Underwriting Mixed-Use Development

Most multifamily developers creating living spaces in infill locations often include a ground-floor retail component in their projects. If you use zoning variances to override the original land use, many local governments, municipalities, planners, and neighborhood groups require/desire the development to include retail. You may ask why.

To enhance the neighborhood. The potential for coffee shops, restaurants, fitness studios, and boutique shops can amenenitize a locality. Retail establishments can create a more walkable community and help spur future economic development in the direct vicinity.

Mixed-Use Development Contents

Mixed Use Real Estate Development Intro

The theory and vision behind first-floor retail in mixed-use buildings are understandable. Realistically, it's much harder to execute and incorporate retail into an apartment complex than some may realize.

Commercial leasing requires unique expertise that is costly. A special CAPEX requirement exists to build commercial spaces to the tenant's specifications. Finally, retail leasing is more challenging than apartment leasing. Commercial units can stay vacant for long periods, and instead of seeing lively, vibrant streets, vacancy can create more of a "ghost town" vibe.

Whether real estate professionals are proponents or opponents of mandatory mixed-use development or redevelopment projects is a discussion for a different day. It is necessary in many projects, and I want to talk about how I underwrite commercial components when vetting a development site.

Tactica Development Model: Mixed-Use Real Estate

Does the Tactica Development Model account for new mixed-use?

The short answer is "no."

The Tactica Development specializes in single-use residential units. That said, I use this model occasionally on projects with commercial use, such as retail or office spaces. I intend to demonstrate the workaround I sometimes utilize.

Note: The tool is not equipped to handle condo development, which is another common question. Condo development is an entirely different ballgame than residential rentals, with the most significant differences stemming from financing arrangements, residual sale(s), and the HOA.

Underwriting a Mixed-Use Development

I've seen the Tactica model used for a variety of uses. The most extreme was a gentleman who purchased the template to underwrite a strip mall development! He told me the model perfectly served its purpose (much to my surprise).

There are two ways to incorporate commercial into the Development Model:

On the "Unit Mix" tab

In the Other Income on the "Stabilized Operations Tab"

Both methods have their pros and cons.

Commercial: Unit Mix

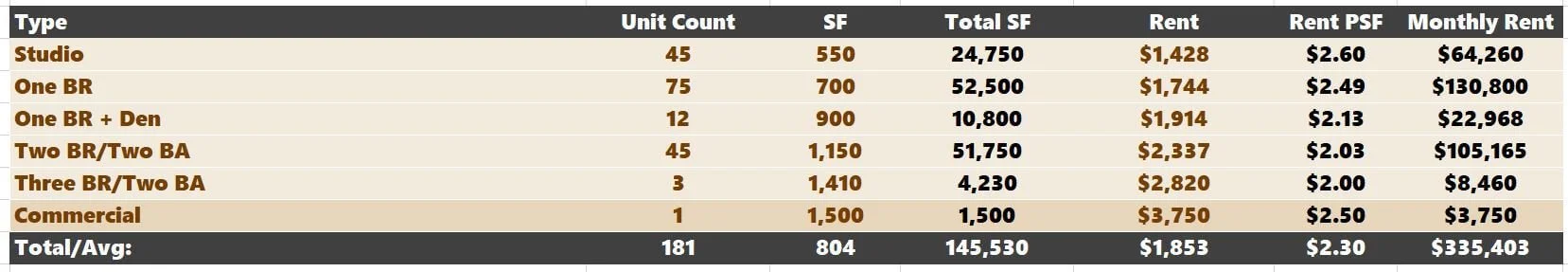

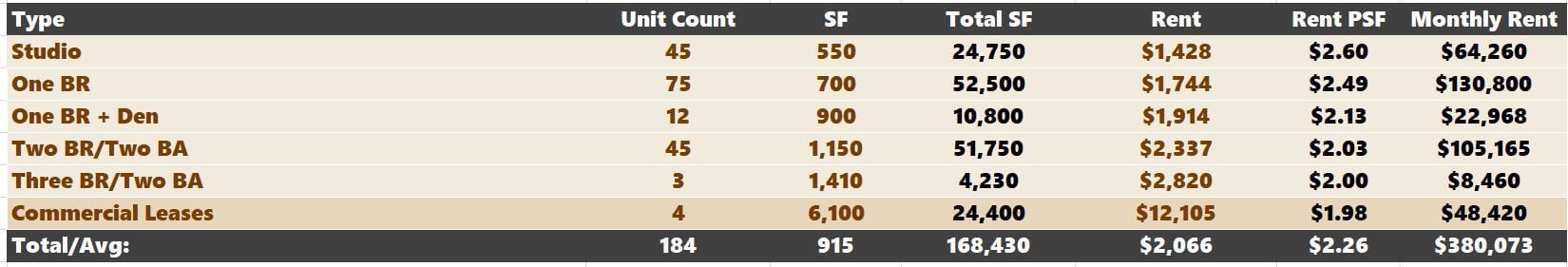

I've seen customers build retail leases right into the apartment unit mix. See below:

The commercial lease is entered below the apartment units. This action has its perks, but it also has a few downfalls.

