Purchasing Pre-Stabilized Multifamily Investments

Looking back at my history of underwriting multifamily investments, pre-stabilized assets are the most difficult to underwrite. So many difficult questions must be answered, but a significant upside could be unearthed for those willing to take on the uncertainty.

Contents

Defining Pre-Stabilized Multifamily Assets

“Pre-stabilized” is when a newly constructed apartment building has an occupancy percentage below what would qualify for permanent financing. As a general rule of thumb, properties less than 90% leased are typically considered pre-stabilized.

Occasionally, a property developer will build an apartment complex and be motivated to sell it before it reaches its full potential.

Example: Property ABC is 30% leased, and ownership (the developer) is in talks with a few investment groups for an off-market sale. A fully stabilized comparable property would sell for a 4.5% cap rate in this submarket. Because of the lease-up risk, the seller is willing to part with the asset at a 5.0% cap rate on the projected stabilized NOI.

Targeting Pre-Stabilized as a Business Plan

This offers an opportunity for the buyer. They take on lease-up risk and can typically receive a pricing discount to account for this challenge. Assuming the buyer can stabilize the property and achieve the forecasted NOI, they effectively netted 50 basis points of arbitrage.

From the seller’s perspective, they sold the asset sooner, which boosted returns and removed operational/lease-up risk. This can offer a win-win situation for motivated sellers and buyers.

There will be unprecedented opportunities for buyers to find a pre-stabilized building. Record deliveries combined with a challenging macro environment could ultimately sway many developers to sell their projects earlier than intended.

Pre-Stabilized Underwriting Challenges

A few facets that make pre-stabilized underwriting challenging are:

Questionable rent assumptions

Uncertain ancillary income charges

Historical Financials

Unfortunately, there will be limited operating history, no T12 financials, and no baseline to underwrite revenue and expense-related line items.

Rental Assumptions

What will rents be once stabilized? It can get murky when the lease-up is marred by concessions that could lead to underwhelming future rent projections. Conversely, an overly expeditious lease-up could indicate that units are under-rented and primed for a rent bump at renewal.

Ancillary Income

How many parking spaces will you lease, and for how much? What about storage? How many units will have pets? These questions are tough to answer without baseline historical financials.

Property Taxes

What will stabilized property taxes cost you? How will they be affected post-purchase? Real estate taxes will likely be your most significant operating expense, and understanding future exposure is paramount.

There is much guesswork when building a proforma at this stage. It is much more of an art than it is a science.

Pre-Stabilized Underwriting Strategy

Tactica offers site visitors two financial models equipped to handle a pre-stabilized investment opportunity.

Your decision will ultimately come down to your financing preferences.

Value-Add Model = Cash purchase or traditional bank or agency financing (likely low-leverage) with no intent to refinance

Redevelopment Model = Obtain bridge financing (likely max leverage) at closing to refinance into traditional bank or agency financing at stabilization.

Another perk of the Redevelopment Model is the ability to scheme a detailed lease-up plan, as I’ll show you shortly.

Value-Add Model Tutorial

The “Value-Add” title is a bit deceiving. It’s an excellent tool for underwriting newer apartment complexes. It can work for pre-stabilized buildings as well.

Renovations Tab

As I did below, you’d enter your project unit mix into the input grid with $0s for premiums and capital.

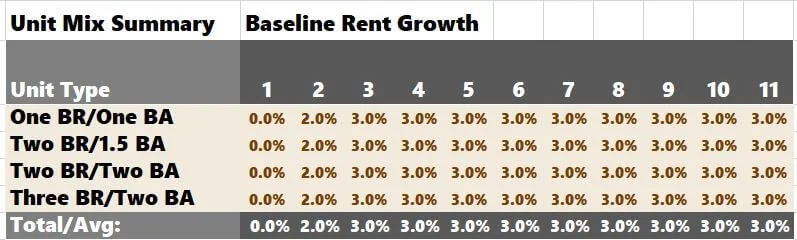

I’m underwriting Year 1 rent growth for all units at 0% because we’d be focused on leasing the units, and unit turns won’t be a factor until the following year.

