Real Estate Waterfall: Simple Interest vs. IRR

I included another partnership distribution model in the paid Tactica multifamily financial models. While the internal rate of return “(IRR) Waterfall Model” has been a popular distribution model with many commercial real estate investors, I think it’s prudent to add a “Simple Interest Waterfall.”

IRR Waterfall Contents

Real Estate Waterfall Model Primer

You will need to first read up on our IRR waterfall distribution model, as this article goes into great detail with the logic. Both the IRR waterfall and the simple interest waterfall are very similar (almost identical, really) except for a small caveat:

The IRR waterfall's unpaid preferred return (return hurdle 1) will accrue and compound. The simple interest waterfall's unpaid pref will accrue (it is still owed to the LP) but will not compound.

Many investors, perhaps limited partners (LPs), are intimidated by the IRR and prefer an uncomplicated return structure. I have seen an uptick of simple interest waterfall structures deployed in many general partners (GP) operating agreements.

Other Helpful IRR-Related Articles:

Properly Analyzing the IRR in Real Estate Investing

IRR For Real Estate Development

Real Estate Waterfall Example: Compounding

Let's say you raise $1,000,000 of equity for a real estate investment. You will develop a property and do not expect any cash flow during Year 1. Your operating agreement specifies a 10% preferred return (not to be confused with preferred equity). You estimate that you will begin paying your passive investors in Year 2.

IRR Equity Waterfall

In the IRR waterfall, the original investment balance would increase from $1,000,000 to $1,100,000 after Year 1. The required return in Year 2 would equal:

$110,000

or

$1,100,000 x 10% = $110,000

You're effectively paying interest on interest: the unpaid pref accrues and compounds.

Simple Interest Equity Waterfall

If you were to deploy a simple interest waterfall as the GP, you'd still owe the investor $100,000 for the year without distribution. However, this $100,000 would not be added to the investment balance like in the IRR scenario. Instead, it is tracked separately and paid down when cash flow improves, a refinance occurs, or the property is sold. The separate tracking means you are not paying interest on interest.

The simple interest waterfall is more favorable to the GP than the IRR waterfall. However, the two models will only vary significantly from each other if there is a prolonged period of non-payment during the holding period. I will show you the two models on an actual development proforma shortly. The difference in total cash flow distributions is nominal.

Simple Interest Waterfall Order of Operations

I break down the order of distributions into four different buckets.

Hurdle Rate/Preferred Return (pref)

Accrued Pref (that has not been paid)

Investment Balance (initial investment from LP equity)

GP Profit Interest Structure

There is no catch-up provision, lookback provision, or clawback clause as the equity investors are required to see a return of capital, plus the annualized pref before the general partner hits any excess profit structure.

In a given year, when cash flow is less than the first hurdle rate on invested capital, the unpaid pref gets shifted to the "accrued pref," which is then paid down before the investment balance is paid down by cash flow or a capital event.

Simple Interest Waterfall Example

$1,000,000 is invested, and the first-tier hurdle rate is 8%.

Year 1

In Year 1, the project generated $60,000 in distributable cash flow.

$60,000 is paid to the LP equity investors, and $20,000 is owed in the "Accrued Pref" bucket.

Year 2

In Year 2, there is $70,000 in distributable cash flow.

All $70,000 will go to the LPs, and the accrued pref will tick up to $30,000 ($20,000 accrued in Year 1 plus an additional $10,000 this year).

Year 3

In Year 3, cash flow and a refinance total $500,000 in distributable cash flow.

After the Year 3 pref is paid in full (8% or $80,000), $420,000 remains.

The accrued pref of $30,000 is paid down first. $390,000 remains, which will then pay down the LP investment balance.

$1,000,000 - $390,000 = the LP equity investment balance at the end of Year 3, or $610,000.

$610,000 is the subsequent year’s LP investment balance.

Year 4

The pref owed in Year 4 drops to $48,800 or $610,000 x 8%.

In Year 4, the owner sold the asset and generated $2,000,000 in cash flow and sales proceeds.

First, the $48,000 is paid to the LP investors, leaving $1,952,000 left over.

Second, the accrued pref is paid down. There is none, as it was all settled up last year thanks to the refinance.

Third, the investment balance is paid down.

$1,952,000 - $610,000 = $1,342,000 remaining

The LP has been made whole ($1,000,000 in initial capital has been paid back) and received its 8% annualized preferred return.

GP Waterfall Incentive

The remaining $1,342,000 is eligible for whatever profit interest structure (also referred to as a carried interest or promote) the GP stipulated in the operating agreement. This is the 4th and final step of the equity waterfall.

If it were a 50/50 split between GP and LP, each party would receive $671,000.

LP Waterfall Summary

LP Investment = $1,000,000

LP Preferred Rate of Return (Each Year) = $80,000 + $80,000 + $80,000 + $48,000 = $288,000

Share of the Profits = $671,000

Total LP Profit = $959,000

Equity Multiple = $1,959,000 / $1,000,000 = 1.959

Annualized Return = (1.959 -1 ) / 4 Years = 24%

By the looks of it, this was a successful real estate syndication!

