Leverage in Real Estate: Cheaper Debt isn't Necessarily Better

Leverage is a crucial component in real estate investing. While leveraging an investment property can boost investment returns, it's also necessary for many real estate investors who can only make a modest down payment.

This article aims to teach you some alternative ways of thinking about leveraged real estate and how debt, in general, can affect your property. I will focus on multifamily properties, but the concepts discussed in this blog post will still be relevant for a wide range of property types across the investment spectrum.

Leverage in Real Estate Emphasis

Biggest Misconception About Leverage in Real Estate

I spend most of my time working with multifamily owners and some rental property owners. A common theme among both investment groups is that they feel obligated to find and purchase deals while interest rates are low.

The allure of seemingly more minor monthly mortgage payments that can be locked in anywhere from 10 - 30 years is enticing. It's almost as if a fear of missing out compels investors to be more aggressive when interest rates are lower than what they are accustomed to. In short, they think that cheap debt is advantageous for them.

Related Content: See how negative interest rates could affect commercial real estate mortgages and how to underwrite floating-rate loans with an interest rate cap.

In a seller's market, this notion is false. In an instance where a deal is fully marketed to the public that will likely solicit multiple offers, all bidders would benefit from the same low-interest debt. A cheaper mortgage loan helps the seller because most buyers will have specific return metrics to achieve that will be more attainable with cheaper debt. This allows them to be more aggressive in their offering price.

I can confidently say that reduced borrowing costs are more advantageous for the seller if the deal is widely marketed. Scrappy buyers finding their deals off-market may benefit from a higher potential return, but only if they don't have to outbid other investors.

Inexpensive Debt ≠ Better Investment

At my last job, I once worked with a client interested in selling their property. They engaged our brokerage team to provide them with analysis and to estimate the approximate property value if they were to sell. This owner was meticulous and wanted our team to update the valuation monthly. After slicing and dicing this particular real estate investment for a year, something interesting jumped at me.

The property's cash flows didn't change much from month to month. There was some slow and steady rental income growth, but the financing assumption was the most significant factor influencing purchase price.

During the year, there were massive swings in treasury rates, which are highly correlated with the interest rates on mortgage loans. Every time I reevaluated this particular deal, I updated the debt terms.

The first time I did this exercise, interest rates were meager. Our team was very familiar with the typical buyer profile of this particular type of apartment building. We were confident that an aggressive bidder in our real estate market would likely need to realize a 12.50% leveraged IRR on a seven-year hold. Because rates were so low, we could maximize leverage at an 80% loan-to-value ratio (LTV) and use an interest rate of around 3.75% for our loan terms in our valuation model.

About eight months later, debt was much costlier. We had to scale back leverage to 67% LTV and use an interest rate of 5.00%. Unfortunately, we had to adjust our pricing expectations significantly to achieve a 12.50% leveraged IRR. Our client was disappointed that our valuation had dropped materially even though their operations had improved over the past eight months.

It became apparent how much potential it is for debt terms to swing the pricing of a real estate deal. Nothing else of note had changed. I think it would be a beneficial exercise to show you how this might look in a real-life scenario.

Low-Cost vs. Expensive Debt Case Study

Let’s briefly examine the same theoretical deal in two different interest rate environments. We will pretend that the lowest acceptable leveraged IRR is 13.00% on a seven-year hold. We will also assume that the debt service coverage ratio (DSCR) must be around 1.20 (typically, a lender will want it above 1.20, but I’ve seen plenty of instances where they have some wiggle room if it dips below).

Note: See how some lenders may depend on the debt yield when sizing multifamily loans.

Cheap Debt

In the first scenario, let’s assume treasuries are rallying, 80% LTV is attainable, and there is a deal that may hit the 13.00% IRR requirement.

The loan terms in the financial model are the following:

This is what the key return metrics will look like:

To summarize, at most, the buyer could pay $13,500,000 so that the leveraged IRR remains above 13.00% and the DSCR hovers around 1.20. If you are wondering why there are three different cap rates, check out this article.

Expensive Debt

Treasury yields have deteriorated, and maximum leverage is likely 70% LTV with an interest rate above 5.00%.

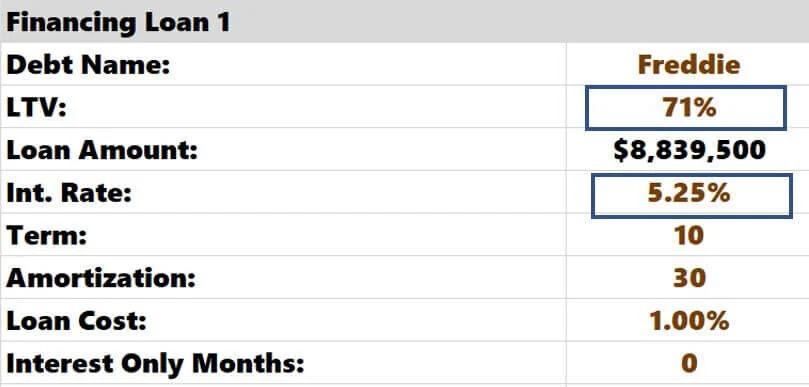

Let’s say our buyer is looking at the same deal and needs to achieve the same 13.00% leveraged IRR over a seven-year hold. Now, debt terms are the following:

Because the interest rate is higher, less leverage is attainable. Holding all other assumptions constant, the maximum price that could be paid to achieve the 13.00% leveraged IRR is now only $12,450,000.

Over $1,000,000 has been shaved off the sales price compared to the previous scenario. This is nearly an 8% reduction in the sales price. It’s also important to note that in these two scenarios, where the interest rate was 1.50% higher in scenario #2, the FY1 cap rate increased by 44 basis points (bps).

Note: A few Tactica models also have a “Financing Loan 2” section, which works great if you use a supplemental loan or are considering seller financing in addition to the first mortgage.

Summarizing Real Estate Leverage

So many investors talk about cheap debt as a lifetime opportunity. This is not usually the case. In most instances, the seller of real estate reaps the benefits of cheap debt because, in a competitive sales environment, it often forces buyers to pay more to win the deal and can lead to negative leverage.

As you can see in the image above, a buyer stretching on pricing at historically low interest rates faces the risk of interest rates snapping back in line with historical norms. This could cause asset valuations to correct due to higher borrowing costs and less leverage available. For a “buy and hold” investor, this is less of an issue that can be weathered as long as operations remain steady. It could become problematic if, along with higher borrowing costs, there is a bout of economic vacancy as a loan comes closer to its balloon.

The best solution is to be creative with how you are finding deals and stressing your residual cap rate. Being on a broker’s distribution list is a great way to see many deals, but you are likely competing with many investors.

Building relationships with owners and buying directly from them can be an excellent way to eliminate excess competition. By stressing the residual cap rate (increasing it), you’ll see how your overall returns (IRR and equity multiples) are affected if rising interest rates impact real estate sales and refinance proceeds.