Mixed-Used Proforma Underwriting Guide

You may encounter a multifamily investment building with commercial (generally first-floor retail). Today's blog post will give you some ideas on underwriting the commercial space.

Contents

Mixed-Use Investing Primer

All the proforma tools I offer investors (free and paid) are for pure multifamily investments (100% residential units).

If you invest solely in mixed-use buildings with a significant portion of commercial income, a Tactica proforma may not be a great fit in the long run. You may be better off finding a more customized tool.

While Tactica models technically can handle smaller commercial components, there are better solutions. A dedicated mixed-use model may offer features such as:

Ability to value residential/commercial separately

Split property taxes between resi/commercial

Separate DCF for residential and commercial

Separate residual cap rates for residential and commercial

Data inputs more aligned with commercial lease structures

However, if you're comfortable with the Tactica analysis tools, generally only purchase multifamily properties, but want to know how to deal with commercial rents in rare occurrences, I have some ideas to help you account for it.

Related: If you are a multifamily developer, I have an article dedicated to underwriting commercial, specifically in new construction projects.

Underwriting Commercial Income

Let's discuss two different strategies for underwriting mixed-use in a standard multifamily proforma.

Unit Mix Method

The easiest way to account for commercial is just as you would residential. You log it in the unit mix with the residential units. Let's say there are two retail spaces:

Space #1: 1,500 SF rents at $28 PSF

Space #2: 1,750 SF rents at $27 PSF

Each space is a freshly signed 10-year lease. The annualized rent for each property is:

Space #1: 1,500 x $28 = $42,000

Space #2: 1,750 x $27 = $47,250

Finally, let's do a monthly calculation, as this is what we will plug into the "Renovations" tab of Tactica's Value-Add Model.

Space #1: $42,000 / 12 = $3,500

Space #2: $47,250 / 12 = $3,938

Then, you can input the retail units just as you would residential.

From there, you can control rent growth for the two units as stipulated in the lease (just as you would for residential units). This is very simple, and I’ve seen others implement it in past underwriting runs.

But there are some weaknesses to this method. The big one is that the proforma vacancy assumption is applied to residential and commercial units.

This shortcoming might be acceptable for some, but retail is riskier than residential and should have a higher vacancy buffer.

If you use the "Unit Mix" method, you should develop a blended vacancy rate for resi/retail. In the current scenario, retail rent is about 7% of the rental income. Let's say we want to come up with a blended vacancy rate that accounts for:

Residential = 5% vacancy

Retail = 10% vacancy

A blended rate calculation:

Retail = 10% x 7% = 0.7%

Residential = 5% x 93% = 4.65%

Blended Vacancy = 5.35%

Note: A similar methodology should be used when determining a residual cap rate.

The altered vacancy rate is minor because retail is a small portion of the total revenue. It can be much more impactful when commercial is a more prominent component.

Another issue with this method is when you make your proforma assumptions and want to make an assumption on a “per unit” basis. The unit count goes from 85 to 87, and those two extra commercial units could throw your benchmarks off, especially for operating expenses.

The other issue I take with this method is transparency. When reviewing the proforma, you should immediately see residential vs. commercial income. However, the "unit mix" method groups all rental revenue in the GPR line without further breakdown.

Other Income Method

I prefer to dedicate a separate "other income" line item to commercial on the "Financials" tab. This way, you can quickly review the financials and see which income comes from residential vs. commercial.

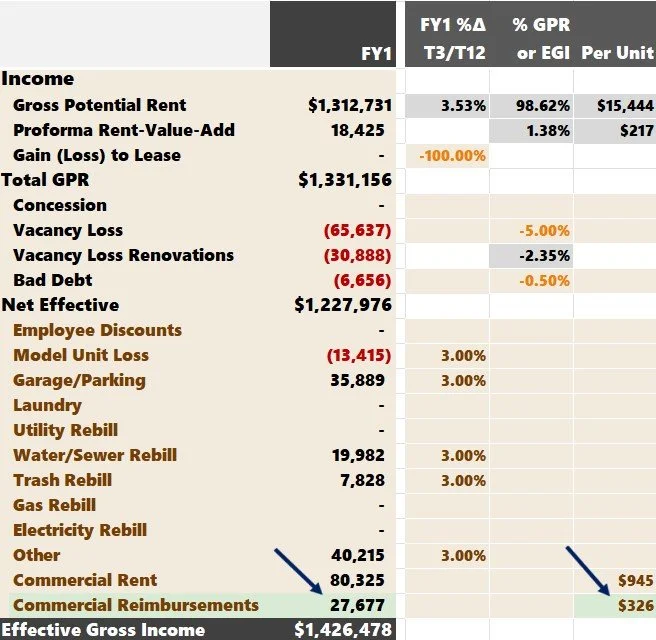

Whatever the rents are in Year 1 of the proforma, I'd set that as a per-unit assumption. In the proforma's forecasted year one (FY1), we will divide the gross rents by the number of residential units.

As a reminder, the annualized retail rent for each property is:

Space #1: 1,500 x $28 = $42,000

Space #2: 1,750 x $27 = $47,250

Total Annual Rent = $89,250

$89,250 / 85 units = $1,050 per unit in retail income

But I also want to factor in the 10% vacancy rate. Factoring in some rent loss is a more conservative way to underwrite the project.

$1,050 x 90% occupancy = $945 per unit in retail income ($80,325)

Note: I am dividing by 85 because there are 85 residential units at this property. A common way to make proforma underwriting assumptions is on a “per unit” basis. While it may not be the most intuitive to do it this way, it is the most effective (but admittedly a flaw of underwriting retail in a pure multifamily model).

