. If we buy one call option, with a $15 strike price and the TRES-L stock ends at $20 when our option expires, our profit is:

$20 - $15 = $5

1 Call Option gives you exposure to 100 shares of stock. The final step of calculating the profit is taking:

$5.00 profit x 100 shares= $500 Profit

But unlike insurance, you can buy multiple policies. So maybe you want to buy four options instead of just one.

$5.00 profit x 100 shares x 4 Options - $2,000 Profit

Option Premium

And just like you need to pay for your insurance coverage, you also need to pay a premium for your option. The market will determine what these premiums cost. It's updating in real-time as the stock trades. When purchasing a call option:

The lower the strike price, the higher the premium cost.

Adversely, the higher the strike price, the lower the premium cost.

This is because the probabilities are much higher that your option will be valuable or "in the money" with the lower the strike price.

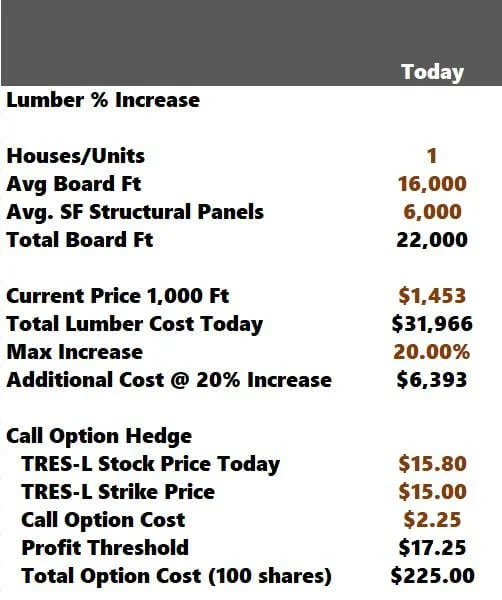

Using the same example above, the July 16th call option with a $15 strike price has a premium of $2.25. Stated differently, you must pay $2.25 for the right to utilize this option (claim if prices rise). When we revisit our profitability formula from above, it will look like this:

$20 - $15 - $2.25 = $2.75

$2.75 profit x 100 shares= $275 Profit

If you bought 10 Options, the total profit would be:

$2.75 profit x 100 shares x 10 Options - $2,750 Profit

Stock Price Decline

If the stock declines, you will choose not to execute the option and will let the option expire worthlessly. You would lose money, but your loss would be capped at the cost of the call option premium. It's like paying your insurance deductible yearly but never making a claim. In the example above, if TRES-L stock were $9.00 when the option expired, you wouldn't execute it. Your strike price is $15, meaning you have the right (not the obligation) to purchase the stock at $15. This is only valuable if the stock is higher than $15. If it is lower, you won’t take any action. The formula for total loss:

Premium x 100 x Option Contracts

$2.25 x 100 x 10 Option Contracts = $2,250 = Total Loss

However, this likely means the cost of lumber has decreased, and you will benefit from paying lower prices. It is terrific, and you are always protected from rising prices. After a year of paying car insurance, do you think, "I didn't get in an accident this year! What a waste!" No, you likely think, "Although I pay insurance every year that will protect me from the "worst-case" scenarios, I am thankful I didn't have to use it."

It would be best if you thought of call options for hedging in a very similar manner.

Putting it All Together

Now, let's take a look at the option chain (theoretical). The expiration date, strike price, and premium are all present in the image below.

You will pay the "Ask" column (or $2.25 for the $15 strike price) when you purchase a call option. I will choose the last call option for this hedging strategy, "in the money." This is the $15 strike price that costs $2.25. The current stock price at writing is $15.86.

Let’s continue with the Excel sheet.

And finally, I need to enter how many options contracts I want to purchase. This will be a toggle we constantly adjust. For now, I will choose ten as it's a round number.

