Protecting Your Real Estate Investment with an Interest Rate Cap

If you are investing in commercial real estate and financing it with floating-rate debt, you’d be wise to explore the possibility of purchasing an interest rate cap.

Interest Rate Cap

An interest rate cap is a hedging derivative offered by financial institutions that caps/limits the maximum interest expense exposure for a borrower using a floating-rate loan. Lenders also benefit as they can require an interest rate cap at a rate threshold that helps ensure the borrower can service interest payments comfortably, limiting the risk of non-payment in a rising interest rate environment.

Contents

Floating Rate Loan Primer

Before we get into interest rate caps, let’s first discuss a vital component of floating debt. Interest expense is derived from two parts:

Benchmark Index

Spread

Benchmark Index + Spread = Total Interest Rate

Variable rate loans will benchmark to an index such as:

LIBOR (widely replaced by SOFR, but still may be prevalent in older loan agreements)

The adjustable-rate mortgage will move commensurately as these indices change. Let’s use SOFR in our example. The variable interest rate will be quoted as follows:

SOFR + Spread

The spread is the interest the lender charges on top of the benchmark index. Riskier, more speculative real estate investments tend to have higher spreads (to account for the additional risk).

If the spread proposed by the lender is 3.50%, the rate would be quoted as:

SOFR + 350

If SOFR sits at 3.00%, that total interest payment would be:

3.00% + 3.50% = 6.50%

If the Federal Reserve raises interest rates by 0.75% and SOFR moves to 3.75%, the new all-in rate for the borrower would be:

3.75% + 3.50% = 7.25%

Floating-rate debt can get expensive very fast in a rising interest-rate environment. The biggest threat for the borrower is that recurring debt service becomes too burdensome at higher interest rate levels, and property operations aren’t sufficient to cover the higher debt service.

Related: Why forecasting future interest rates based on the forward SOFR curve is dangerous.

Interest Rate Cap Components

You can purchase an interest rate cap to protect your downside and combat rising rates. The cap is generally purchased upfront and can often be financed in a development project or heavy renovation business plan (negotiable with the lender).

The cost of the cap will generally depend on a few factors:

Rate Cap Size

Rate Cap Duration

Strike Price

Interest Rate Volatility

Rate Cap Size

Cap size (or the “notional”) will usually match the total loan amount—the more significant the loan, the more costly the rate cap.

Rate Cap Duration

Lenders may require the cap term to be coterminous (the same) with the loan term. The longer the duration, the more expensive the rate cap. A 10-year loan term requiring a 10-year cap will be more costly than a 5-year cap.

Strike Price

The strike price or strike rate is the specified rate threshold an index would hit to trigger the cap. The lower the strike you choose, the more expensive the rate cap. Some lenders may set the strike based on the debt service coverage ratio (DSCR) at varying interest rate thresholds.

Interest Rate Volatility

The more expectation that rates will change, the more expensive the cap will be. For example, there is a strong sentiment that the Federal Reserve will continue to raise the benchmark interest rate in the upcoming months, resulting in costlier interest rate caps. An interest rate cap in late 2022 would cost more than a cap in 2020 if all other factors were constant.

Interest Rate Cap Example

Let’s say we purchase a $12M, 5-year, 3.25% strike interest rate cap for $420,000.

The loan term is SOFR + 375

If SOFR is 2.50%

Total all-in rate = 2.50% + 3.75% = 6.25%

If SOFR is 3.00%

3.00% + 3.75% = 6.75%

IF SOFR is 3.75% (interest rate cap is exceeded)

3.25% + 3.75% = 7.00%

The cap is triggered at SOFR = 3.25%. As long as SOFR stays above 3.25%, the borrower will pay a fixed rate of 7.00%.

As you can see, the cap acts as an insurance policy. If rates decrease, the borrower will benefit from lower interest expenses (although most loan agreements will specify an interest rate floor to protect the lending institution from falling rates).

