8 Rookie Multifamily Underwriting Mistakes to Avoid

Updated: September 2024

A proforma will never match the actual investment results, but it can set expectations and help you ensure a reasonable outlook.

For nearly a decade, I've experienced underwriting deals as a brokerage analyst, critiquing proforma assumptions from Tactica customers, and reviewing investment memorandums intending to invest personally.

Here are eight underwriting mistakes and oversights that have popped up most frequently in my career and some ideas on how to avoid them.

Over-Dependence on a Residual Cap Rate

When reviewing an investment offering, one of my favorite things is re-underwriting the deal using Tactica's Value-Add Model and back into the exit cap rate. Too often, it needs to be higher, and if I add a point (100 basis points) to it, most return metrics fall into the red.

This decline shows an overreliance on residual sales proceeds to make the deal work. Unfortunately, this assumption is easy to adjust, and one minor alteration can change the entire outlook of a deal.

Over my career, plenty of ambitious investors have fallen into this trap, but many were bailed out thanks to rampant appreciation during the cheap money era.

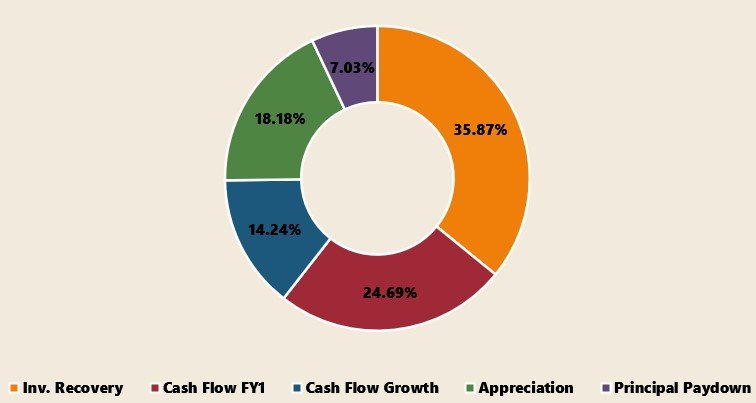

There's a reason why I include the IRR Sources analysis in the Value-Add model.

It helps ensure that appreciation isn't the predominant source of investment gain. Ideally, you'll see yield coming somewhat proportionally from:

Return of initial capital

Cash flow

Cash flow growth

Loan paydown

Taking Historical Financials at Par

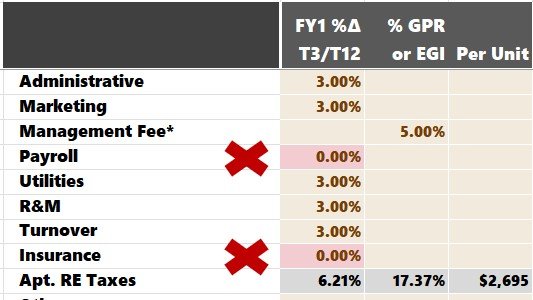

It is dangerous to assume your operating expenses will be the same as the previous owners', especially with insurance and payroll expense line items.

Insurance premiums have seen the most inflation over the past few years. Some insurance providers have pulled out entirely in specific markets prone to natural disasters, leading to consolidation and pricer quotes.

You can get insurance bids before you close your property. Getting quotes and having a relatively vetted insurance expense in Year 1 of the proforma is the best action. Do not take the previous owner's annual insurance expense as your baseline. Consider it irrelevant.

Payroll is the other expense that has skyrocketed. Quality employees are hard to come by, and operators constantly complain about their bad luck finding the right person for leasing, management, or maintenance.

If you buy a property from a group with more units/scale than you, they can likely operate it much more efficiently. On the flip side, if you are buying from a one-off "ma/pa" owner, they could be running it very lean with caretakers and self-management.

Where do you fit in? How will you operate the property, what will your involvement be, and how many employees with you need?