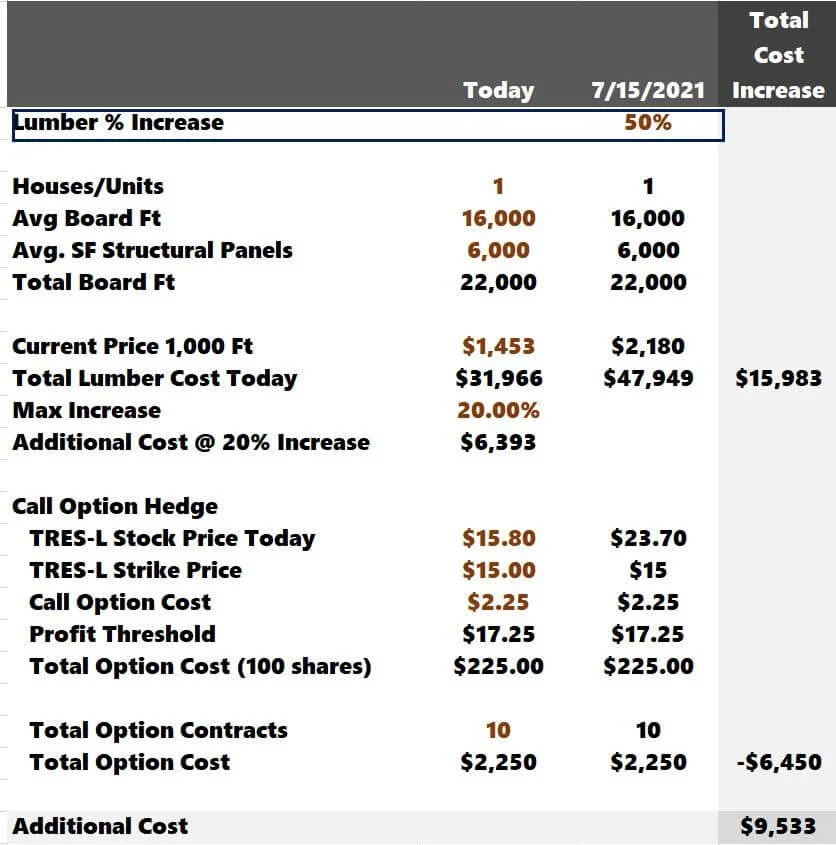

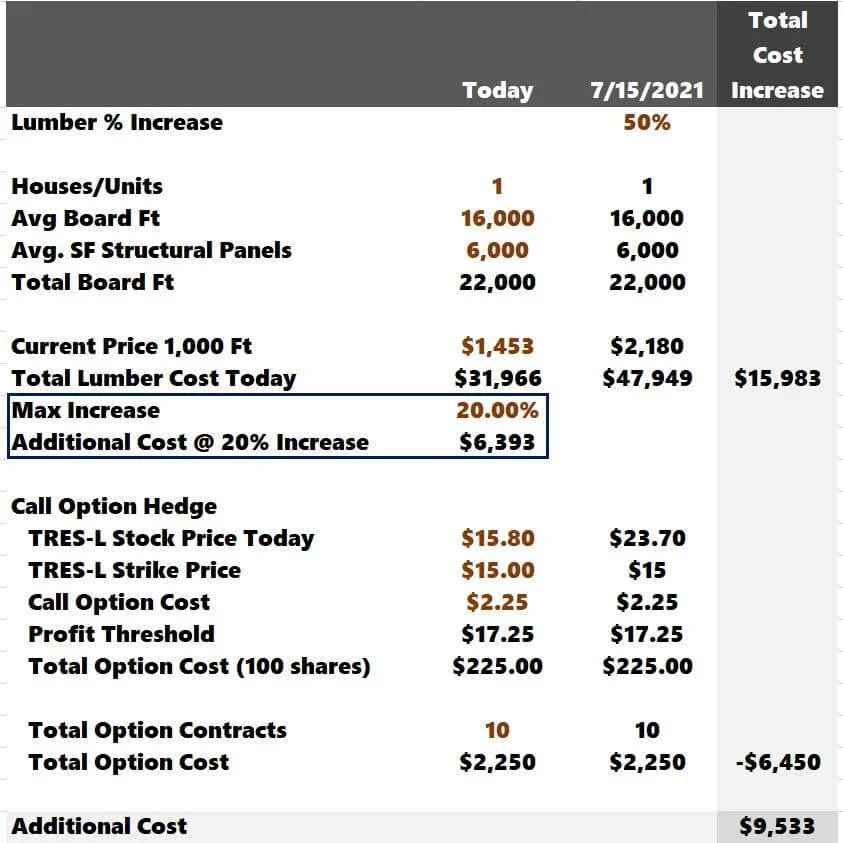

Now comes the big assumption. How much do you think lumber will increase or decrease before 7/15/2021? I am going to put in 50%. It's just a placeholder.

You would interpret this as the following:

If lumber were to increase by 50%, the cost would increase from $31,966 (today) to $47,949 for a $15,983 increase in price.

