Multifamily Predevelopment Underwriting

When constructing new apartments, most developers will structure the land purchase to match their construction loan funding. In my experience, this is the case with most multifamily new construction projects and is the logic behind how Tactica’s Multifamily Development Model functions.

However, there may be instances where a developer purchases the land in cash with investor equity before the construction loan funds. When this happens, the underwriting exercise will change. You'll need to populate the proforma accordingly.

Contents

Predevelopment Definition

Predevelopment is when a developer explores the feasibility of constructing an apartment building. If they don't already own the land, they generally have the parcel under contract or use a purchase option that allows them to:

Gain approvals (for various zoning and setback requirements)

Conduct environmental studies

Get preliminary building plans put together

Carry out a market analysis

Receive bids on numerous aspects of the project (GC, property operations, construction management)

This stage is risky because there are expenses associated with the bullets above that the developer has to front until the project is approved and construction can begin. If the project never comes to fruition, the developer will lose these funds.

A friend of mine recently commenced a multifamily development. During predevelopment, he committed hundreds of thousands of dollars of his capital before the project was approved, and the lender reimbursed him via construction financing proceeds. There were some uncertain moments when he was nervous about project feasibility and whether or not he would see a return on his capital invested.

Tactica's Predevelopment Proforma Logic

Tactica's proforma model doesn't include the predevelopment period at all. The proforma timer intends to start when the lender funds the construction loan, corresponding with the land purchase and cash equity funding. This sequence may not always be the case, but in most developments, this is the standard order of operations.

From an underwriting standpoint, the developer would cover typical predevelopment items out of pocket with cash. Once the developer deems the project feasible and has financing secured, the lender funds the construction mortgage, and the inflow of new funds reimburses the developer for the excessive out-of-pocket items they've paid for up until now.

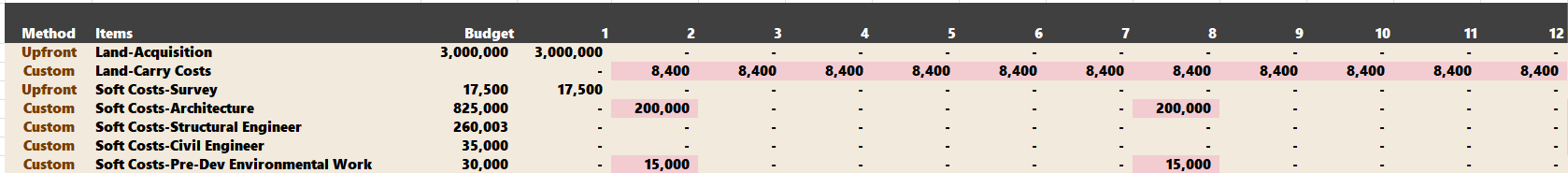

To account for these expense items in the proforma model, mark them as an "Upfront" payment in the "Budget & Draw" tab.

Along with the bank funding the construction financing, equity investors would wire any additional cash equity required to construct the project. The IRR timer officially starts, and the proforma commences.

Tutorial: Land Purchased Before Loan Funding

Disclaimer: The solution I’m about to present is a workaround and is meant for rare instances where financing isn’t aligned with the land purchase because of a challenging debt market. If raising equity before the construction and/or using alternative financing to fund the land acquisition is common in your business plan, I would recommend a different development tool that caters to that.

How could you handle a development scenario where you purchased land in cash and didn't expect to receive a construction mortgage for another 12 months? The original financing plan fell through, and you are exploring a HUD construction loan that will take at least a year to close. Because you used investor equity to purchase the land, the IRR clock must start now.

Note: This scenario is different from a land contribution.

The method I'm about to teach you is only possible if:

You purchased the land in cash

You pay for predevelopment costs with cash

You need the time-value-of-money (TVM) clock to start because investor equity is in the deal

If you have additional financing to fund the land or predevelopment costs, unfortunately, that would be too complicated to fit into the model outline.

Before commencing, be sure to "Save the workbook As." The first step would be to set the construction period to:

Predevelopment Period + Construction Period

If you expected a 12-month delay to receive funding and the construction period to last 14 months, then set your assumption to:

12 + 14 = 26

The next part is tedious. One of the perks of using this tool is having an automated expense allocation such as:

Evenly over the construction period

Upfront, when the loan funds

Bell curve over the construction period (slow build-up with the bulk of expense coming halfway through construction)

Related: More on the logic of the "Budget & Draw" tab of the MF Development Model

Choosing one of the methods above will flawlessly take the budgeted expense and allocate it appropriately over the construction period. There's also a "custom" designation where you can manually type in your expense schedule. You'll need to depend on the "custom" method a lot in this scenario.