It's best to talk to a qualified 3rd party manager in your market, tour the property with them, asses the condition, detail the level of service you expect, and have them help you come up with reasonable expense estimates.

You can also get multiple bids on recurring contracts you won't inherit from the seller (trash, elevator, snow removal, landscaping, etc).

Reliance on Refinance Proceeds

A refinance can have a massive impact on returns. Therefore, I advise investors to use extreme caution with refinance assumptions and to account for them only when the business plan requires it, like in multifamily development or significant redevelopment of a distressed property.

None of our free tools or Tactica's Value-Add Models includes a refinance toggle to help prevent overreliance on refi proceeds. I am always skeptical when reviewing an investment package for a stabilized project with a refinance, returning all investment proceeds within the first few years of the investment hold.

While that would be a fantastic accomplishment, you shouldn't count on it in an era of rising interest rates, decreased lender appetite, a softening rental market, and recession fears.

Refinances are incredibly sensitive to macro events that investors have no control over. That lesson couldn't be more evident in 2024 when some investors are forced to consider ‘cash-in’ refinances.

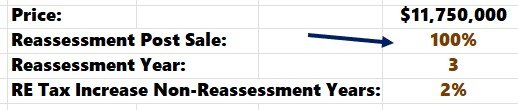

Underestimating Property Taxes

Never underwrite your property taxes like this:

"I will increase them by 3% over this year's payable amount."

You should estimate property taxes based on two things:

Sale price & reassessment

Property taxes are likely to be your most significant operating expenses (frequently more than 20% of revenue). It would be best if you could make this assumption correctly.

I wrote an ultimate guide to property tax underwriting a few years ago, and it still rings true today. If you are unfamiliar with the submarket or how reassessment and the tax calendar work, don't be afraid to call the local assessor.

I've reviewed investment packages where the assessments are published for the following calendar year and would be 10%+ higher than the current year. Yet, the sponsor was only underwriting a 2% property tax increase in Year 1 of the proforma.

This oversight is an instant disqualification for me, especially when the purchase price was closer to 20% above the current assessment levels, which inevitably would trickle down into a higher property tax burden during the investment hold.

Over-Renovating

If you're a "Class C" or "Class D" investor, there are diminishing returns on what a renovation can yield. Spending more and electing gaudier finish levels doesn't necessarily correlate to a higher premium.

With the rise in labor and materials pricing, it's more crucial than ever to understand what updates add value that the residents would appreciate and pay for. This understanding is best achieved by conducting a rent comp survey.

As some have learned the hard way, this frequently isn’t a lesson learned until years later once you’ve spent the money and didn’t achieve the initial rent projections.

I also think looking at how rents compare to "better" or "newer" properties is essential. If proforma rents start to creep within the levels of "superior" assets (maybe your "Class C" rents are getting close to some "Class B" rents in the general vicinity), you'll unlikely achieve your desired rent level.

A renter will likely choose the better property if the rental rates are close enough. I've seen some odd instances lately in markets where more vintage rental units are approaching "Class A" because of record supply being delivered, and owners of the newer properties are offering concessions and cutting rents severely to fill up properties.

Losing Track of Homeownership Costs

Another thing that can impact rents negatively (and a mistake I've made) is not paying attention to the cost of homeownership. I once reviewed a deal with a significant renovation scope, and rents were projected to be higher than what it would cost to purchase an "average" home in the area (assuming a 5% down payment).

Note: The proforma rents were higher than the “average market rent” presented below.

Homes in this city were very affordable and had yet to experience rampant appreciation like those in other coastal and sunbelt markets.

The sponsor was convinced that this neighborhood appealed to young professionals looking for walkability, easy access to the CBD, and the local nightlife. The perceived disinterest in homeownership for their target renter demographic and a comparable property already achieved higher rents than our projection.

Years later, this property still wasn't stabilized. I'm convinced that owning a home for nearly the same monthly price as renting is far more enticing, and converting prospects to tenants is exponentially more difficult if you’re pricing units in that danger zone. It was also a great lesson to trust my gut.