Because TRES-L correlates closely to lumber futures, we assume the stock price increases by 50%.

Another Disclaimer: If I were to implement this strategy, I would have done far more research on TRES-L to ensure it is the best possible candidate for this hedge. A strong pricing correlation with lumber futures is just the tip of the iceberg.

The ten call options would reimburse us $6,450, but we would still be on the hook to pay $9,533 in additional costs once the call options refund us.

$15,983 - $6,450 = $9,533 Total Cost Increase

This is still above the maximum lumber increase we stipulated earlier.

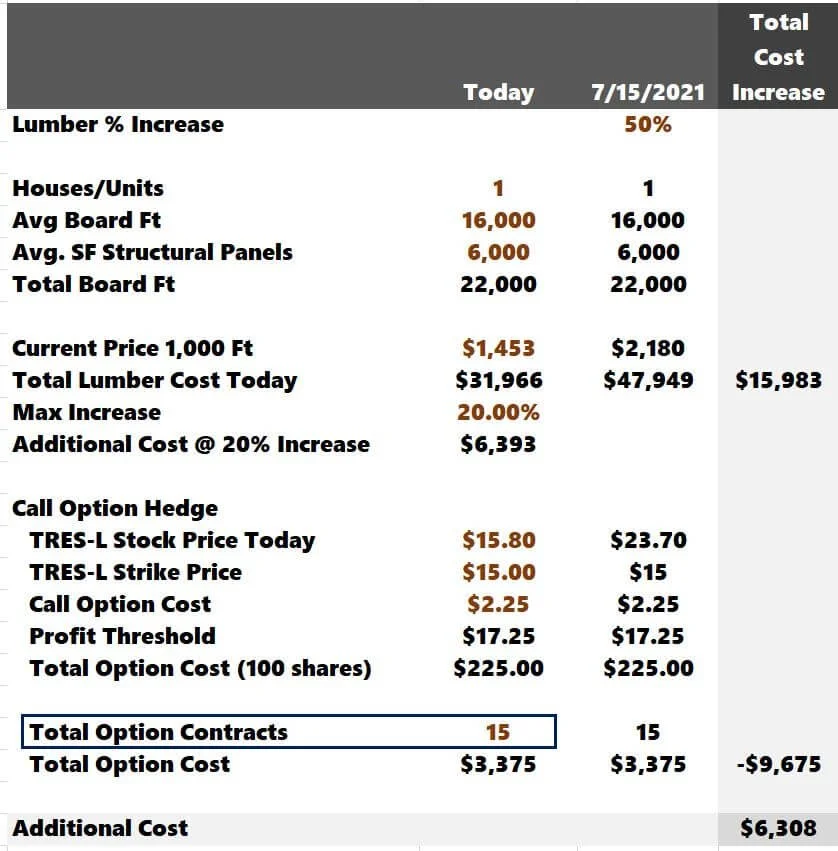

Let's trying bumping up ten call options to 15 to see if a larger hedge helps.

It does. The call options would reimburse $9,675 of the $15,983 increase, and the net additional cost is $6,308, under the max lumber increase of $6,393. So, the project would still be a go.