Awkward

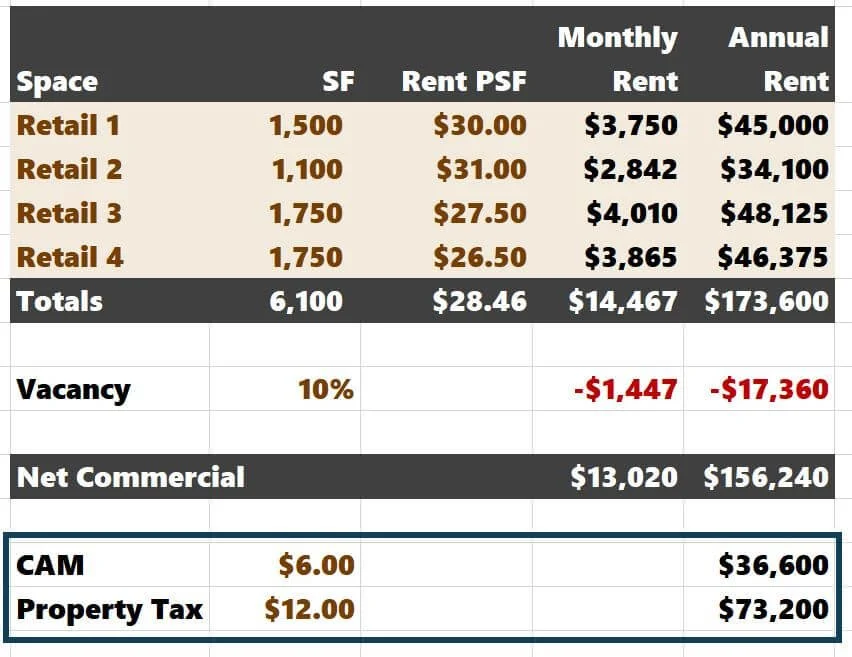

Commercial leases are typically discussed on an "annual rent per square foot" basis. A commercial lease would be quoted as something like $30.00 PSF. If the space was 1,500 square feet, you could deduce the annual rent is:

$30 x 1,500 = $45,000

To make this data work with the rental inputs, you must input this term as monthly rent. While it's easy enough to back into:

$45,000 / 12 = $3,750

It's not intuitive and could be perceived as confusing. If I ask a client, "Hey, what are you leasing the commercial space for?" And they answer, "$3,750" or "$2.50" (the monthly rent PSF). This means nothing to me. I still need to “back into” the annual rent PSF to conceptualize the quality of the lease term.

Rental Phase-In

The commercial lease won't "phase in" like apartments. For example, you may forecast apartments to be 20% pre-leased and rent out 8% of the units each month after that. The income will phase similarly if you put commercial in the unit mix. Technically, this isn’t accurate.

Commercial income will abruptly start one day in the future, and the tenant will begin paying their agreed-upon rent by the commencement date of the lease (pending any concessions).

Note: While pinpoint accuracy may be lacking, this is a more conservative way to underwrite the commercial income. The slower phase-in of this commercial income stresses the proforma more than earning commercial rent immediately at the certificate of occupancy date.