If rates increase, the borrower will see higher interest payments until the cap triggers and the maximum interest rate takes effect (SOFR Strike Rate + Spread).

Interest Rate Cap Providers

When purchasing a cap, you buy a financial derivative from a provider willing to speculate on interest rate movement. For a lender requiring an interest cap, you’ll generally pay for it and assign it to the lender, and they would receive the payments from the provider in instances when the “strike” rate is surpassed.

For example, you can review the interest rate cap requirements for Fannie Mae’s adjustable-rate mortgage (ARM) loan program.

Cap Provider Upside

The provider or “counterparty’s” upside is that they’d get an upfront fee, and rates never move beyond the “strike” threshold over whatever period is determined in the agreement.

Cap Provider Downside

Their downside is that rates move above the “strike” threshold, and they’d be on the hook to pay the excess interest expense to the lender on the borrower’s behalf.

Assuming you find a provider that offers interest rate hedging in the form of interest rate caps, you’d want to verify their creditworthiness.

Fannie Mae has a list of potential cap providers and requires these counterparties to maintain a good credit rating from S&P or Moodys. Lenders and borrowers depend on cap providers to have cash available to pay excess interest and must ensure they have the capital to fund this potential liability. Excellent credit quality is paramount for a counterparty to offer this financial service to borrowers and lenders.

Underwriting an Interest Rate Cap

Tactica financial models only allow fixed-rate interest debt assumptions. While I have thought about altering specific models to account for variable-rate, I ultimately decided against it because it emphasizes interest rate speculation vs. more controllable investment assumptions like:

I believe that if you choose floating rate debt, and there is a chance that rising rates could hurt you (no matter how small the odds), not having a cap is still very risky. Some investors who took out floating rate bridge loans in 2020/2021, before interest rate hikes were on the table, are learning this the hard way.

If you purchase an interest rate cap, I think it’s wise to underwrite the loan interest rate at the maximum (capped) interest rate.

Example: If the max interest you’d have to pay is 7.50% once the cap triggers, that’s what you should underwrite in the model as a 7.50% fixed rate (even if the current rate is, say, 6.25%). Stress the deal at the interest rate cap to ensure debt service isn’t too burdensome.

Multifamily Development Example

If you’re using floating rate debt for multifamily development and purchase a cap, you could put the cap cost as a soft cost in the “Budget & Draw” tab of the Development Model. Let’s say the cap costs $420,000.

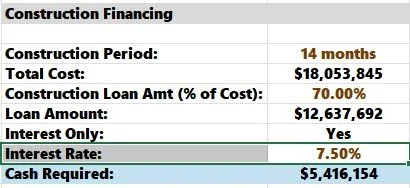

You’d also use the construction financing figure for the highest possible interest rate (7.5%).

Note: In the example above, the model assumes the lender would finance 70% of construction costs, including the interest rate cap (so 70% of $420,000 = $294,000 of the cap is financed by the lender). If this wasn’t the case, and you need to pay for the interest rate cap out of pocket, you’d need to adjust the LTC assumption to back into the total loan proceeds that are not inclusive of the cap.

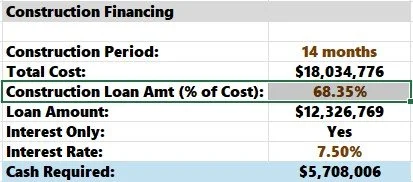

The construction loan factors in 70% of all costs except the interest rate cap (and thus the 68.35% true LTC).

This logic will be the same if you use Tactica’s Redevelopment Model and floating rate bridge debt with a cap for a serious repositioning effort on a distressed multifamily project.

Summarizing Interest Rate Caps

Interest rate caps take risk off the table for lenders and variable-rate borrowers in a rising interest rate environment. While interest rate caps can have a significant upfront cost, they offer tremendous peace of mind to know with certainty the highest potential interest payment and how it would affect your investment metrics.