Aligning the Multifamily Proforma and Property Tax Calendars

Underwriting real estate taxes can be confusing when you analyze a property in a state with multiple payment installments throughout the year. The sale timing could affect how the property tax calendar aligns with the proforma schedule. In certain instances, they will not align perfectly, and you will need to adjust to underwrite accurately.

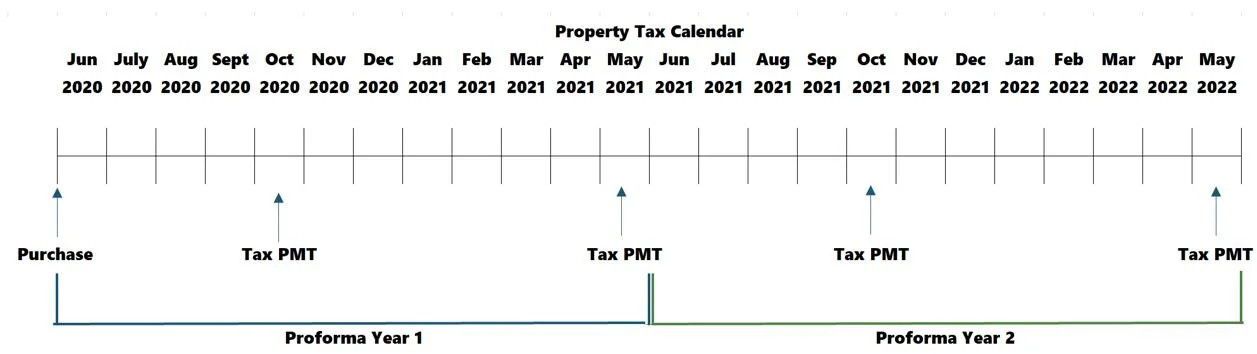

This adjustment is called a "stagger." I recently updated the Tactica Value-Add Financial model to account for the instances when an adjustment is needed. Let's use a real example. Let's say you are purchasing a multifamily property in Minnesota. In Minnesota, the property taxes are paid in May and October each year. The expected close is June 1st, 2020. The sale timing will cause the property tax calendar to go off-kilter with the proforma schedule.

The purchase date is sandwiched between the two tax payable deadlines of 2020:

May 15th: 1st payment due

June 1st: Purchase

October 15th: 2nd payment due

If you used 2020 taxes payable as your proforma year one, this wouldn't be entirely accurate as the previous owners had already paid May 15th taxes. If you used 2021 taxes payable as your proforma year one, this would also be slightly off because you would skip the October 2020 payment.

The property tax calendar is the following:

The purchase takes place on June 1st, 2020, and tax payments are due each year on October 15th and May 15th. Due to the timing of the sale, the proforma schedule doesn't align perfectly with the tax calendar. Since the previous owner paid the 2020 May payment, the correct proforma year one taxes would be:

October 15th, 2020

May 15th, 2020

Anytime the sale date is between the tax payable periods of a given year, you would need to stagger the real estate tax payments to ensure accuracy.

If you projected the sale to occur in November 2020, staggering property taxes would not be necessary. In this instance, 2020 taxes payable would be paid in full by the old ownership group, and you would be on the hook for 2021 taxes. The May 15th and October 15th payments would naturally align perfectly with proforma year one.

You can see in the image above that if you close on the property any time before May 15th, 2021, you will not need to use the stagger option.

Another state where this dilemma could arise is Wisconsin. Taxes in Wisconsin are also paid in two installments, due January 31st and July 31st of each year. If you estimate the close date between January 31st and July 31st, using a stagger would be a suitable option, just like in Minnesota.

Staggering Property Tax Payments

The solution is a simple one. The Tactica model has a switch that allows choosing whether or not a stagger is necessary.

If you selected "Yes," the "Proforma RE Tax" column will take:

50% of Year 1 Net Payable + 50% of Year 2 Net Payable

$229,044 x 50% = $114,522

$230,797 x 50% = $115,399

Total: $229,921

This pattern continues for the duration of the hold. By selecting "No" as the Staggering option, the "Proforma RE Tax" column will equal the "Net Payable" column. The "Proforma RE Tax" flows into the proforma cash flow on the "Financials" tab.

In the above example, the difference between the stagger and the net payable isn't extreme. In instances where there is a significant real estate tax exposure post-sale, you will see a sizable difference early on.

You must research the submarket and understand the tax calendar, sales velocity, and the assessor's general practices. Please make sure to review our property tax underwriting guide. If you don't understand the real estate tax exposure and the timing of when this liability hits the proforma, staggering the taxes will provide little value. Also, finding property tax comps is a helpful exercise.

Related: Underwriting property taxes in a development proforma requires a slightly different mindset and is beyond what this article will cover.

Summarizing Proforma & Tax Calendars

While staggering is the accurate way to account for the tax calendar not aligning with the proforma schedule, it won't have a sizable impact on returns. In the example from the image above, staggering RE tax equated to a 16.75% leveraged IRR on a 7-year hold. Not staggering equates to a 16.89% IRR, a mere 14 bp difference.