Tactica's Real Estate Waterfall Model

Project Level IRR

Hurdle rates are based on project-level returns. This is the same as all Tactica partnership models. Please review the IRR Waterfall Model Tutorial to understand how this can differ from hurdle rates measured at the LP level.

Profit Interest

I also explain the profit interest logic in the article I just linked. It's very straightforward in the Tactica model. If your second hurdle rate is set at 20% as the GP, the GP will get 20% of the distribution. You can click the link above to see how this may vary in other partnership models where the profit split is a function of previous return hurdles.

1-Tier or 2-Tier

Finally, this model can be a 1-tier profit interest or a 2-tier.

If you want to do something like:

1-Tier

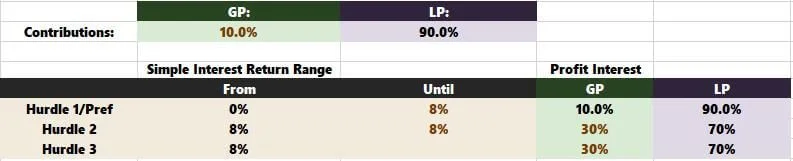

GP puts in 10% of initial equity and will see a 30% profit interest once an 8% hurdle is met. You can set up the model as the following:

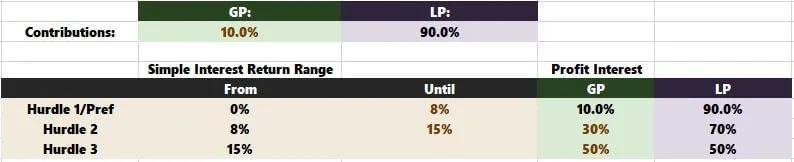

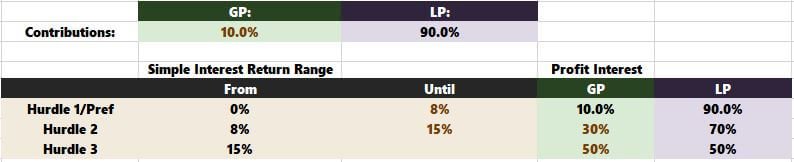

2-Tier

Or if you want greater incentive, such as the GP puts in 10% of equity, will see a 30% profit interest once an 8% hurdle is met, and then see a 50% profit interest on any distribution above 15%, you would set up the model as the following:

Note: Cash flow splits are paid pro-rata until the first hurdle is met. If the GP/LP contributions are 10%/90%, distributions are 10% to the GP and 90% to the LP until distributions exceed an 8% total return.

IRR Waterfall vs. Simple Interest Waterfall

The Simple Interest Waterfall is better for the GP because unpaid pref doesn't compound. This could be impactful in a project that goes horribly. However, there will rarely be much difference between IRR Waterfall and Simple Interest Waterfall returns in a well-executed project.

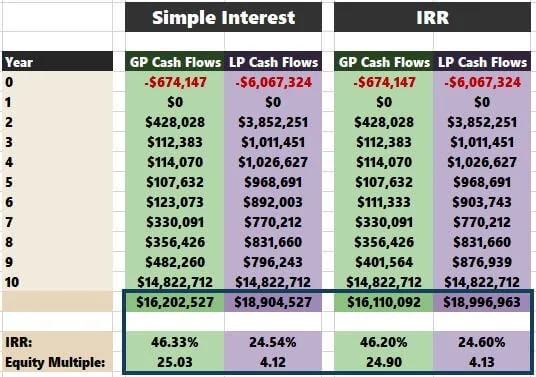

Here's an example of a development project. I chose a development real estate deal because there is a period where no cash flow is distributed while the project is constructed and leased up. You may think that this "pref accrual and compounding" period would make the IRR Waterfall much more lucrative for the LP.

The contributions and hurdle rates are the same for both the Simple Interest and IRR Waterfalls:

Surprisingly, if we put both models side by side, GP/LP total returns are very close, even when there are no distributions in Year 1.

The LP earns a few more dollars in the IRR waterfall model, but it doesn't materially impact overall investment returns for the GP and LP. Refinance and residual sales are the driving forces for returns. In this example, a year or two of missing cash flow has a marginal effect when comparing IRR vs. Simple Interest.

Caution: Waterfalls heavily depend on the asset's sale to see return metrics climb into the mid-to-high teens (15% -19%). Returns are incredibly sensitive to distribution timing. Therefore, to hit higher benchmarks, selling the asset earlier will help inflate returns, catapulting the sponsor into the promote. Check out the “Trifold Alignment Tactic” to learn of a distribution structure less dependent on the residual sale.

Existing Properties

The delta between the two partnership models can be more pronounced in an existing deal that doesn't have a refinance (such as a cosmetic value-add business plan). The refinance is the ultimate “stopper” to make the LP whole and dig the GP out of a potential hole. On an investment hold that is ten years, never refinances, and pays out below the Hurdle 1 rate for multiple years, the IRR waterfall will swing more noticeably in favor of the LP investors.

Summarizing Real Estate Waterfalls Models

The difference between the Simple Interest Waterfall and the IRR Waterfall comes down to whether or not unpaid pref only accrues or accrues and compounds. Many operating agreements I read will specify a simple interest waterfall structure. I wanted to add a partnership distribution model to the Tactica Financial Models that could be a precise match for sponsors.