Commercial: Other Income

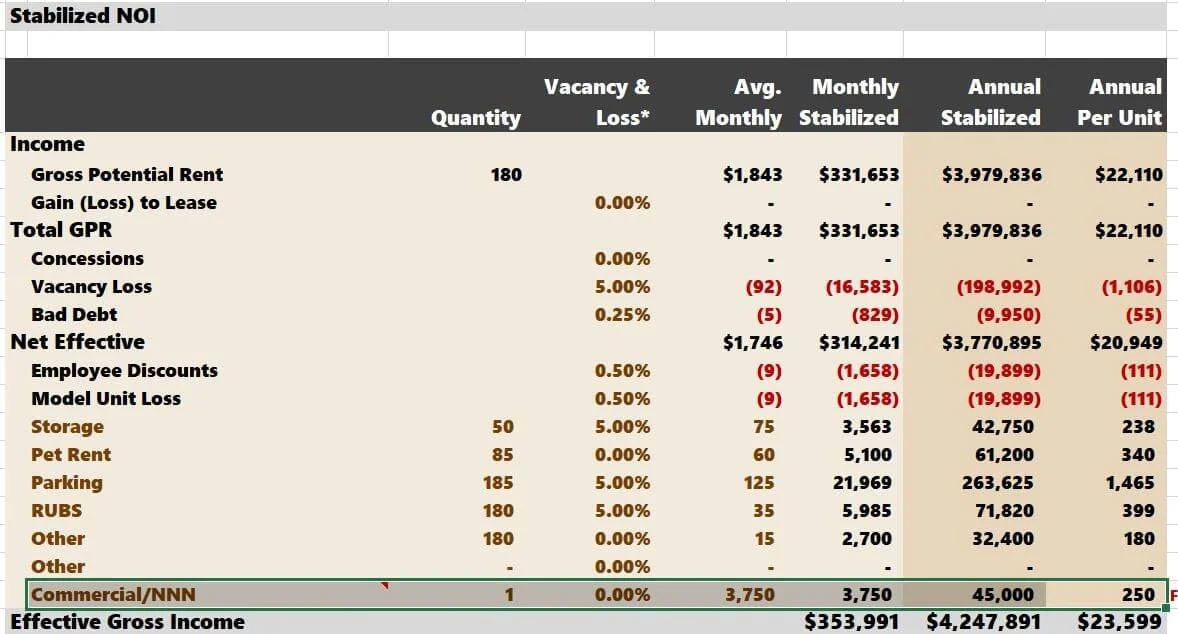

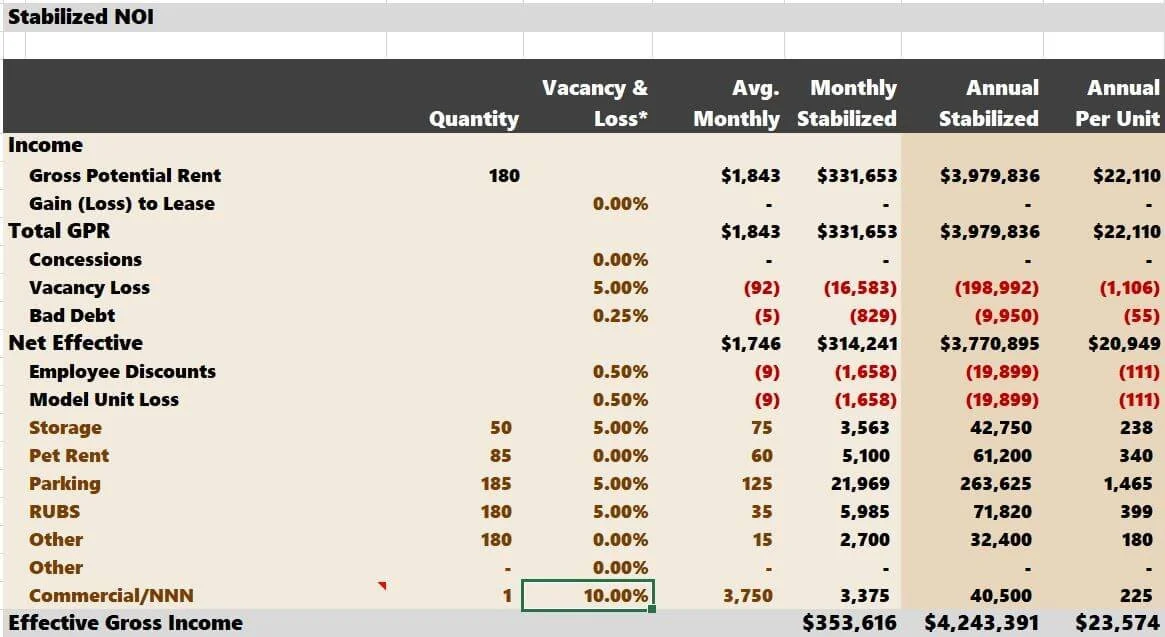

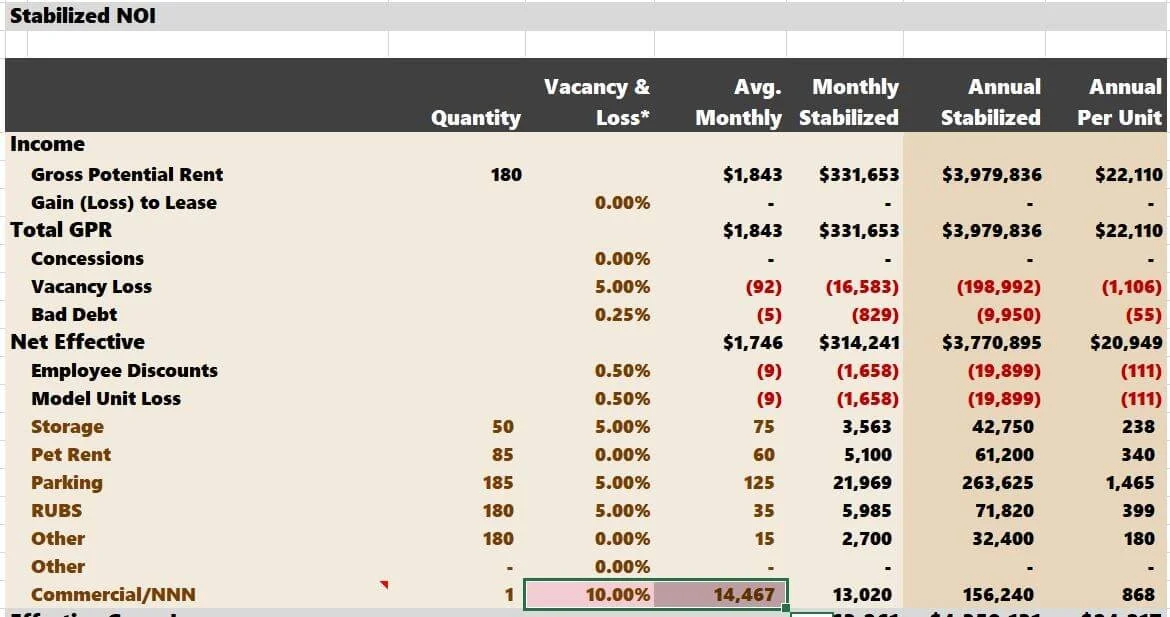

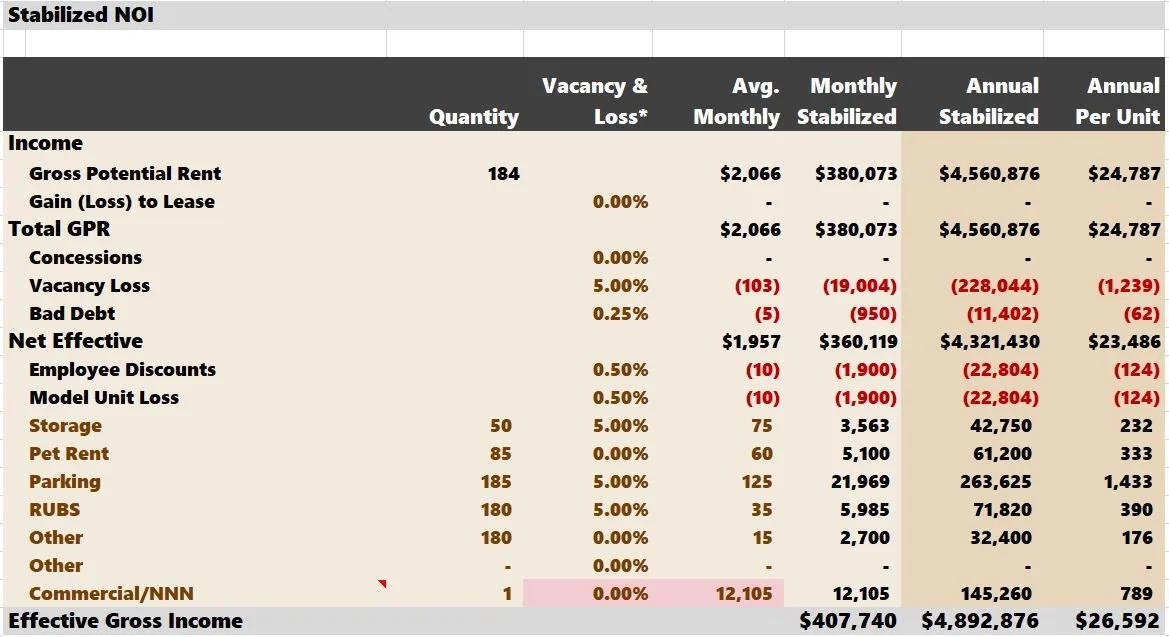

The other way to account for commercial income is in the “other income” of the "Stabilized Operations" tab.

The formula is altered slightly in the last line item of the revenue section. Instead of phasing in revenue commensurate with the apartment lease-up, this line item will hit the proforma in full force as soon as the property is open for business (at C.O.).

When the residential building opens, the commercial rent will phase in immediately. If you have one commercial lease, this is likely a more accurate representation of how the commercial rent will eventually hit the proforma.

The input process is still a tad awkward (as in the unit mix method).

Quantity = 1

Avg. Monthly Rent = $3,750

You could run a vacancy assumption here, such as 10%.

Annual commercial income adjusts to $3,375 monthly or $40,500 annually.

The commercial assumptions are very high-level, but this could be sufficient for some underwriters. Let's go a little deeper.

