Modeling Inclusionary Zoning Units in Multifamily Market-Rate Development

There are two ways you can underwrite affordable units into a market-rate project within Tactica’s Development Model if your municipality has inclusionary zoning policies in place.

Option 1

The first option is off to the right.

If you don't have any affordability requirement, you can ignore it (leave it ‘zeroed’ out).

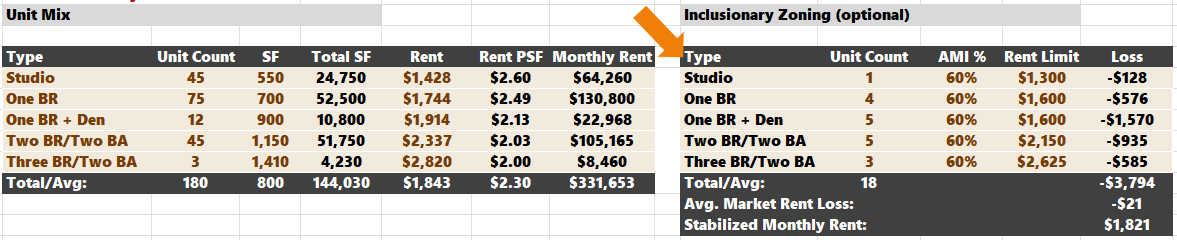

You'd enter your unit mix on the left for the entire unit mix (ALL units), and enter your estimated market-rate rents for each unit type. Then, to the right, you can enter the affordable rents for each unit type.

In this example, 10% of the units must be affordable at 60% AMI, so that I will designate the rents for those 18 units (18 out of 180 total units).

Note: The AMI % column doesn't affect any calculations; it is simply for your (or investors') knowledge (60% AMI, 80% AMI, etc).

The model will then discount the monthly rent potential to account for the revenue lost to affordable units, and that will flow through to the rest of your underwriting.

Option 2

If you don't like how the option above is presented, you can also include the affordable units in the overall ‘unit mix’ section, ignoring the optional IZ inputs to the right.

Whether you account for your affordable units in the IZ section or in the overall unit mix, the end result will be the same. Just make sure not to double-count them. Check out our full multifamily development underwriting tutorial here.