The strategy inputs would be the following (to essentially “turn off” the value-add).

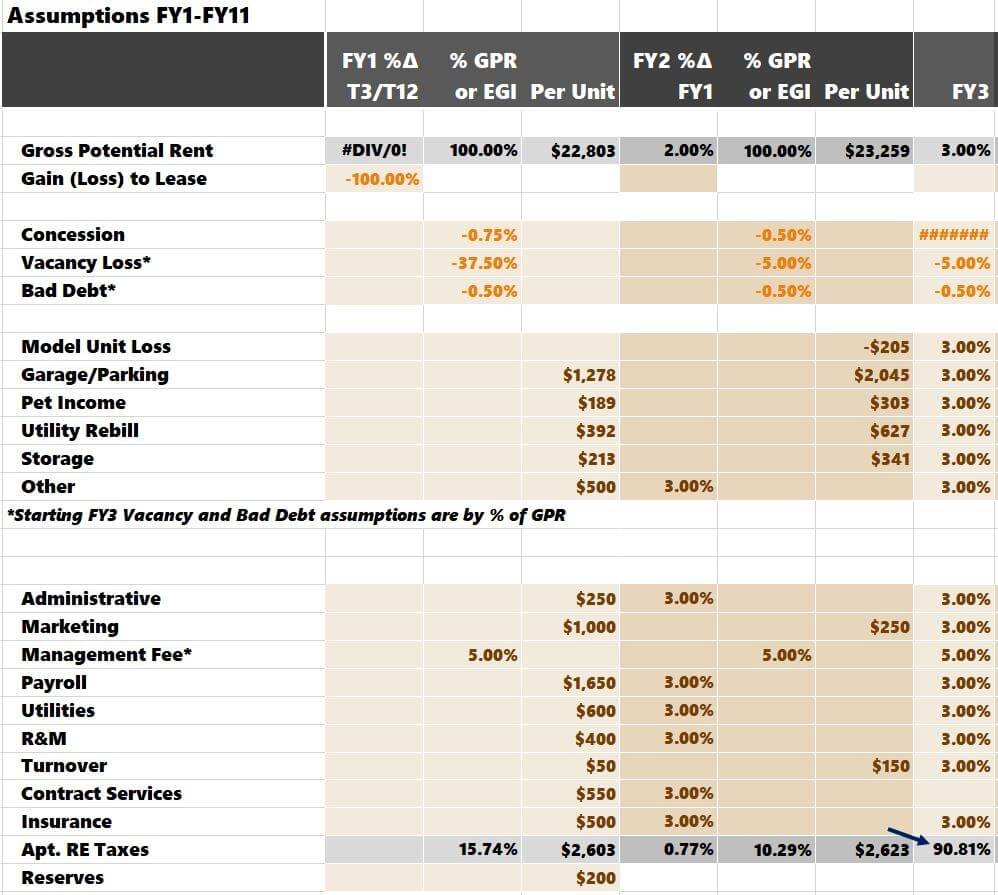

Financials Tab

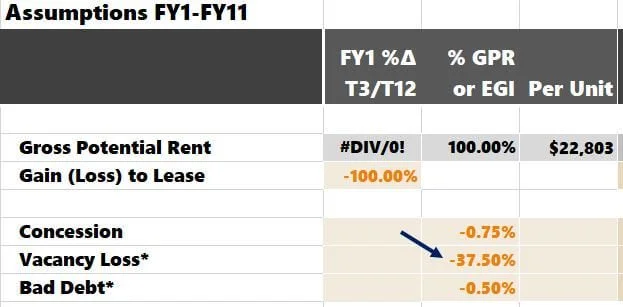

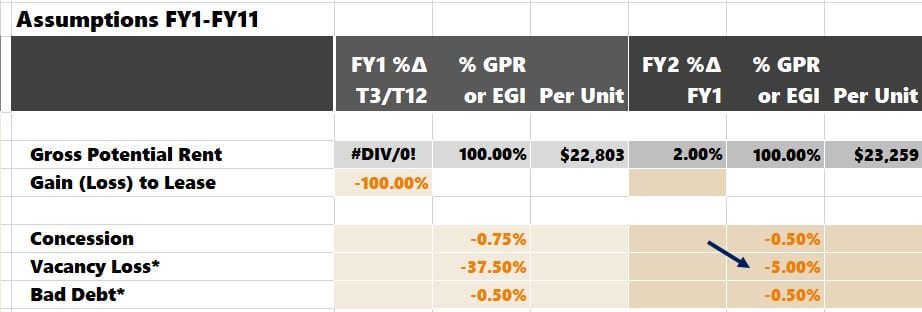

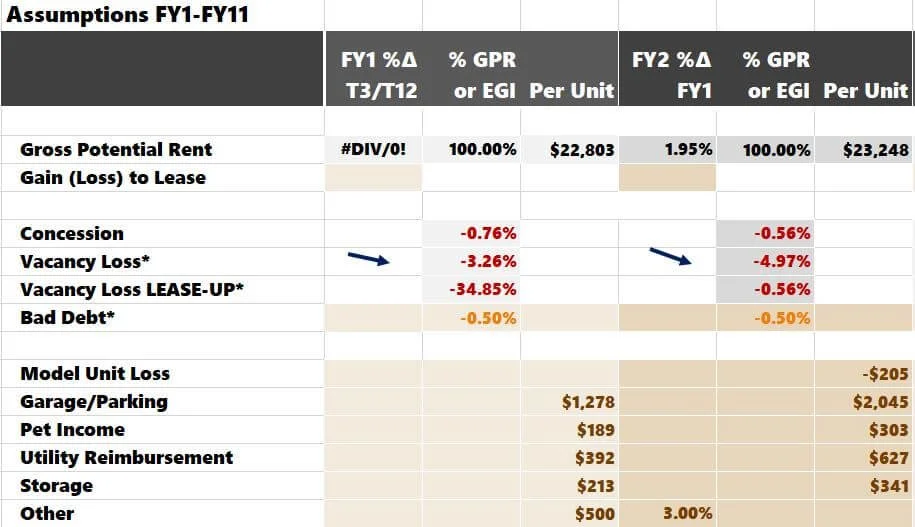

The financials tab is where the assumptions get difficult, specifically with the vacancy assumption for the lease-up year. Historically, I’ve always come up with this assumption manually.

Example: We’re taking over the property when it’s 30% occupied. We expect it to hit 95% occupancy in 12 months. For our Year 1 vacancy assumption, we could take a blended approach:

(30% + 95%) / 2 = 62.5%

Vacancy Assumption = (1 – 62.5%) = 37.5%

Each month, the average occupancy will increase by about 5.4%

(95% - 30%) / 12 = 5.4%

If the property is 88 units, this is about five units per month. Do you think that’s feasible? Does your leasing team or property manager believe that is reasonable? If so, you can enter the Year 1 vacancy assumption.

Note: I hid the rows dedicated to “renovation premiums” and “renovation vacancy” as they aren’t prevalent in a pre-stabilized underwriting exercise.

The following year, Year 2, the property is projected to be stabilized at 95% occupancy (5% vacancy).