Other Mixed-Use Real Estate Considerations

What if we want to take into account some more complexity, such as:

Multiple retail leases

Retail vacancy

Tenant improvements (T.I.s) and leasing commissions

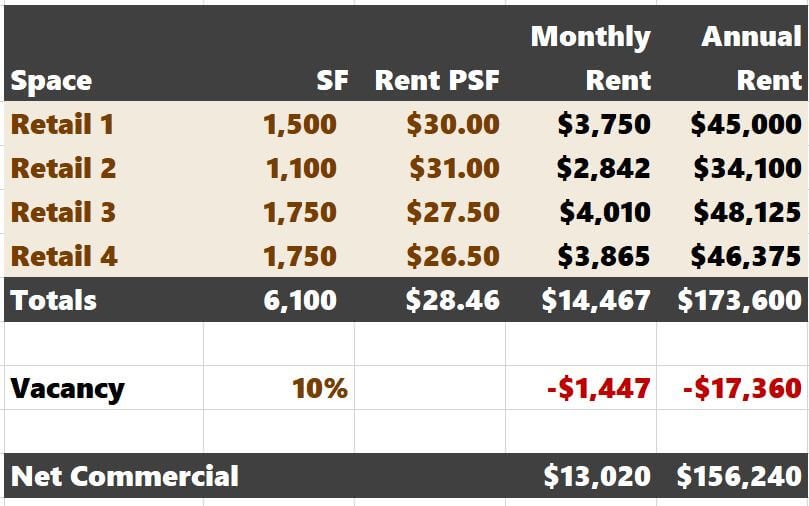

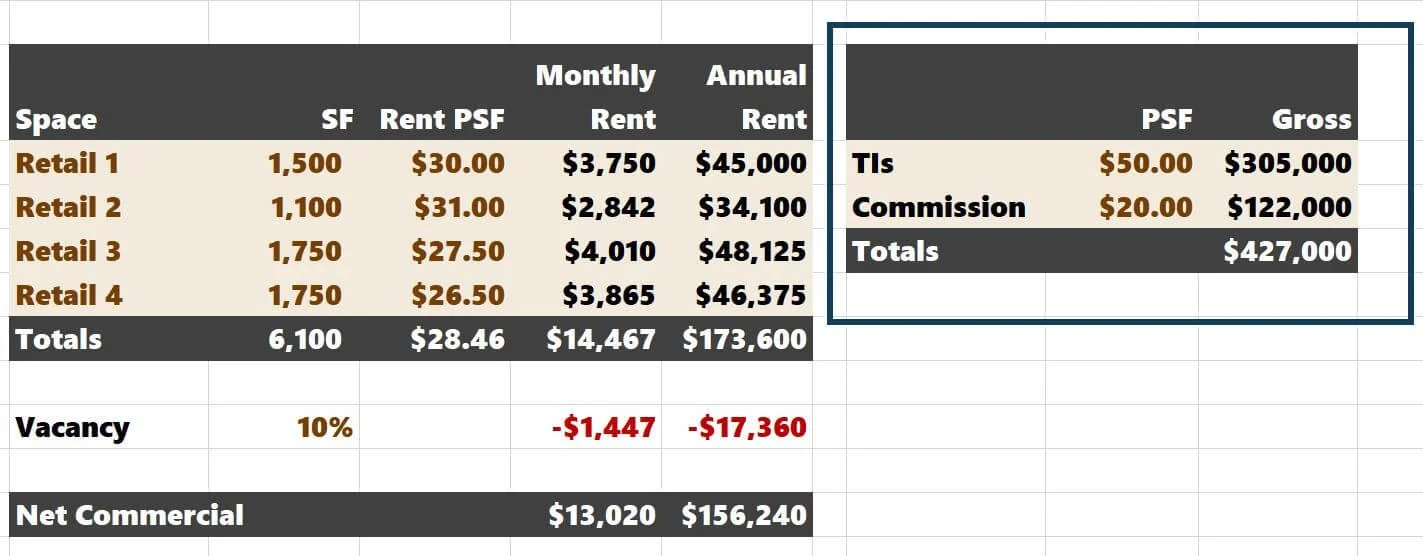

I would create a "Retail" tab to host an elementary retail rent schedule. This tab would stipulate rents and your vacancy assumption.

Disclaimer: No “Retail” tab is included in the Multifamily Development Model. This is simply an idea to summarize retail cash flows conveniently and intuitively.

