Multifamily Development: 4 Critical Stress Tests

Stressing the best and worst-case scenarios is critical in any real estate analysis. I've been fortunate to work with prevalent developers, pick their brains, and understand what elements they are paying attention to when stressing their multifamily housing developments.

I have determined that four major stress tests should be applied when assessing the financial feasibility of a development project.

Contents

Excel Data Table Primer

Tactica models use data tables to host various sensitivity analyses or “stress tests.” Data tables are a “what-if” analysis tool (similar to Goal Seek but more robust) that allows you to alter two variables and see how changes affect the investment outlook. Every scenario we run through will only change two variables and assume every other assumption within the development proforma model is constant.

A data table should show you an unbiased, wide-casting range of results. Ideally, you’ll be able to see and comprehend the “worst-case” scenarios if the investment outlook doesn’t go as planned.

Permanent Debt Coverage

Investors develop apartment units because they feel they can construct them cheaper than the market will pay. One of the enticing aspects of building an apartment building is that once it's completed and stabilized, the developer can refinance their construction debt and pay back a significant portion of their initial equity investment.

The key to a successful refinance is hitting the initial rent projections while obtaining a 95% occupancy. But what if things don't go as planned?

What if the average projected rent of $1,800 ends up being $100 less?

What if the property only achieves a 92% occupancy instead of 95%?

What if the property is 100% occupied and overachieves the initial rental projection?

Holding all other assumptions constant (operating revenues, operating expenses, permanent financing terms), I want to see how the debt coverage service ratio (DSCR) is affected at different:

Rent Levels

Vacancy Levels

Typically, a lender would hesitate to lend on a project that doesn't at least cover 1.20 (NOI / Annual Debt Payment).

If the baseline assumption is hovering right around 1.20, I would want to be sure that the rent projections are an accurate estimate for the submarket. The above example's baseline assumptions are a $1,781 targeted rent and a 5% vacancy. The 1.19 DSCR is an aggressive target. I would return to the model and adjust the leverage on the permanent financing (less) to drive that 1.19 up above 1.20.

Market rate rents are dependent on location and construction type. A high-rise in San Francisco will project far different rents than a podium mixed-use deal in Washington, DC. A thorough rent comp analysis is critical for determining an appropriate rent.

Refinance Proceeds as a Percentage of Equity Investment

A successful refinance can allow investors to get most of their capital investment out of the deal and reap solely the upside in the future years. I think it's also important to stress the refinance proceeds. This stress test does this by adjusting two toggles:

Effective Gross Income (EGI)

Cap Rate at Refinance

The more revenue the apartment community earns, the higher the potential for more refinance proceeds. Revenue generation is in the owner/developer's control. The cap rate is at the mercy of the markets. When a lender considers your refinance request, they will likely call on an appraiser to determine the property's market value. They will look at the NOI and divide it by the appropriate market cap rate.

Years can pass from when the new construction project gets approved to stabilization. During this time frame, market cap rates can change from good to bad, and the development company will have no control over it. If cap rates increase, this could be problematic for maximizing refinance proceeds.

This stress test looks at stabilized revenue and cap rate fluctuations and shows you what percentage of your initial investment you'd get paid back in a refinance.

Warning: We’ve learned that as interest rates rise and lender appetite wanes, a funding gap could require a ‘cash-in’ refinance.

Leasing Effect on IRR

The faster you can lease up your property, the quicker you can grow future rents, increase revenue, and sell at a higher price. I think it's essential to look at how pre-leasing and monthly lease-up can affect the project's internal rate of return (IRR). Being able to pre-lease 25% more of the units before officially opening the property can have a significant effect on overall returns for your apartment complex. Also, leasing nine units a month vs. 21 will have a massive impact on profits. It's essential to understand how a slower-than-expected lease-up could affect your property by looking at different variations of:

Pre-Lease Percentage

Leases Per Month

A slower than anticipated lease-up can also be a significant strain on cash flow.

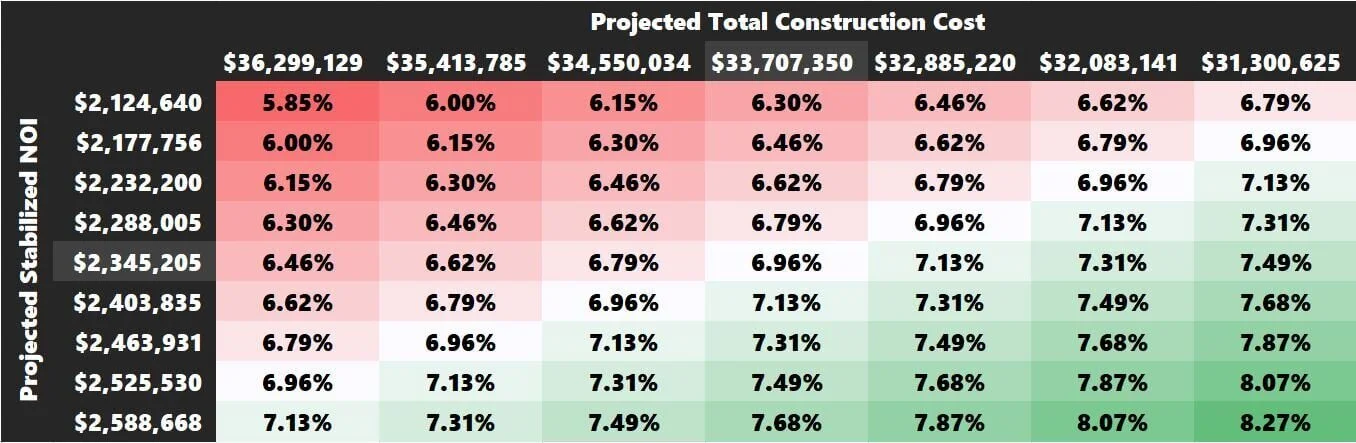

Return on Cost

Return on Cost (ROC) is arguably the developer's most crucial metric when deciding to move forward with a new development opportunity. You calculate Return on Cost:

Stabilized NOI / Total Project Cost

So, naturally, this analysis focuses on stressing different:

Project Costs

NOI

The higher the ROC, the better. Developers will compare their ROC to the anticipated stabilized cap rate. The spread between the two yields is their upside. The larger the delta between ROC and cap rate, the more upside the deal has. The final stress test looks at construction costs and projected NOI and answers questions such as:

What if construction costs end up being higher than the initial budget?

What if the projected NOI is 5% less than what you anticipated?

The deal may be too risky if the spread between the ROC and the Cap Rate gets too small.

Video: Building Sensitivity Analysis into Your Real Estate Proforma

Summarizing Development Stress Tests

The four stress tests discussed above are built into the multifamily development model:

Permanent Debt Coverage Stress Test

Refinance Proceeds Stress Test

Leasing Stress Test

Return on Cost Stress Test

They’ll allow you to adjust the intervals of both variables for all tests to understand even the most extreme scenarios.