Residual Cap Rates in Real Estate Investing

One of the fundamental assumptions commercial real estate investors make will revolve around the property's future sale proceeds. The big question is:

What will the investment property's sale price be "x" years?

Most analysis models (including Tactica's) will use a residual capitalization rate (cap rate) to determine this.

Residual Cap Rate Contents

Residual Cap Rate Terminology

You’ll also hear the residual cap rate referred to as:

Exit Cap Rate

Terminal Cap Rate

Reversion Cap Rate

Residual Cap Rate Methodology

The property's future value is determined by its future NOI divided by a market cap rate.

Future Sale Price = Future NOI / Cap Rate

Even though cap rates have been compressing for the last decade, prudent investors will typically underwrite a residual cap rate higher than today's market cap rate (as a general rule of thumb).

Reversion Cap Rate Confusion

The most common question I receive on both free and paid financial models is the following:

"Why do you not 'cap' the sale year's net operating income (NOI)? Instead, you use the subsequent year's NOI."

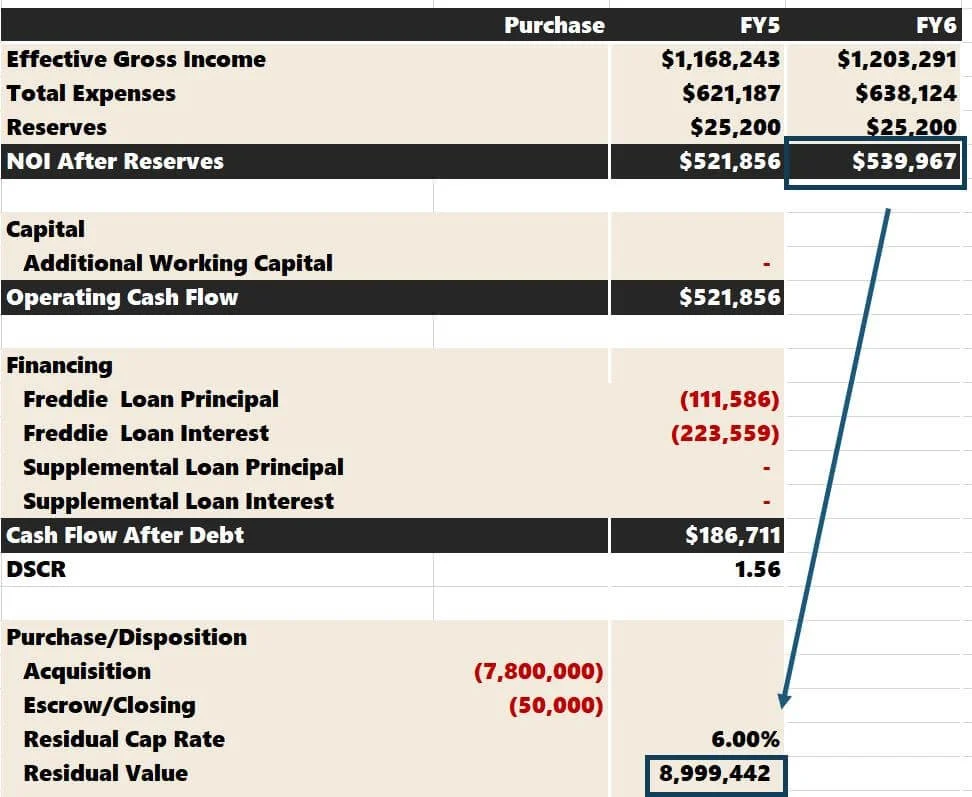

For example, if you have a 5-year DCF valuation, Tactica models will use the Year 6 NOI to determine the Year 5 property value (sale proceeds).

Holding Period = 5 Years

Year 5 NOI = $100,000

Year 6 NOI = $102,500

Terminal Cap Rate = 5.5%

Residual Value = $102,500 / 5.5% = $1,863,636

Why use $102,500 in the numerator instead of $100,000?

It's a great question, and I remember wondering the same thing when I was a newly minted multifamily analyst. I received the following explanation at the time and have seen it play out in many property listings.

Terminal Cap Rates: Industry Standard

Real estate valuations are heavily dependent on trends. The apartment building could be heavily swayed by what has happened recently vs. over the long haul.

Let's think about it very literally. We purchased a multifamily real estate investment on January 1st, 2022. After exactly five years, we plan to sell on December 31st, 2026.

To sell by December 31st, you'd likely hire a broker and start the sales process in the fall. At that time, you'd provide prospective buyers with:

As the sale process marches towards closing, the prospective buyers will request updated rent rolls and financial statements as the calendar turns each month.

What's happening here?

Prospective buyers are underwriting their proforma Year 1.

Your property’s Year 5 financials play into these projections, but the buyer is likely much more interested in the recent trends like:

Occupancy

Lease-Trade-Outs (rental income growth)

Trailing-Three (T3) revenue trends

Anomalies in operating expenses

Possible income streams that don't yet exist

If a buyer solely focuses on your Year 5 historicals and not the recent trends or the upside opportunities in a competitive bidding situation, they wouldn't win the deal. In other words, as December 31st comes closer, Year 5 numbers become more outdated and irrelevant.

Even the buyer’s lender will likely annualize the current rent roll when sizing debt service instead of depending on the T12 historical financials.

Short Answer: Year 6 of your proforma is probably more in line with the buyer's Year 1, which is why we cap it.

Exit Cap Rate Calculation Weaknesses

There are some flaws with the rationale that I just laid out. The biggest issue is that all return metrics will be inflated (internal rate of return (IRR) and equity multiples) if you capped a slightly increased NOI. Generally, properties have performed well, cash flows improve yearly, and capping an inflated net income hasn't been troublesome for aggressive buyers.

Residual Cap Rate Safety Cushion

Although industry veterans taught me that the "future" NOI is the industry standard, and I use this rationale in all Tactica models, I'm not blinded to its danger.

It could be problematic if the fundamentals reverse, interest rates rise, operations struggle, and property valuations begin to correct.

While I don't plan to change any models, I always recommend building a decent amount of safety into a proforma, especially estimating the expected net residual sale proceeds.

Some examples are underwriting:

Higher cap rates at sale

Modest gross income growth

Conservative expense growth

You can even run a scenario where the property sees no appreciation to see how the subject property fares. Could a project support itself if short-term appreciation isn't in the cards?

Summarizing Residual Cap Rates

The residual cap rate will play a significant role in any CRE analysis. It's paramount to understand the logic behind this calculation. Tactica models use the subsequent year's NOI in the numerator to calculate residual sale proceeds, as this year is likely more aligned with the buyer’s “Year 1” of their proforma analysis.