I'd then enter the blended rent rates into the model here:

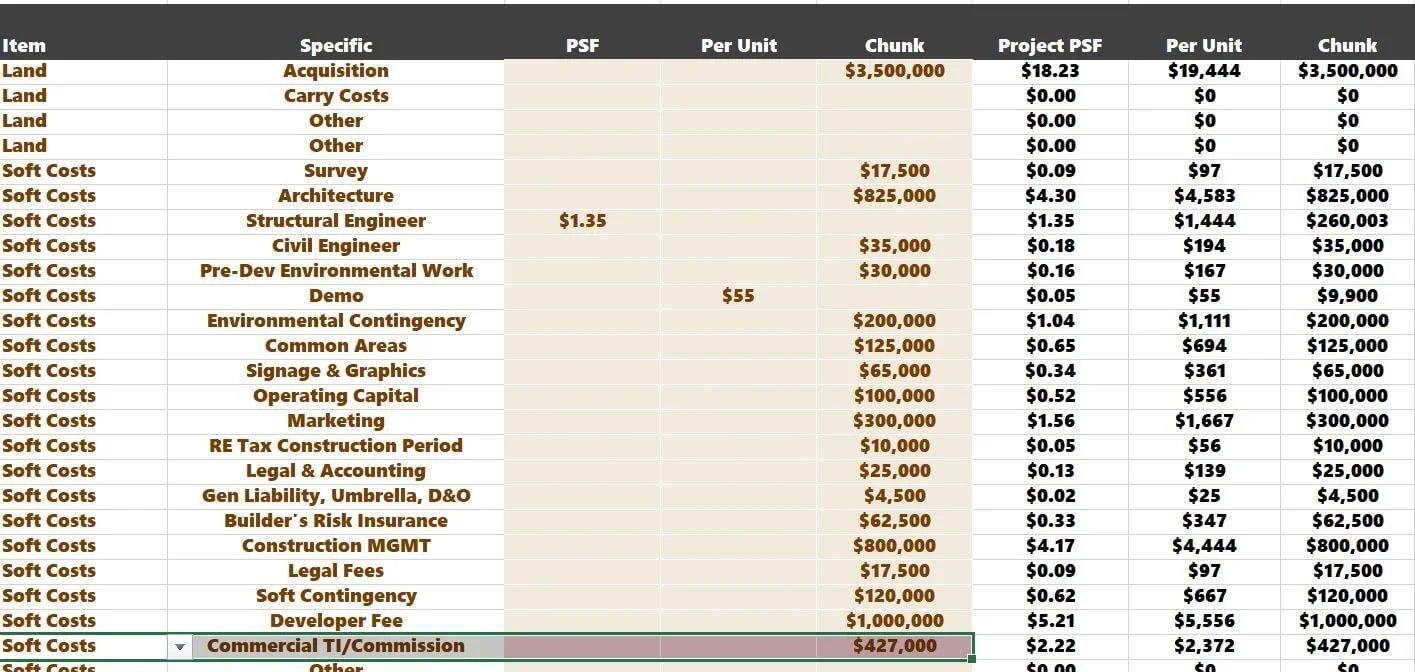

For the last bullet, I'd account for the T.I.s and leasing commissions in the construction budget. If we estimate T.I.s at $50 PSF and leasing commissions at $20 PSF, and our retail S.F. is 6,100:

I'd plug the following into the construction budget as soft costs:

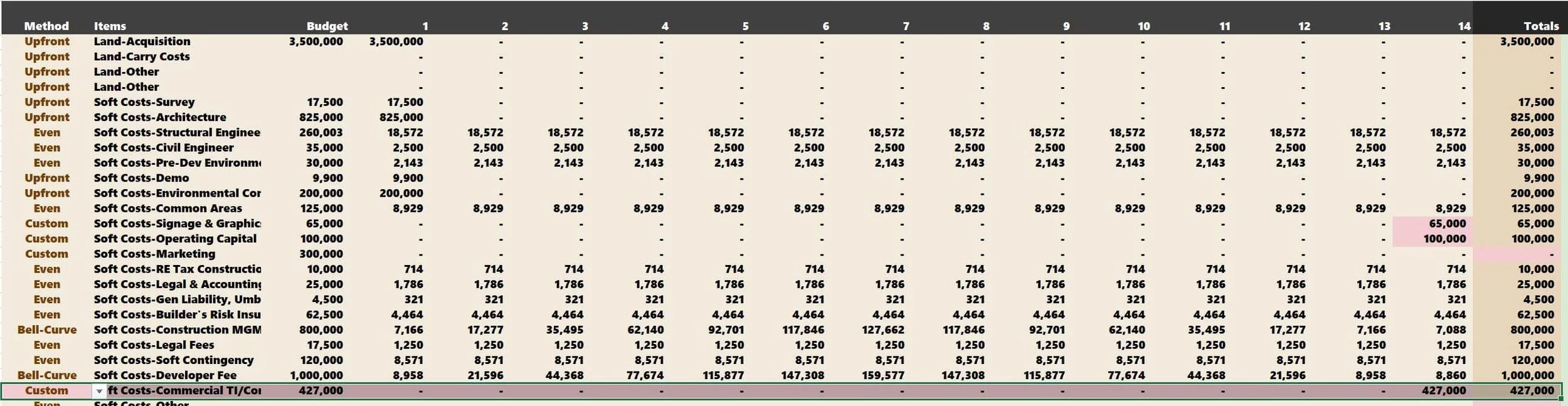

Note: Be sure to use the "Custom" method for this expense and allocate it at the end of the construction term.

