Optimizing Syndication Structures: Enhancing Alignment Between GPs and LPs

As the commercial real estate industry struggles, I've witnessed an avalanche of criticism in social media circles about the alignment of sponsors (“capital raisers,” “syndicators,” or the "GP") with their investors (the limited partners or "LPs").

The biggest gripe is that sponsors are accused of a deal structure that doesn't strike alignment with LP investors. In other words, the GP can profit even if the LP investor falters. Grievances include:

High sponsor fees, regardless of investment performance

Promote structures that the sponsor can profit significantly before the LP investor

Promote structures manipulated by short-term decisions in the GP's favor

These criticisms got me thinking: Is there a superior distribution structure to better align GP and LPs?

Contents

Disclaimer: This is a tricky question to answer (even though I will attempt it). I think rapport with the sponsor, their character, and their mission is far more potent than any spreadsheet when determining "alignment." This article is more of a brainstorming session, exploring ideas for structure improvement from a numbers perspective.

Common Partnership Structures

Some common structures you'll come across in syndication agreements are some of the following:

These models are all included in Tactica's paid proformas. These structures are tried-and-true arrangements that you'll often see in syndicated real estate deals.

When used responsibly, they are valuable and can serve the partnership well, but each has weaknesses that could be exploited and impact alignment negatively.

Straight Profit Split

On day one of this arrangement, the sponsor will take an outsized profit interest. In other words, if they put in 10% of the required equity, they would immediately earn a more significant chunk of the distributions (such as 20% ) of the profits (via cash flow, refi, or sale proceeds).

There are no hurdles or benchmarks; the sponsor immediately reaps a more significant allocation of distributions for the duration of the investment hold.

Weakness: The sponsor will see more significant profits than the LP before they've accomplished anything.

Waterfalls

Waterfalls are a great structure because they ensure that LPs are paid back in full and receive a predetermined return on their investment at varying success levels before the GP reaps any upside.

Weakness: Waterfalls heavily depend on the asset's sale to see return metrics climb into the mid-to-high teens (15% -19%). The most common waterfall uses the IRR metric as a benchmark, which is incredibly sensitive to distribution timing. Therefore, to hit higher benchmarks, selling the asset earlier will help inflate returns, catapulting the sponsor into the promote.

Preferred Return + Profit Split

Preferred returns are a great annual benchmark that will stipulate what the LP investor is paid (such as 8% on their investment balance) before the sponsor takes any promote.

Weakness: Generally, a preferred return + profit split arrangement is less advantageous for LPs than a waterfall as the sponsor can reap a promote (outsized distribution) before the LP is paid back. The promote is determined year-by-year and is independent of past or future years.

What Constitutes GP & LP Alignment

My definition of alignment between the sponsor and LP investors is the following:

Sponsorship fees are not consequential

Long-term hold desirable (defined by incentive structure)

Maximizing cash flow and tax benefits (avoiding unnecessary tax liability)

The GP should be paid only when the LP has been paid back in full and earned a return greater or equal to some benchmark. Let's discuss these bullets.

Sponsorship Fees

I understand fees are necessary for a project, but when a project struggles, fees shouldn’t hedge the sponsor from loss exposure. I think in a deal; there should be two reasonable fees:

Acquisition Fee

Asset Management Fee

Acquisition Fee

I don't have a strong opinion about the proper charge of an acquisition fee. Every firm sources deals uniquely, and it's hard to pinpoint a general amount that works for all. However, it should be transparent and laid out as a percentage of purchase price and gross dollars. Example:

Acquisition Fee: 2% of purchase price or $250,000

The sponsor should also communicate how much fee they will reinvest in the deal. Ideally, the GP will invest personal funds beyond the acquisition fee amount, and you can confirm that with this information.

Asset Management Fee

I'm okay with an asset management fee as a percentage of revenue as long as the sponsor executes its plan. This opinion is potentially extreme, but why is an asset management fee necessary for a deal underperforming proforma expectations?

Sadly, overly ambitious underwriting has been a theme over the past few years. An asset management fee contingent on hitting proforma revenue projections would lead to realistic underwriting and more critical thinking when sponsors make assumptions. If revenue numbers falter, a clawback of asset management fees would follow and be available to the LPs.

