Underwriting a Land Contribution in Multifamily Development

In any development project, land purchase is just one of many costs to bring a development to life. But how do you account for land when it is contributed and not paid for? In other words, the owner of the land partners with the developer via a land contribution. Let's talk it through.

Contents

Defining a Land Contribution

In most development projects, the developer buys the land where they’ll eventually build their investment property. Usually, the payment for that given land takes place when they close on the construction loan. The landowner is compensated and removed from the picture, and the developer can begin constructing their project on their newly purchased parcel.

However, in some instances, the developer doesn't outright purchase the property. Instead, the landowner contributes the parcel(s) and retains an equity stake in the development. Partnership alignment has benefits, and you must consider some things when deciding if this is the best course of action.

Some common terminology you may hear for this arrangement:

Land Contribution

Land Lift

Land Equity

Disclaimer: You should verify with your lender, equity partners, attorney, and accountant how to correctly account for a land contribution. This article is purely theoretical, and slightly different circumstances could significantly alter the impacts on project-level returns, partnership returns, and taxes. My interpretation may not be accurate for every scenario.

Development Sources & Uses Example

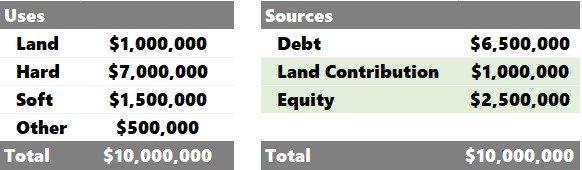

Let's take a development with a $10,000,000 total cost. Land costs $1,000,000—the project funds with a 65% LTC construction loan and 35% equity.

Standard Land Purchase

If you had to purchase the development site, the high-level "sources” and “uses" would look like this:

A mix of debt and equity covers the total uses.

Land Contribution

Let's look at how it might look with a land contribution.

Now the land is also a credit on the "sources" side of the "sources” and “uses” statement. Only $2,500,000 is needed as cash equity if the construction lender allows a land contribution.

Note: A lender will usually determine the value of land based on an appraisal and/or sales comps.

Developer's Benefits of a Land Contribution

There are a few reasons why it could be advantageous to partner with the owner of the land than purchase it outright from them.

Less Equity

As we saw in the "sources and uses," if the land is contributed, less cash is required to close the construction loan. Less money from outside investors or potentially from their pocket is generally advantageous.

Potential Time Savings

If the landowner already got the ball rolling with entitlements, that could save the developer months, if not years, which could help with timelines and derisking administrative aspects of the project. Although this will likely mean the land is worth more and require a more significant ownership percentage.

Synergies

The landowner is a submarket expert, offers a fresh perspective, or has knowledgeable contacts that could help execute the project or unique insights into the location.

Flexibility

I've heard of instances (before interest rate hikes) where developers own the land, get a sizeable land lift on paper, back-fill that land equity with cash equity from investors, and leave the closing table with a check. A developer with a solid track record, willing investors, and developable lots in A+ locations could clear some risk before ever putting a shovel into the ground.

Landowner's Benefits of a Land Contribution

The landowner also could see benefits from partnering with the developer via a land contribution.

Greater Upside

An equity position in development could offer more profit potential than the current property use.

Synergies

The developer may have a skillset and knowledge base that could help the owner achieve far more success than they could on their own.

Tax Benefits

There could be tax benefits or deferrals of contributing land vs. selling directly, which a qualified CPA must confirm, as it appears to be quite complex.

Flexibility

Depending on the landowner's expertise and risk tolerance, they could convert the land contribution credit to either LP or GP equity or something unique like preferred equity or mezzanine debt, or even a combination of cash and partnership equity.