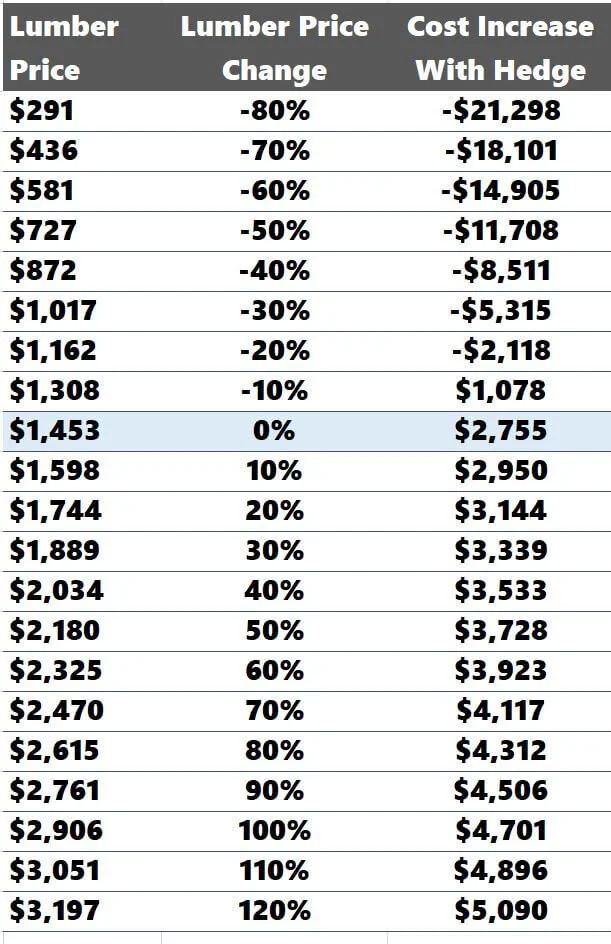

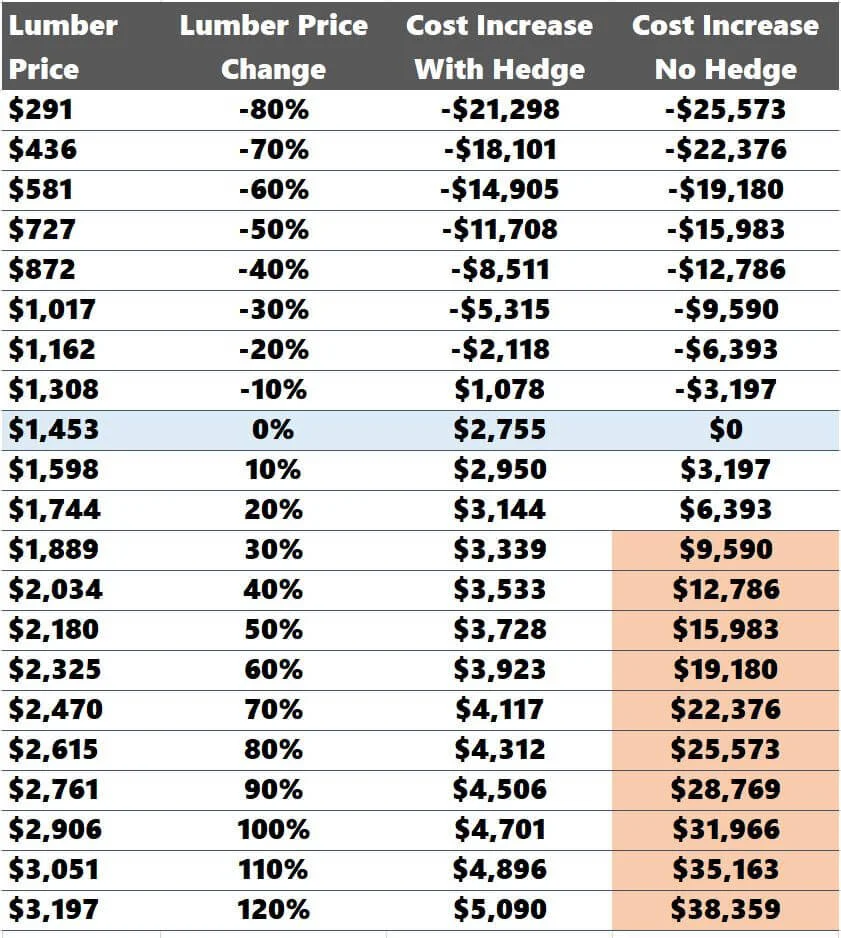

The question you should be asking is, what if lumber increases 75% or 100%? What if it decreases 30%? Anything can happen between now and July, and I created a sensitivity analysis to capture all these scenarios.

In the table above, you can see the cost savings at many different lumber price points. The orange cells are meant to show us when we would no longer be hedged because call options payments wouldn't sufficiently keep the total payment below the max lumber increase of $6,393. The goal would be to add more call options until you are fully covered. This is plug-and-play. I experimented with adding more call options contracts until there were no orange cells.

Purchasing 19 call options would do the trick.

If the lumber cost is between $291 and $3,197 board feet, we will not pay more than $5,090 in additional cost, under the $6,393 max cost increase we decided on earlier.