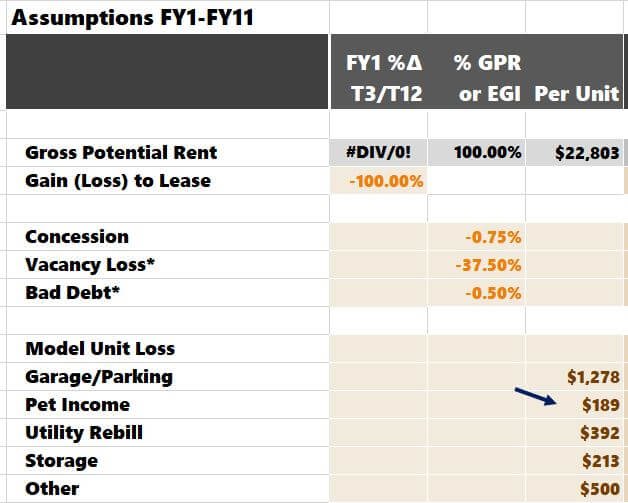

Ancillary Income

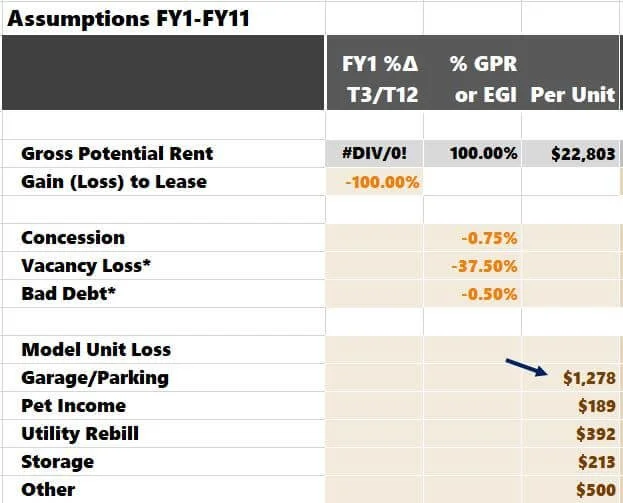

What about income from underground parking, storage lockers, pet rent, RUBS, etc.?

I’ll make stabilized assumptions for all these line items and then peg them to the vacancy assumption we just stipulated above.

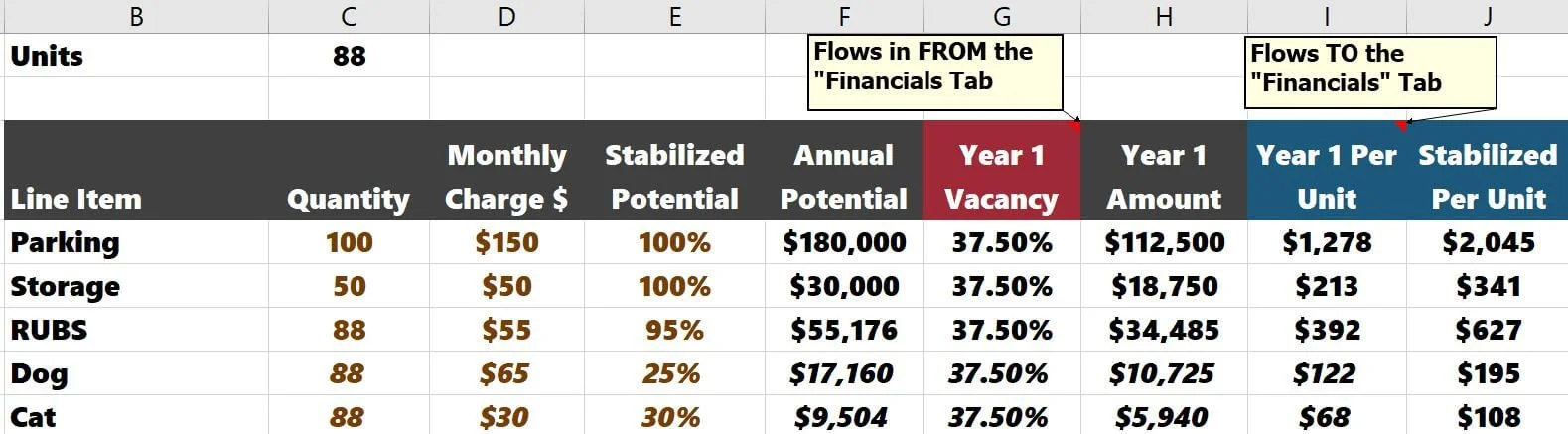

Parking Income

There are 100 parking spaces, and we think once the property is fully stabilized, all 100 spots will be leased at $150 per month. I would use that information and multiply it by the 62.5% occupancy.

(100 x 150 x 12) * (1 - 37.5%) = $112,500 in Year 1 Parking income

In the model, I’d input this assumption with the “per unit” election:

$112,500 / 88 units = $1,278

Pet Rent

For pets, I’d assume that 30% of the units will have cats once the property stabilizes, and 25% of units will have dogs.