Mixed-Use Underwriting Weaknesses

There are weaknesses associated with commercial underwriting components in the Tactica Development Model.

If you have multiple commercial leases, they will likely start at different times.

2nd generation commercial leases are not accounted for in the model, nor are the costs associated with them.

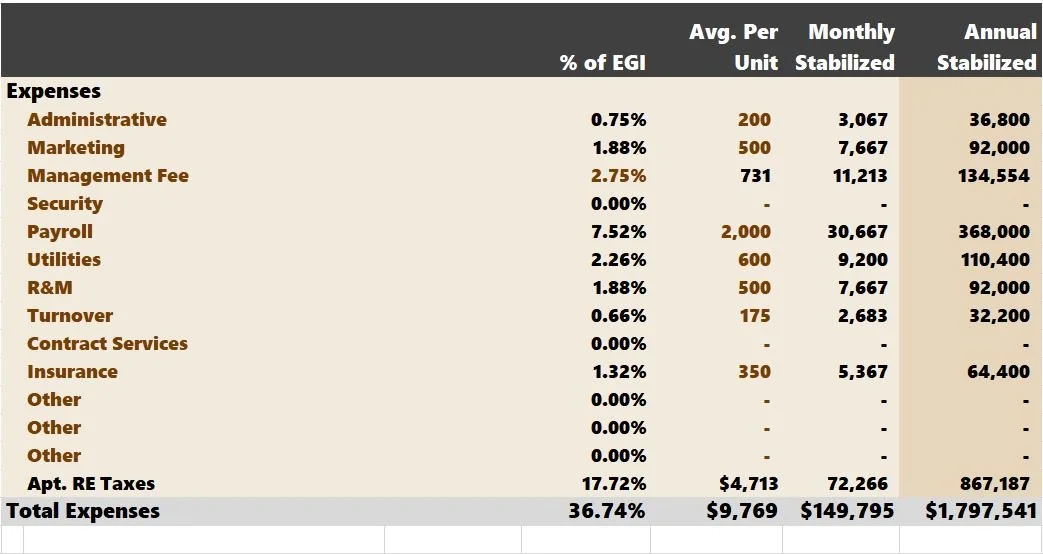

Property tax, CAM, and insurance are not bifurcated between the mix of uses (residential vs. commercial).

For any lease that is not NNN, the lease would be much more tedious to model accurately.

The model doesn't do a great job of showing total commercial tenant cost exposure.

Commercial Rent Growth (YoY) doesn’t have a dedicated assumption toggle.

Multiple Commercial Lease Starts

For the first bullet, there is a minor workaround. Remember how we discussed entering commercial units on the "Unit Mix" tab, which would cause the retail units to phase in with the apartment units? Well, perhaps this would be helpful in a situation with multiple commercial leases. You could input them on the "Unit Mix" tab to facilitate a smoother phase-in. It's not perfect by any stretch, but it factors in a more gradual commercial lease-up instead of all commercial income hitting the proforma at C.O.

Remember to grab the "net rental amount” into the "Unit Mix" grid.

2nd Generation Leases & Leasing Costs

If the master plan is to build and hold a property long-term, you'd need to think about 2nd generation leases. When commercial leases expire, there is a vacancy, leasing commissions, tenant improvements, and potentially free rent (even on renewals). Ideally, cash flow from the apartments would cover this. If not, budgeting is required beyond the scope of the Tactica underwriting template.