The proforma will still start when the equity is raised, likely corresponding to when the land is purchased. You can still use the "Upfront" expense method for the land and any other soft costs you might pay that month.

The model will still assume all equity is raised in Month 1.

In Months 2 - 12, you can manually enter any expenses you'll incur before the construction loan. You'll notice the cells turn pink to warn you that you're overwriting formulas.

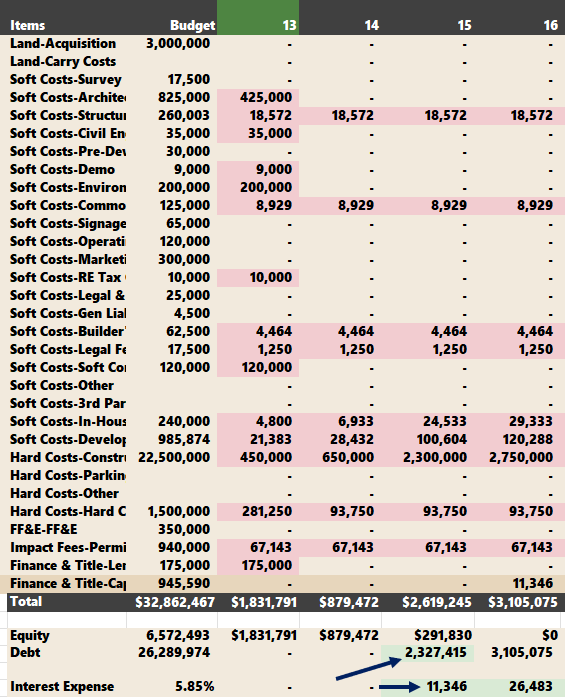

Then, the bank funds the construction loan in Month 13. You'd need to manually enter all the construction costs for the next 14 months (or however long your construction term is).

While this is slightly more time-consuming, the model has safety checks to ensure you account for everything.

The reason you have to type them in manually and can't do the automated "Even" or "Bell Curve" methods is that those selections would make the expense begin in Month 1 before the construction loan is approved. This timing wouldn't be accurate. The hard costs and some of the soft costs wouldn't ramp up until the actual construction begins.

Note: Spending earlier in the construction timeline is more conservative as this will mean capitalized interest will be higher. When in doubt, allocate the expense earlier for a safer proforma by erring on the side of caution.

You can ensure the "Balance" column is "0" for each line item (on the far right and green). However, it is wise to have certain expenses you won't exhaust during construction. I have an operating contingency ($120,000) and some marketing budgeting ($150,000) likely used during the lease-up. The remaining balance is intentional for those two expense items.

Accrued Interest: There’s always a carry-over over accrued interest ($126,680 in the image above). You’ll never adjust this row in the proforma.

Every other line item net out at "0," which means I am accounting for every budgeted expense within the 26 months of predevelopment/construction.

You'll notice the construction is funded officially in Month 13, but there's enough investor equity to fund the expenses through Month 14. Then, you'd draw on the construction loan in Month 15, and the interest begins accruing.

Caution: The maximum construction period the model allows is 36 months. If you have a prolonged predevelopment period, it could encroach on that limit. Also, The model will only work if the property operations stabilize in five years. Using a more extended predevelopment period also eats into that finite time frame.

Related: These timeframe limitations have only ever been an issue when the developer is in a more sophisticated JV partnership that requires precise tracking of equity being phased both in the predevelopment and construction phases, which, admittedly, Tactica isn’t a good fit for.

Summarizing Predevelopment Method

You'd rarely purchase land before the construction loan funds. Tactica's Development Model, in its baseline state, assumes the developer closes on construction financing the same day they buy the parcel and request investor equity. This is the moment when the IRR clock officially starts.

While there were likely some predevelopment expenses the developer incurred, they wouldn't be included as part of the investment analysis, and they'd be reimbursed at the loan closing. Those expenses would be logged as "Upfront" on the "Budget & Draw" tab.

When the developer uses investor equity to purchase the lot/land before the construction loan funds, you'd need to alter your thought process slightly to account for the predevelopment period (the timeframe from when you'd buy the land to when the construction loan funds). It's possible to account for this scenario in the Tactica Development Model as long as:

You purchase the land in cash

You pay for predevelopment costs with cash

You need the TVM clock to start because investor equity is in the deal

The expense budgeting is more tedious as you cannot use all of the "preset” expense allocation methods and instead have to rely on manually entering the construction budget. Due to the tedious nature and the model losing some effectiveness, I consider this tutorial a workaround, not a permanent solution.