Cat Rent = $30/Month

Dog Rent = $65/Month

Stabilized Cat Rent = 88 x 30% x $30 x 12 = $9,504

Stabilized Dog Rent = 88 x 25% x $65 x 12 = $17,160

Total Stabilized Recurring Annual Pet Income = $26,664

Year 1 Pre-Stabilized Pet Income = $26,664 x (1 – 37.5%) = $16,665

In the model, I’d input this assumption with the “per unit” election:

$16,665 / 88 = $189

I would assume the same for storage lockers, utility rebills, and other income items.

Usually, I will create another tab to host this basic arithmetic to simplify the proforma inputs. It looks like this:

Then, I can grab the “per unit” in column “I” directly from the “Financials” tab and not have to type out the equations in the assumption cells manually. The vacancy flows into this grid from the “Financial” tab. This way, it’s easier to tweak these assumptions and ensure they are reflected in the proforma underwriting.

Note: This tab, “Ancillary Income,” is not included in any paid models. It exemplifies how you could alter the model for more accessible inputs. If you have a longer projected lease-up (perhaps two years), you can follow the same logic above for both Years 1 and Years 2. It’s a simple addition that could help prevent mistakes.

Expenses

Generally, expenses are fully baked in except for some turnover, utilities, and perhaps marketing, which may be elevated. Because there won’t be historical data, I’ll underwrite all expenses per unit except for the management fee. The property management company overseeing them should confirm most of these assumptions.

Property Taxes has a dedicated tab.

These are how the Year 1 through Year 3 assumptions look for a pre-stabilized scenario.

You can see property taxes increase significantly in Year 3 (post-sale).

In the final step, you could change the tab name from “Renovations” to “Lease-Up” or something more appropriate for the asset type.

Reminder: As I mentioned earlier, underwriting at this juncture is more of an art than a science—error on the side of caution.

Redevelopment Model Tutorial

Assuming you want more precision and control over the lease-up and the ability to refinance out of bridge financing at stabilization, the Redevelopment Model can also handle pre-stabilized underwriting. Before I dive into the details, it may be worth reviewing how to use the blended method for the Redevelopment Model. I’ll be following the same rationale today.

Note: It may be helpful to check out all the Redevelopment tutorial content as you explore this method.

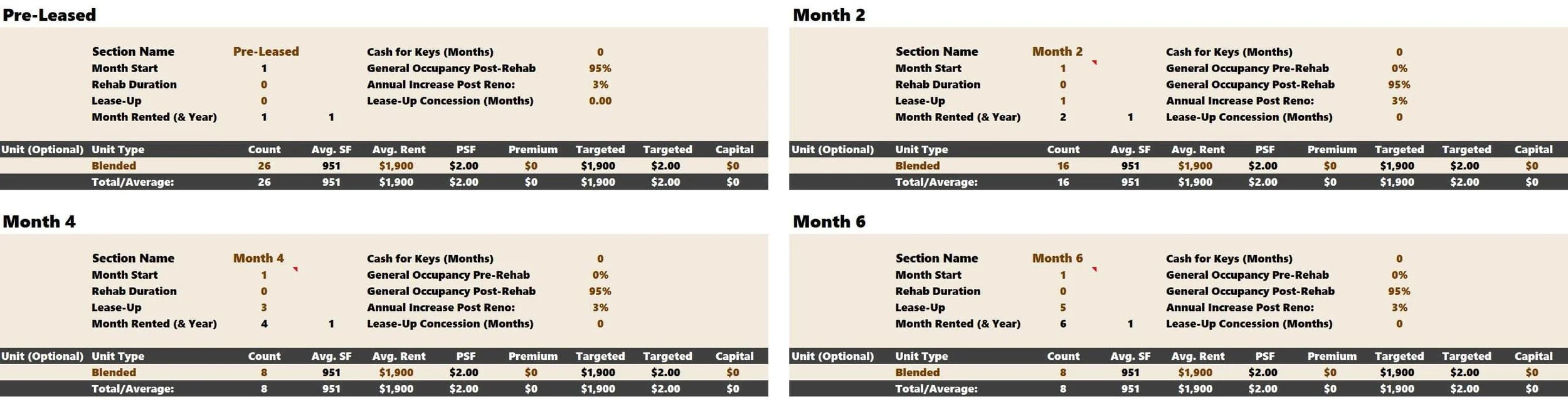

Reno Inputs Tab

Instead of using the “Reno Inputs” tab for a renovation plan, we can use it for the lease-up strategy. There are eight blocks you can use to organize your project. You can see in the image below that I have the unit mix broken up as follows:

