Development Fee Underwriting (Standard vs. Deferred)

The development fee is what real estate developers charge for their skills, expertise, and experience and for managing their overhead during construction. I plan to tackle how the developer fee is typically underwritten and give you an idea of how to underwrite a deferred development fee.

Contents

Standard Development Fee Underwriting

A development fee is generally a percentage of the total construction cost. This percentage ranges from 2% to 5% (hard, soft, finance, and other costs), but it is specific to the developer, their experience, and the overall deal structure. I've also seen developers target gross fees such as $1,000,000 or $750,000.

Generally, the development fee compensates the development team for their craft and covers their overhead during construction. The vast majority of underwritings I've reviewed over the years will allocate the development fee evenly over the construction period.

For example, if the construction period is ten months and the developer fee is $1,000,000, the developer would receive $100,000 monthly in developer fee proceeds.

I've also seen a "bell curve" payment where the development fee will ramp up as construction costs do (and back down again towards the tail end of construction).

Deferred Development Fee

You may have heard of instances of a deferred development fee. A deferred payment is when the developer fee is paid at a milestone after construction. This arrangement is typical in affordable multifamily development.

While I'm far from an affordable expert, I know developers who often will take half of their development fee upfront (or at the closing of the construction loan) and defer the other half to be paid out with project cash flow years later. In other words, it's a partially deferred fee.

Tactica's multifamily development model cannot handle a deferred development fee in its baseline state. It's a market-rate development model, and developers rarely defer a development fee payment, so I didn't build a deferral option into the logic.

However, given the challenging economic environment (riskier and uncertain), I could see investors intrigued by a deal in which a developer is paid a fee after a significant capital event (refi or sale).

While this might not be possible for all developers, for ones that are well capitalized and financially willing to delay the payment of their fee, for investors in the project, this can mean:

Less construction interest expense

Deeper reserves (for unforeseen setbacks)

I plan to touch on these bullets more with real examples.

A customer asked how to incorporate a deferred fee, so I brainstormed a workaround. I will share my solution and its implications.

Deferred Development Fee Workaround Tutorial

On the "Project Summary" tab, I currently have the development fee set to 3% or $975,538.

We still want to include it as a "soft cost," as lenders generally will fund a portion of the development fee. Ignoring the development fee entirely at this juncture would lead to less funding.

On the "Budget & Draw" tab, I initially allocated the development fee "Even" over the construction period.

I will change the election to "Custom," but I will forgo manually typing in the development fee expense.

Since I didn't allocate the payment anywhere in the 14-month construction period, the entire $976,537 sits in the balance (or leftover funds not yet used).

We need to make an alteration to the "Returns Summary" tab. In the proforma, we'd be paying off a construction loan of $20,115,825.

But this needs to be refined. The total construction loan was $21,136,969.

Currently, the model thinks we never spent the nearly $975,000 development fee and assumes we'd pay off the construction loan we drew on (only $20,115,825). The $975,000 savings would be split between the sponsor and passive investors, which we don't want.

We must add a dedicated deferred developer fee line item in the refi and sales proceeds sections.

That $975,000 has been broken out of the general project cash flows as intended and will flow to the developer.

Note: The return metrics (IRR and equity multiples) know that the development fee will come from the sale proceeds if a sale occurs before/during the refinance year. The deferred fee comes from the refinance proceeds for a longer-term hold.

Another item you need to be aware of is that allocating the development fee as "custom" on the "Budget & Draw" tab will technically make these funds eligible to pay construction interest during the lease-up.

If you have a slow lease-up and property operations are insufficient to cover loan interest, the model resorts to the "balance" of the loan amount to cover the Shortfall.

Usually, the balance (or leftover funds) consists of expense items such as:

Capitalized interest

Operating reserve

Unit marketing

However, we added the developer fee of $975,538 (we didn’t spend it during construction ). If your developer fee is in the balance (green column), those funds will also cover the cashflow shortfall if you haven't allocated enough operating reserve.

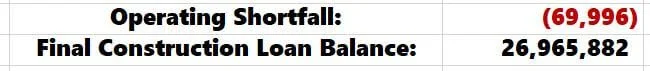

Warning: The model won't accurately tell you about your operating shortfall, as in the example below, because it will use the development fee to pay down construction interest if necessary.

It will be zeroed out due to the enormous balance of funds left over after construction.

To counter this, I set up a simple calculation off to the right of the numbers of the “Returns Summary” tab that calculates your total loan amount and total draws.

Loan amount = What Construction Loan Amount we were approved for

Draw Amount = Loan Draws* + Development Fee Payment

*Draws can be less than the loan amount due to a fast lease-up and not using the entire operating reserve. This happens in more conservative underwriting with a robust operating reserve.

Surplus = The difference between them

If the surplus is positive, you are clear, and you won't need to tap into the deferred development fee to pay construction interest. However, if it's negative, you will. While this isn't the end of the world, it does mean you'll depend partially on refi proceeds to pay your full fee, as some allocated development fees went towards covering a cashflow shortfall.

To be sure there is a large enough operating reserve, you can add to the operating reserve:

I’m being extra conservative in this underwriting run to ensure the dev fee is paid in full from the budgeted funds. However, if the surplus is too large, you could back off reserves too.

Operating Shortfall: In this section of the main multifamily development tutorial, I discuss the operating shortfall cell and its functions.

Comparing Deferral to Standard Development Fee

First, I'm defining development fees as the following:

Deferred: Paid during Refi/Sale (whichever happens first)

Standard: Paid evenly over the construction timeline

I have two identical developments in the model except for how the development fee is handled (standards vs. deferred until refi/sale).

Here are my observations:

Interest Expense

Capitalized interest is about 5% lower in the "deferred" scenario as the $975,000 fee doesn't accrue and compound interest like it does when drawn evenly in the "standard" scenario.

Returns

Returns (IRRs and equity multiples) are slightly higher in the deferred scenario due to these interest savings, but this is immaterial.

For example, the 5-year IRR is 26.98% vs. 27.34%

Peace of Mind

An additional unused $975,000 in proceeds is an excellent cushion for unforeseen setbacks. Ideally, the developer never has to tap into these funds as a "contingency," but they are available if needed (the model will use them as such in a slow lease-up).

Alignment

While I don't expect market-rate developers to consider delaying their fee, those who can stomach it can show some of the benefits above and spin it as a differentiator. It could build a lot of trust and confidence for a developer to forgo their fee until there is a significant capital event. Ultimately, for many, this will not be feasible (not should it be expected).

Video: Modeling a Deferred Development Fee Tutorial

Summarizing Development Fee Underwriting

Real estate developers receive a development fee for their experience and cover their overhead during construction. Typically, the fee is dictated as a percentage of the total project cost.

The fee is generally paid out during construction, but there may be instances where it makes sense to defer it. While the Tactica Development Model can't account for a deferred fee in its baseline state, you can emulate it by:

Using the "custom" expense allocation method on the "Budget and Draw tab

Creating two "Development Fee Referral" line items on the “Returns Summary” tab

Verifying there's enough operating reserve to handle cash shortfalls (so the deferred developer fee isn't allocated to it)

Some of the benefits of deferring the fee could include:

Less interest expense

Slightly higher returns

Peace of mind (more emergency reserves)

Developer fees are rarely deferred in market-rate development, but if you want to explore it, I provided you with an adequate workaround.