5 Signs a Multifamily Development isn't Financially Feasible

Since the Federal Reserve began increasing interest rates, there isn't a more challenging multifamily asset class to execute than development.

Higher borrowing costs, tighter lending standards, sky-high labor and materials pricing, robust new supply coming online, and the risk of rental declines make it very challenging to underwrite and achieve return parameters that were commonplace pre-2022.

If you're using Tactica's Multifamily Development Model, there are five tell-tale signs that the project is in the “danger zone.” The lessons should carry over even if you use a different proforma analysis tool.

Contents

Development Deal Outlook Spectrum

Before diving into the analytics, I suggest discussing the range of development potential. I think of a development project's financial feasibility on a spectrum:

I think Tactica's development tool is very effective in evaluating projects falling into this region:

Thankfully, this is where most projects pencil out, but with 11 interest rate hikes since 2022, I have reviewed bad deals where the numbers are non-sensical and deep into the "danger zone."

I won't sugarcoat it: a deal can look pretty messy when the numbers are far from feasible, and admittedly, it may come as a shock if you have yet to underwrite a project in this new environment.

Note: Deals often “exceptional” can also defy the proforma as they appear almost “too good to be true.”

Five Proforma Defects

Let’s review the most common blemishes I see when reviewing a multifamily development that lacks the potential to become financially feasible.

1. Yield on Cost Less Than Market Cap Rate

The first method is the easiest method to disqualify a potential project. If the yield-on-cost (YOC) is less than the market cap rate for new construction, it will be nearly impossible to be successful.

YOC = Stabilized NOI / Total Construction Cost

The market cap rate is simply what the market is willing to pay for your stabilized NOI:

Cap Rate = Stabilized NOI / Purchase Price

If your project costs $30,697,880 to build, you estimate a stabilized NOI of $1,653,298. The YOC:

$1,653,298 / $30,697,880 = 3.50%

If newly constructed projects are selling at a 4.75% cap in your submarket (backed by sales comps), you, in theory, could purchase the same building that has already been built and de-risked from:

Entitlement Risk

Construction Risk

Lease-Up Risk

Developing market-rate multifamily doesn't make sense if you could buy the same completed building cheaper. The whole purpose of development is to create an asset worth more than the cost to construct.

Profitability is only possible if the YOC > Cap Rate. The larger the spread between YOC and Cap Rate, the more profitability potential.

You can execute this analysis in Tactica's "Back of the Napkin" Development Template with minimal time investment.

Note: I’ll use “YOC” and “ROC” or “return-on-cost” synonymously.

If you were to sell the asset at stabilization, you’d lose about 75% of your investment (or a 0.25 equity multiple).

If there is a healthy spread between YOC and Cap Rate, it will be easier to be successful; unfortunately, that is uncommon right now.

2. Permanent Financing Less Than the Construction Loan Pay Down

I've seen more proformas hit my inbox where the permanent financing from refinancing isn't sufficient to take out the construction loan, which creates negative refinance proceeds.

The $24,208,912 in permanent financing proceeds isn’t enough to satisfy the $27,395,197 construction loan balance, creating a nearly $3,400,000 shortfall.

Negative cash flow is technically a capital call (‘cash-in’ refinance) where you'd need to call on equity investors to bridge the equity gap. If we look at the Simple Interest Waterfall Model, investors would need to contribute more capital in Year 2 (the refi year).

Pitching an investor on a deal you forecast a capital call is likely tough. It would also be hard to convince a lender for construction financing when the stabilized numbers aren't sufficient to pay off the outstanding loan balance.

From a returns standpoint, recovering from a significant capital call and still hitting return metrics suitable for a development project may be insurmountable.

3. Permanent Financing DSCR Less Than 1.20

Permanent financing is a two-part process. If you see you have a negative refi, you may be tempted to increase the refinance LTV or use a more aggressive refinance cap rate. However, you must pay attention to the debt service coverage ratio (DSCR).

With a 60% LTV, we currently have a 1.35 DSCR. Let’s increase it to 65%.

We get a little more leverage, and the DSCR drops to 1.24, but unfortunately, our refi proceeds are still negative on the “Returns Summary” tab.

If the DSCR drops below 1.20, an agency or bank lender won't likely fund the loan. In other words, it's an unrealistic assumption if you dip below. It would be best to back off the LTV until you have at least a 1.20 but hopefully a 1.25+ DSCR. Ideally, the refi proceeds will be positive, and the DSCR above 1.20. Accomplishing both is much more difficult with the Federal Funds at 5.00%—5.25% and construction financing often quoted as high as 10%.

4. Significant Operating Shortfall

You may see an operating shortfall appear in your proforma.

This negative balance populates when you've fully drawn down the construction loan but property operations are insufficient to cover the monthly construction loan interest. Typically this is due to a combination of the following:

High vacancy (slow lease-up)

However, fundamentals have changed drastically where:

Rental markets are softening, and slower lease-ups will likely be prevalent in more cities

The cost of debt is more impactful, especially on more significant loan balances

In past years, in a hot real estate market with cheap financing, borrowing additional funds for an operating reserve was manageable to fund any cash flow shortage.

Now, the stakes are much higher. A slower lease-up with more concessions means more borrowing, higher interest expense, and longer construction loan terms, which could ultimately bleed the project before a refinance is possible.

Tying back the point #1, accounting for a significant operating reserve will create more overall construction cost (the denominator in the YOC formula), ultimately driving down the YOC and making it harder to accomplish financial feasibility.

5. Market Rent Growth Dependency

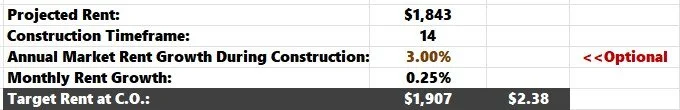

A few years ago, I added an assumption to the "Unit Mix" tab that allows you to increase rents during construction.

A few customers brought to my attention that construction can take years, and market rents tend to inflate (especially in 2021). I begrudgingly added this toggle, but with a huge disclaimer: Please use this assumption responsibly.

I understand why it could be a helpful toggle in specific markets, but there is potential to over-inflate rent growth, which could boost return metrics like the IRR and equity multiples.

If you plug in your unit mix (floorplans, square footage, and rents) and the deal metrics don't pencil with a 0% rent growth assumption during the construction period, please don't apply a blanket growth rate; see improvements in all metrics, and think the project “works.”

Increasing rents has a massive impact on returns. Using 3% rent growth over a 14-month construction period takes the 5-year project IRR up nearly 260 basis points (holding all other assumptions constant).

Always ensure you have a cushion with your rental projections because the explosive rent growth of the early 2020s is likely behind us for some time. You don't have a deal if you need market rent growth to make the deal work (which you have no control over).

Concluding Development Feasibility

Across the development feasibility spectrum, financial feasibility ranges from:

When projects enter “inadequate” territory, some signs could be apparent if you're paying attention.

YOC < Cap Rate

Negative Refinance Proceeds

DSCR under 1.20x after Refinance

Significant Operating Shortfall

Dependent on Market Rent Growth For Returns

A lot of the symptoms will "carry over" to others. It would be rare to see one of the above bullets with everything else tracking adequately.

The bottom line is that developing property is hard right now due to the following:

Higher borrowing costs

Labor and materials costs

Softening rental markets

I've talked to a handful of developers who are currently sidelining development pursuits and instead focusing on uncovering value-add and redevelopment multifamily investment opportunities.