Pre-Leased Units

Month 2 Leases

Month 4 Leases

Month 6 Leases

Month 8 Leases

Month 10 Leases

Month 12 Leases

Month 14 Leases

30% of the units (or 26 out of 88) are occupied immediately upon taking over.

Month 2 = 16 occupied units

Months 4,6,8,10,12 = 8 occupied units (each month)

Month 14 = 6 occupied units

A couple of other things to note:

“Month Start” is “1” in all eight sections

“Rehab Duration” is “0” in all sections (there is no rehab); the lease-up assumption is what should be changed in each block

“General Occupancy Pre-Rehab” is “0” in each section

“General Occupancy Post Rehab” is “95%” in each section

I have one month of concessions for the last two sections (Months 12 and 14), as the last remaining vacant units are likely going to be the hardest to lease

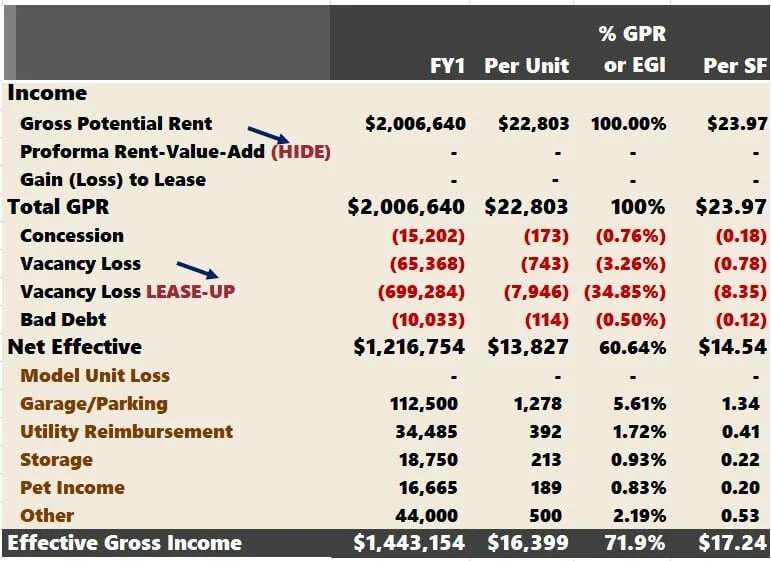

Financials Tab

Unlike on the Value-Add Model’s “Financials” tab, vacancy and concessions are calculated for you and depend on your lease-up assumptions from above.

You can make your ancillary income assumptions the same we did before on the Value-Add portion of the tutorial.

You can hide the “Proforma Rent-Value-Add” Row and change the terminology for “Vacancy Loss Renovation” to Vacancy Loss Lease-up.”

Property tax assumptions would follow the same steps as the Value-Add Model.

Value-Add vs. Redevelopment

The big perk of the Redevelopment Model is the ability to incorporate a refinance. When the renovation is complete, you must blow out the bridge debt with traditional financing. You have the flexibility to choose the refi month. However, it must be 36 months or less.

On the other hand, the Value-Add doesn’t allow for a refinance or a detailed lease-up plan. In both the Value-add and Redevelopment Models, there’ll be tabs and analysis sections that won’t be relevant because there isn’t a rehab component. Feel free to hide irrelevant tabs and ignore the sections summarizing the renovation metrics.

Summarizing Pre-Stabilized Asset Underwriting

Pre-stabilized multifamily underwriting is challenging due to the lack of historical financials, murky rent assumptions, questionable other income prospects, and property tax exposure. This risk is why investors willing to take on this asset class usually see a pricing discount.

I gave you some ideas on how to underwrite these projects. There is much guesswork, and it is always recommended to err on the conservative side.