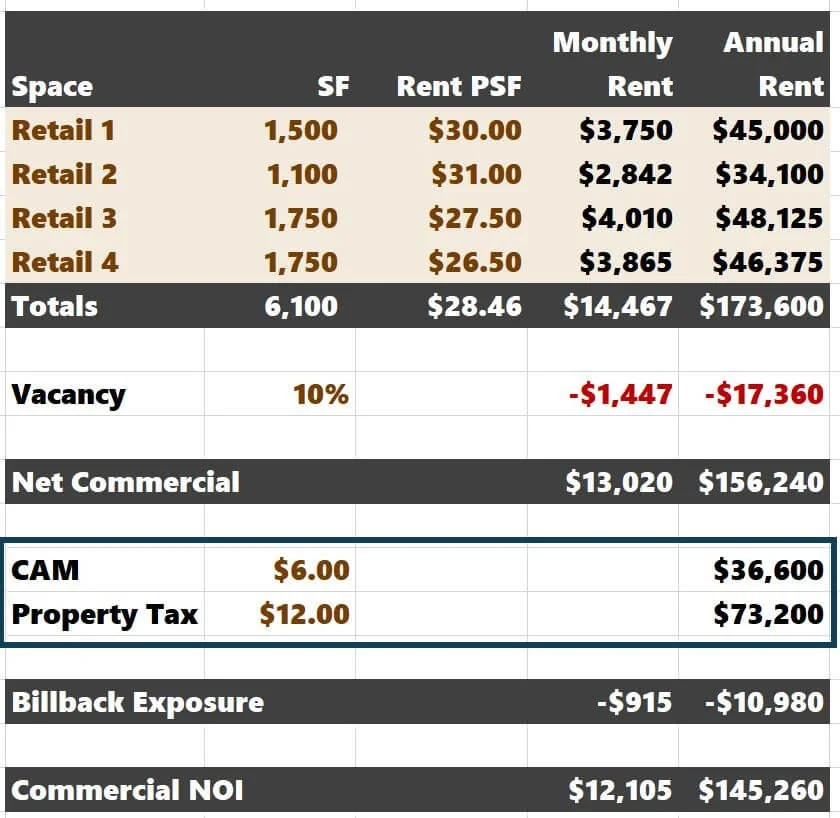

Property Taxes & CAM

As the deal sponsor, you'd want to know the breakdown of property taxes between residual and commercial. The county will assess the apartment and commercial components separately and apply different applicable tax rates.

Related: When looking at property tax comps, you must be aware of commercial components in other apartment projects and exclude them from calculating the residential property taxes per unit.

You only solve for the apartment component in the property taxes section of the "Stabilized Operations" tab. The retailers pay for the commercial segment (assuming a NNN lease). But what if there is a retail vacancy? If only 50% of the commercial is leased, the landlord would be responsible for 50% of unpaid commercial property tax and other CAM.

If you wanted to be extra conservative, you could project what CAM and Commercial RE Tax are on a PSF basis.

You could then run the same vacancy projection as we did previously (10%).

In the example above, you’d be on the hook to pay 10% (or $10,980) of the commercial tenants’ CAM and tax.

Finally, we can input this “bill-back adjusted rent” on the "Stabilized Operations" tab that accounts for this loss in Property Tax reimbursements and CAM.

I will use the $12,105 on the "Retail" tab to simplify the entry and put vacancy at 0%. The $12,105 already is factoring in a vacancy and CAM/Tax loss of 10%.

Note: It's important to remember that all operating expenses are for apartments only.

Because commercial leases are NNN in this example, all costs will be reimbursed, theoretically canceling the landlord's commercial expense altogether. As a conservative plug, we only need to account for commercial reimbursement loss in the revenue.

If you want to use the "Unit Mix" method instead, you will enter the following:

Lease Terms (NNN Optimal)

If leases aren't triple net, modeling will get very hairy. I can't recommend using the model as it would require rebuilding the tool to account for more complexity and tracking/bifurcating between apartments and commercial.

Thankfully, I can't think of many instances where ground-level retail on new construction has been anything but NNN in this cycle.

Commercial Tenant's Perspective - Total Exposure

Remember, with a NNN lease, rent isn’t the only tenant cost. It's essential to think about the commercial tenants' all-in cost. If we use $30 PSF for rent, once we pile on CAM and property tax reimbursements, this gross payment could be $40+ PSF.

When underwriting commercial rents, it's crucial to consider the total exposure for your retail tenants. The model itself doesn't do a great job of highlighting this. I've seen firsthand how CAM and real estate taxes can negatively affect a small business renting commercial space. Ensure your prospective tenants are equipped to handle all the liability beyond just the rent.

Rent Escalators

Commercial rent escalators don’t have their dedicated growth assumption year over year. Using the “Unit Mix” method, commercial rent growth is tied to apartment rent growth. If you use the “Other Income” method, commercial rent growth ties to “Other” apartment income increases.

Summarizing Mixed-Use Real Estate Development

Accounting for a commercial mixed-use development component involves three steps when using the Tactica Development Model:

Add a “Retail” or “Commercial” tab summarizing rents, vacancies, CAM/RE tax leakage, and commercial leasing costs.

Depending on your preferred method, this data flows into the "Stabilized Operations" tab or the "Unit Mix" tab (it has to be one or the other)

Input 1st generation leasing costs in the construction budget (T.I.s, leasing commissions, and potentially rental concessions)

Calculate a CAM/Reimbursements Exposure Assumption

I demonstrated how to model commercial leases without abundant complexity in a Multifamily Development Model. For some, the methods I used may not be sufficient, and greater detail may be necessary. I recommend checking out Argus or more sophisticated models specifically for mixed-use/commercial properties.