Disposition Fee

As I will explain, a disposition fee is unnecessary. If the investment hits its projections, the sponsor will be paid a promote at the asset's sale.

Maximizing Alignment: Trifold Alignment Tactic

We must define three main variables to ensure long-term alignment between all investors.

Benchmark Rate

"Long-Term" Definition

Annual GP "bump" if the benchmark is achieved (in IRR terms).

Benchmark Rate

This rate is the IRR you will strive to pay an LP investor over the long haul if the project is prosperous. Let's use 12.00% as a placeholder.

Benchmark Rate = 12.00%

Defined Term

The sponsor must state their "long-term" time horizon. Generally, there should be a negative correlation between "Benchmark Rate" and "Defined Term." This timeline will eventually tie into their promote. The longer the term, the lower the rate requirement, and vice-versa.

A 12.00% return over three years is "good," but a 12.00% return over 20 years is exceptional, and a massive amount of wealth compounding would occur over those two decades. Let's use five years as the placeholder.

Defined Term = 5 Years

GP Incentive

If the sponsor holds the asset for 5+ years and achieves a greater return than 12.00%, what is their "promote?"

If the GP holds the asset beyond the "Defined Term" every year, they should receive a more significant percentage of LP cash flow to the extent that the return doesn't fall below 12.00% of the benchmark rate.

If the sponsor holds the asset beyond five years, they can reduce the LP's IRR by 0.25% annually.

GP Incentive = 0.25%/Year

10-Year Case Study

Thus far, here are our terms, neatly laid out:

Sponsor Acquisition Fee = 2.00% or $250,000

Sponsor Acquisition Fee Invested = 100%

Sponsor Total Invest (Including Fee) = $1,250,000

Asset Management Fee (subject to clawback) = 2.00%

LP Benchmark Rate = 12.00%

Defined Term = 5 Years

GP Incentive = 0.25%*

*after five years

Summary: If the sponsor holds the project for more than five years, and the LP's IRR is greater than 12.00%, the GP can adjust the distributions to take 0.25% annually away from the LP so long as the LP's IRR doesn't dip below 12.00%.

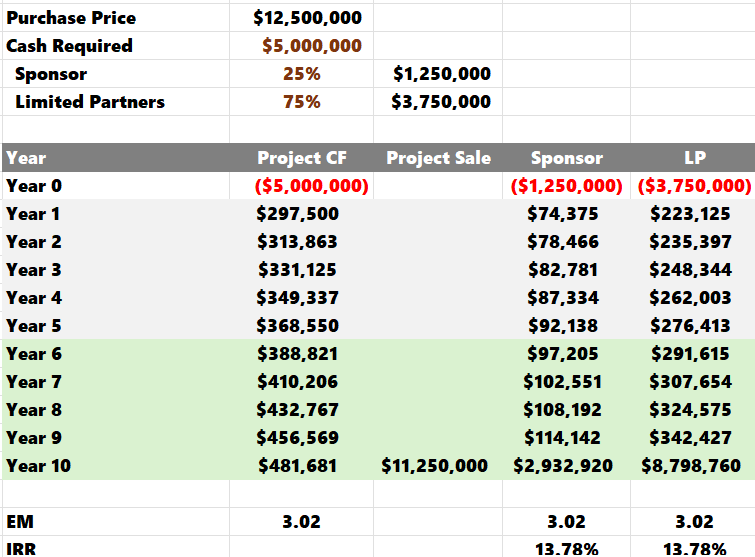

Let's look at a sample capital stack and distributions:

The sponsor invested for ten years, and the project's IRR was 13.78%. The green rows are the years that the sponsor held the asset beyond the defined term of five years (they held the asset for five additional years)

The GP is eligible to adjust the residual sale proceeds to clawback IRR from the LP:

5 Additional Years x 0.25% Incentive = 1.25% clawback to GP

LP IRR at sale = 13.78% - 1.25% = 12.53% LP Adjusted IRR

It's a simple Excel Goal Seek exercise to calculate the percentage of the residual sale proceeds the GP will receive to back into the LP's 12.53% IRR.