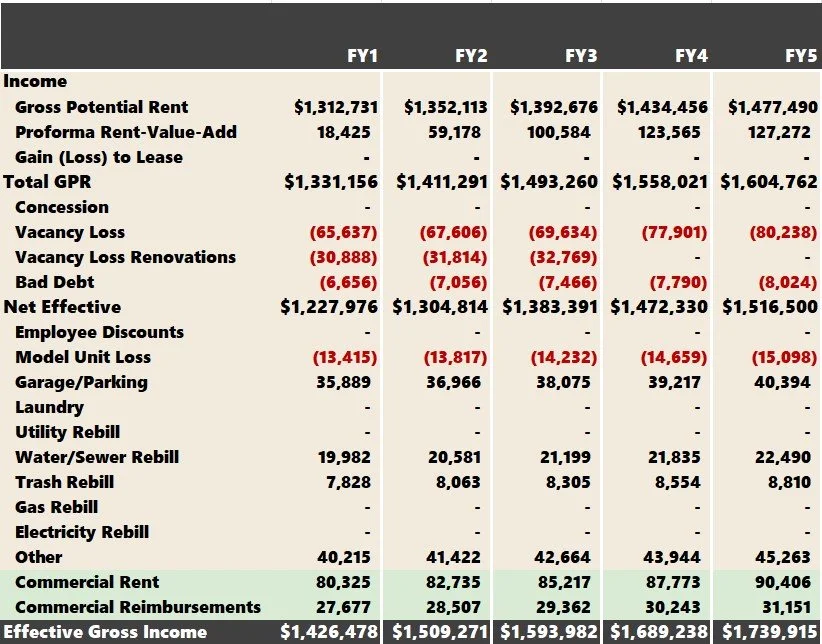

From here you can control your annual retail rent increase as you would with any other line item on the "Financials" tab.

Commercial Reimbursements

Whether you are using the "Unit Mix Method" or "Other Income" for your retail rents if you inherit triple net (NNN) leases where the tenant is required to pay you back for their portion of CAM, property taxes, utilities, and insurance, you need to track that in the proforma. The easiest way to do this is with another "Other Income" line item. But first, you’ll need to investigate and figure out what is a reimbursable expense. There are a few different places you can look.

Historical Financials

Generally, you can look at historical financials to see how much ownership has been billing commercial tenants back for their portion of expenses.

Lease

Reimbursements also may be specified in the lease for each commercial tenant.

County Property Taxes

Regarding property taxes, the county usually bifurcates taxes payable between commercial and residential. For other expenses like utilities, insurance, security, and grounds (think snow removal), square footage often determines the allocation between residential and commercial (again, verify in the lease).

CAM Reconciliation Schedule

An organized owner generally will have a "CAM Reconciliation Schedule" that shows all the expenses eligible for rebill and details on the precise allocations. This report is beneficial when figuring out future reimbursement potential.

Targeted Reimbursement

In our example, the lease stipulates reimbursements are based on project square footage (except for property taxes where the county publishes separate payable amounts for residential and commercial).

If the commercial square footage is 3,500 and the residential square footage is 96,500, the shared expenses are split 3.50% and 96.50%.

Commercial Property Taxes = $15,000 x 100% = $15,000

Utilities (water/trash payment stipulated in the lease) = $13,300

Insurance = $42,500 x 3.50% = $1,488

Snow Removal = $11,500 x 3.50% = $403

Misc. Repairs = $16,020 x 3.50% = $561

Total Targeted Reimbursement = $30,752

We want to continue with the 10% vacancy buffer we used for commercial rent.

$30,752 x 90% = $27,677

$27,677 / 85 units = $325.61

Note: Vacancy in the commercial units will impact both the rents collected and the CAM collected. Using a “higher than market” vacancy rate would be wise if commercial leases are set to expire in the short term.

You can see that a 5-year investment snap-shop commercial is summarized nicely and easily distinguishable from residential income.

Tenant Replacement Expenses

Don't forget there will also be costs associated with re-leasing your retail in the form of:

Leasing commissions

Tenant Improvement (TIs)

Miscellaneous Repairs

If you suspect a commercial lease will expire without a renewal from the current tenant, you’d be wise to allocate funds in Year 0 to hedge against this future departure. If you estimate the cost to lease the space is $100,000, you’d want to account for that on the project summary tab.

This $100,000 is cash equity from the investor(s) or yourself. You don’t want to ignore the re-tenanting costs and be forced to use project cash flow or bring more cash into the deal with outside capital to pay the future TIs and leasing commissions.

Video: Adapting a MF Excel Proforma to Mixed-Use

Summarizing Mixed-Use Underwriting

As I demonstrated in the article, you can go about underwriting commercial in Tactica’s Value-Add Model in a few different ways.

These methods are also effective in the Redevelopment Model and Free Multifamily Template.

The strategies work best when one or two commercial spaces account for a relatively small portion of the total property revenue. If you are consistently analyzing mixed-use, with staggered lease terms, it may make sense to pursue a model better equipped to handle commercial underwriting that has features such as:

Ability to value residential/commercial separately

Split property taxes between resi/commercial

Separate DCF for residential and commercial

Data inputs more aligned with commercial lease structures

While all Tactica proforma tools are tailored for pure multifamily, if you stumble across a project exhibiting some ground-level retail, you now have a framework to account for it in your proforma analysis confidently.