All else being equal, if a person can afford both a rental and a mortgage, they're likely to choose homeownership over renting.

You need to keep this in mind if you are purchasing a property that could directly compete with homeownership (think larger townhomes, build-to-rent, converted condos, or high-end luxury). However, with 7% mortgage interest rates, most cities may have a larger cushion.

Deeper Dive: I have a tutorial blog post on how to track “rent vs. own costs” in your city.

Ignoring Basis

I love crunching the numbers and examining yield-on-cost, equity multiples, cash-on-cash returns, and stabilized cap rates. But sometimes, it can be helpful to step back from all that, look at the sales comps, and determine if you are making a wise purchase from a "basis" standpoint.

As wise investors say, "Your basis is forever." Getting in at a favorable price per unit can save you if investment fundamentals decline.

Candidly, I was part of a deal where this happened. The proforma fell apart due to many factors outside anyone's control (eviction moratoriums, proposed rent control, and expense inflation), and generally, the property didn't hit initial expectations. The loan had a reprice due, and the sponsor decided to sell.

There were two things I liked about this project when I invested three years earlier:

Its basis (much lower than any "marketed" sale comp)

Positive leverage (negative leverage wasn't a hindrance)

While we could have never foreseen the pandemic, pandemic policy, and rent control, we could still exit the project intact thanks to buying the property on an outstanding basis.

You must ask yourself: Can your basis save you if your business plan gets uprooted? Or do you need flawless operations to find success? Answering yes to the latter means you'll have a lot less margin for error in the face of adversity.

Fixation on Assumed Loan Terms

Investors assuming existing loans is more prevalent in late 2024. This is because market-rate debt today is expensive, often in the 6% to 7% range. I’ve seen groups keen on assuming debt from the seller of a deal that allows them to lock in the financing terms originated before rate hikes took effect, generally between 2.75% and 4.00%.

Example: The buyer is purchasing a property with an existing $7,600,000 10-year loan placed in 2021 at a 3% rate. The loan had three years of interest only, so in 2024, the balance is still $7,600,000 (no principal payment have been made). The buyer will assume the entire $7,600,000 loan in 2024, have a fully amortizing payment, and be responsible for retiring the loan in 2031 (in seven years) via a sale or refinance.

For the buyer assuming this debt, they benefit from:

Cheaper monthly debt service

Healthy DSCR ratios

Higher leverage (potentially)

More cash flow (most important perk)

But in my opinion, in certain instances, while they are locking in cheaper debt and more short-term cash flow, they are paying a big premium for the asset, which is a direct contradiction to another underwriting mistake:

Ignoring the Basis (see above)

Nobody knows what will happen to CRE asset valuations over the upcoming three to seven years, and overpaying by millions to save thousands in debt service could wreak havoc on investors when the balloon date sneaks up.

There’s a sentiment that MF valuations are due to climb back to peak pricing levels seen in the early 2020s. While this could happen, if you’re overpaying today to lock in cheap debt, know that you’re betting on appreciation (macro) for your exit, which is never a good idea.

The wisest investors claim “basis trumps all,” and short-term, attractive debt terms wouldn’t sway them from that conviction.

Summarizing Rookie Underwriting Mistakes

Over the years, eight underwriting mistakes have been the most prevalent. Some of these mistakes may have gone unnoticed thanks to friendly monetary policy and a constantly appreciating real estate market. However, the margin for error is now diminished, and it's best to weary of the following:

Over-Dependence on Residual Cap Rate

Taking the Historical Financials at Par

Over-Reliance on Refinance Proceeds

Underestimating Property Taxes

Over-Renovating (overstating rents)

Losing Track of Homeownership Costs

Ignoring Basis

Fixating on Assumed Loan Terms

I plan to update this article as I see new underwriting trends emerge in the upcoming years.