Goal Seek tells us that the GP will receive 35.17% (beyond their 25% interest) of the sale proceeds, so the LP IRR equals 12.53% over 10 years. The sponsor sees their equity multiple climb to 3.93x, and their IRR jumps to 16.89%.

20-Year Case Study

We could even run this analysis for 20 years.

In this instance, the sponsor would run into the 12.00% LP IRR floor, a desirable result for a 20-year hold. The LP would beat the historical S&P 500 and The NAREIT All Equity REIT Index and receive real estate tax benefits for two decades.

Note: If a drastic market correction or other factor drastically impacts the sales value and the project IRR falls below 12.00%, the GP/LP would be paid equally (in line with each side's contribution percentage). This risk is the most notable when projecting multi-decade investment holds.

If the investment were held for five years or less, the cash flows would be paid out 25%/75% to GP/LP as stipulated by each side’s equity contribution in Year 0. There wouldn’t be any opportunity for a GP promote.

Additional Benefits of the "Trifold Alignment Tactic"

On top of long-term alignment, this method boasts a few other benefits.

Easy to compare deals

Easy to track distributions

Better longer-term wealth planning

Deal Terms Comparison

Imagine if more sponsors started offering LPs a similar distribution structure. Comparing the terms side-by-side is flawless, and you can make a decision that aligns with your expectations and investment needs.

My general conclusions from the three offers above are the following:

Sponsor C offers the best terms (highest benchmark rate and lowest GP incentive) but doesn’t invest the full acquisition fee or put any money in the deal beyond 50% of its fee.

Sponsor A has the most skin in the game. They offer a competitive benchmark rate but have the shortest time horizon

Sponsor B has the least competitive terms (lowest benchmark rate and highest GP incentive) but has the longest investment horizon. While they are investing their acquisition fee plus more funds, they still have very little skin in the game compared to Sponsor A

While it’s hard to determine which sponsor to choose without knowing anything about the underlying projects, you can see that this uniform term offering should make it easier to decide which sponsor aligns with your risk appetite, time horizon, and return expectations

Distribution Tracking

Sponsors can also effortlessly track and assess in real-time. Do you have choppy, inconsistent distributions? No problem. Simply adding a date to the distribution row and using an "XIRR formula" instead of the "IRR formula" makes it easy to gauge investment expectations, play with residual sale scenarios, and make strategic decisions.

After switching to the XIRR, all remaining steps would be identical to what I described above. This adjustment will be effective even if distributions are paid quarterly or monthly.

Better Long Term Planning

This partnership structure's most significant underlying benefit is forcing the sponsor to estimate an investment hold for the asset and back that statement up with their incentive.

One of my biggest frustrations as an LP investor is when an investment I envision holding for the long term (because that's what the sponsor pitched to me) ends up being held for only a few years.

This change of mind could be problematic for older investors who depend on real estate investment cash flow in retirement.

Ultimately, the sponsor still has the flexibility to sell the asset earlier than expected. However, aligning their incentive with longer-term investment horizons should help avoid surprise sales, potential tax liability, and the need to redistribute the investment proceeds elsewhere.

Summarizing Partnership Alignment

Some historically popular partnership distribution structures have recently been criticized as "too one-sided."

I've spent a month reflecting on this and brainstorming a better way sponsors and limited partners can structure a real estate investment to improve both sides' success.

Alignment between the sponsor and LP investors means transparent, non-consequential fees, a long-term mindset, and incentive structures that tie to longer investment horizons.

Maximum alignment can be achieved with a deal structure emphasizing:

Benchmark Rate of Return

"Long-Term" Definition

Annual GP "bump" if the benchmark rate is achieved (in IRR terms) beyond the defined term

Further benefits include:

Easy to compare deals

Intuitive investment tracking

Better longer-term wealth planning for LPs

While I've yet to see a similar structure proposed in an actual deal pitch as the one detailed in this article, future capital raisers must think creatively about projects to regain investor trust and stand apart from the syndicators.