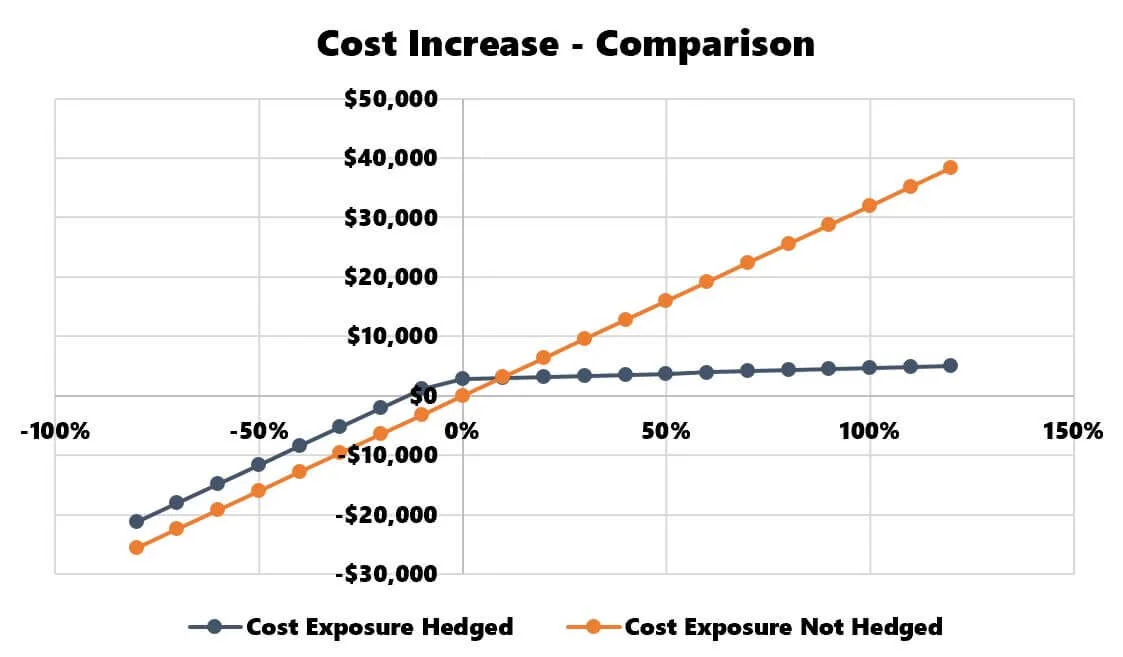

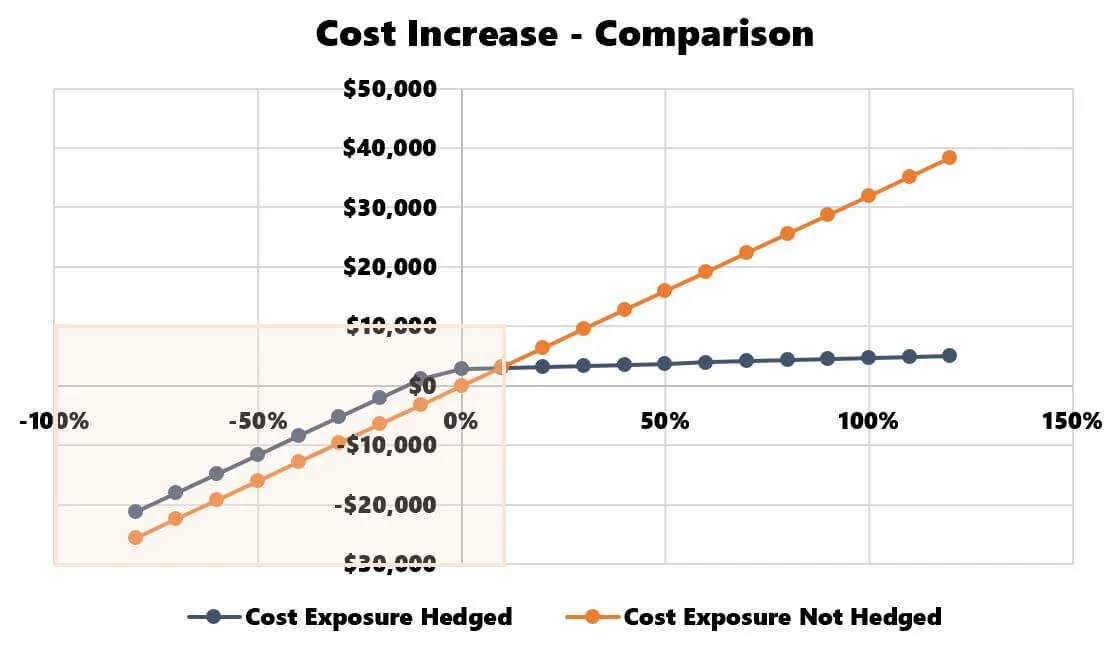

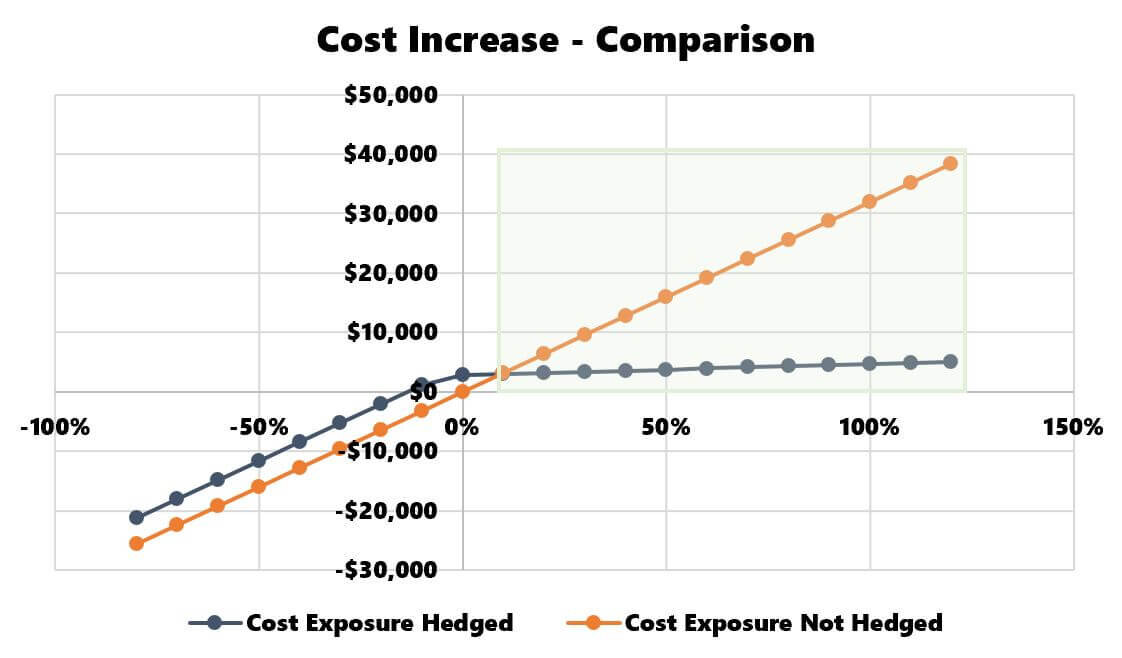

This data graphed looks like this:

Lumber price increases/decreases are on the horizontal axis, and total project cost increases/decreases are on the vertical axis.

If you didn't hedge, you would have severe exposure once lumber increased by more than 20%. Look at the far right column.

We can also compare hedging vs. non-hedging graphically.

The biggest downfall with hedging is that if lumber prices stay the same or decrease, you'd still be on the hook to pay the call option premium and have a slightly higher cost basis if you didn't hedge at all.

Conversely, your downside risk is curtailed above a 20% increase. So even if lumber hits record highs two months from now, you can still hedge appropriately and lock in a price under whatever threshold you desire.

Other Risks to Consider

The TRES-L call options do not perfectly correlate to the cost of lumber, so in theory, lumber could continue to increase while the TRES-L stock price declines. This would blow up your strategy. Although the correlation is positive, it's important to remember that pricing could vary between the two instruments.

Low liquidity for a particular call option may make selling the option difficult before expiration. The less liquid the option, the more expensive it will be to sell.

I was looking at the lumber price increasing by 120% max. You won't be fully hedged if lumber rises by 150% or 200%. You must have a reasonable sense of what the worst-case scenario could be and solve that. The more extreme the worst-case scenario, the more options contracts you’d need to purchase.

You need to spend money to make money with call options. If you put every penny into the construction project, hedging won't be possible as you won't have the funds to pay the call option premiums.

You’d need to talk to your accountant about the tax consequences of trading short-term options. Tax consequences are beyond the scope of this article.

Summarizing Option Hedging

Hopefully, this blog post stimulated outside-the-box thinking on managing real estate cost output risk in volatile commodity markets. You could use this thought process on building materials, not just lumber. Hedging can be a fruitful endeavor if you put ample research behind your strategy. The financial markets may be intimidating for real estate investors, but they can be beneficial if you know your options.

This article should not be construed as investment advice. Always consult with investment professionals before making investment decisions.