Multifamily Value-Add vs. Redevelopment: Key Differences

The image below compares the components of Tactica’s Value-Add and Redevelopment models. The remaining blog post will discuss each feature in the image in greater detail and how they’re incorporated into the Value-Add or Redevelopment Model.

Multifamily value-add and redevelopment overlap but are distinct investment strategies overall. The most significant differences are financing, refinancing, and renovation logic methodologies.

Just a reminder, I have complete “how to” tutorials for both the Value-Add and Redevelopment Models:

Financing

Construction or Bridge Financing (Year 0)

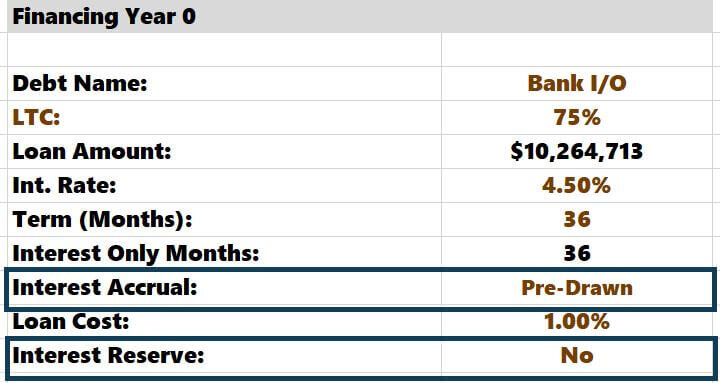

The redevelopment model allows users to account for short-term construction or bridge financing. The purpose of this debt is to acquire the property and fund the construction. Investors using this model will have complete control over whether the lender allows an interest reserve and whether or not the interest expense is pre-funded or accrues interest as borrowed funds are drawn.

Due to the short-term nature (and often costly nature) of this financing, a refinance is necessary upon completing renovations, which I’ll touch on shortly.

Amortizing Agency or Bank Loans (Year 0)

Only the Value-Add Model is capable of utilizing amortizing debt at close. The Redevelopment Model is built for expeditious rehab and refinance and, therefore, is not equipped to handle long-term amortizing debt at closing.

Agency or Bank Loan with “Interest-Only” Term (Year 0)

The Value-Add Model is built to handle an IO term for an agency or bank loan. The Redevelopment Model is not, but can be altered slightly to account for it. You must:

Set interest to: “Pre-Drawn” (interest will accrue on the entire debt balance starting in Year 0)

Set interest reserve to: “No”

Refinance upon completing the renovations.

I have clients that will use bank financing for significant renovation projects. The banks will technically offer two loans (purchase and construction) with identical terms and hold proceeds aside (the construction portion) for the rehab budget. In this scenario, you could use the Redevelopment Model only if the lender’s terms are interest-only during the construction period and you intend to refi upon completion.

Loan Assumption (Year 0)

Only the Value-Add Model can handle assuming an existing loan.

Supplemental Financing (Year 0)

Only the Value-Add Model can handle supplemental loans.

Refinancing Assumptions

Only the Redevelopment Model can handle refinancing. You’ll be able to select the cap rate at refinancing, the LTV for the loan proceeds, the loan's interest rate, amortization, and the interest-only term (if any).

You can also select if there is a repositioning fee for your effort in securing permanent financing.

Renovations

Granular Renovation Detail

The Redevelopment Model will allow the user to get detailed with their renovation plan (down to the individual units if desired). It is also fantastic for adding units or combining smaller units into larger floorplans.

“Blocking” or “Sectioning” Off Groups of Units

Underwriting is more efficient if you take chunks of the rent roll and renovate them over one to three years. You can see how you should do this on any 100+ unit property if time is of the essence by expeditiously using the “Error Check” feature to underwrite rehabs for larger properties.

A “Generalized” and “Linear” Renovation Assumption

The Value-Add Model is great for quickly assessing the value-add potential of a property. You can take all the units and apply a few assumptions, such as:

Renovation Term

Renovation Vacancy

Premium/Capital Spend

The model will phase in premiums over your renovation term and is very efficient at showing you what stabilized revenue could look like a few years later. The Redevelopment model is more thoughtful with rehab planning by design, but this requires more time to plan the renovation project's logistics.

Delayed Renovation Start

The Value-Add Model allows you to choose when the renovation begins (which year of the investment hold). This flexibility is not included in the Redevelopment Model due to the short-term nature of the construction financing.

Renovation Stress Test

The Value-Add Model has a renovation stress test. You can see how the return metrics would be affected if over/underachieving on your value-add plan. This stress test took up a lot of computing power and was quite complex behind the scenes. The Redevelopment Model naturally requires much more “computing,” I felt it necessary to cut this analysis to preserve maximum Excel efficiency.

Common Areas and Exteriors

The Redevelopment and Value-Add Model can account for CAPEX allocated to common areas, exteriors, contingencies, holding costs, etc. The difference is the level of detail the Redevelopment Model brings.

First, let’s talk about the Value-Add model. There are three different ways you can account for common area capital:

(1) Allocate it to the unit:

(2) Classify it as “Other” on the “Investment Summary” tab:

(3) Pay for it with cash flow from the project:

Or you could use a combination of the three ideas above. For some, the above logic will be sufficient.

For other investors who want more transparency, the Redevelopment Model has a robust solution. There is an entire tab dedicated to CAPEX where you can set timelines for specific expenditures. The interest expense is calculated automatically and is determined by the projected construction draws.

Summary

If you’re on the fence, trying to determine if a Value-Add or Redevelopment Model is right for you, hopefully, this article clarified the components of each. Redevelopment and Value-Add are distinct investment strategies, varying in how the investor accounts for debt and renovation planning. Both models serve crucial purposes depending on the investors’ course of action upon taking over the property.