Underwriting a Land Contribution

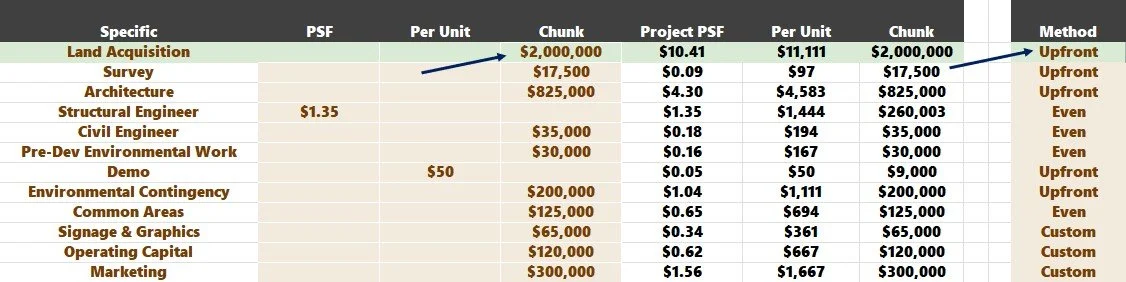

When underwriting project-level returns, there's no difference in steps when the developer purchases the land vs. contributed. You'd input your land cost on the "Budget & Draw" tab and an "Upfront" cost.

Note: The land value you input on this tab is the bank's interpretation of the value (likely backed by an appraisal). This assumption will affect the loan proceeds you receive, summarized in the "Project Summary" tab.

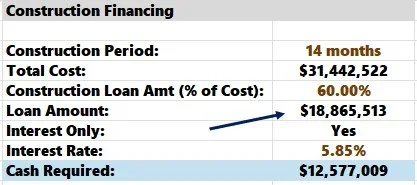

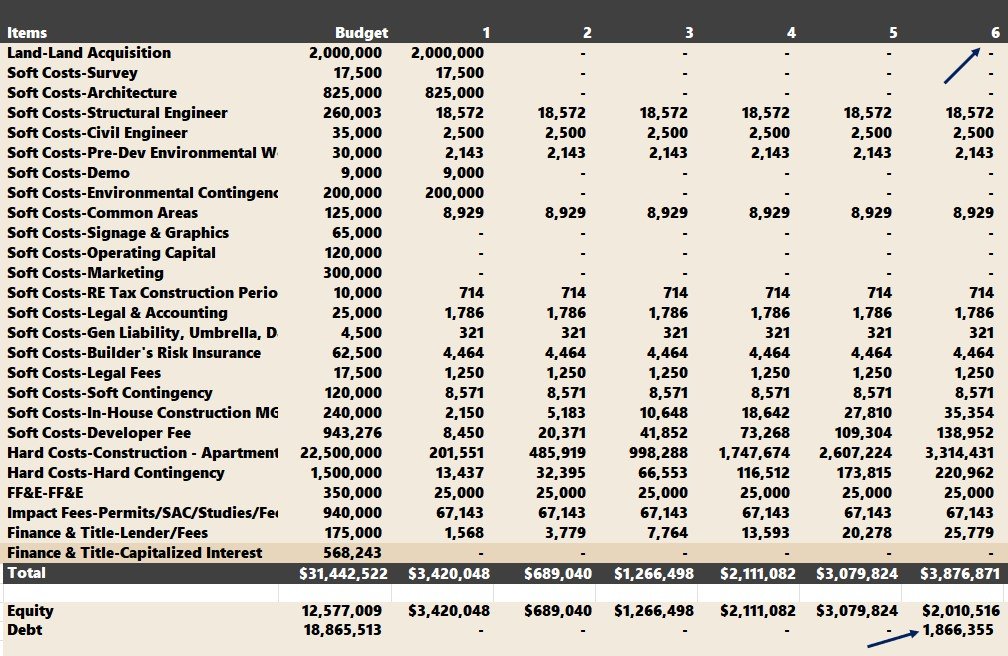

A higher land value will correlate with more loan proceeds. When we look at the equity funding in Month 1, the land is funded "with equity," just as it would be in a "purchase with cash" scenario.

Nothing changes; equity is equity regardless of its classification as "cash" or a "land contribution."

In this scenario, we wouldn’t need to draw on the construction loan until the 6th month.

At that point, the construction loan interest would begin accruing.

Partnership Distribution Modeling Options

The project return metrics should stay the same regardless of whether or not the land is purchased or contributed, and you should have a good sense of whether the project is financially feasible. However, depending on the deal structure with the landowner, it could impact the partnership returns.

Land Contribution as LP Investment

Earmarking the land contribution as LP equity is straightforward, assuming you vetted the GP and want to proceed. Below is an example using the Tactica Simple-Interest Waterfall distribution model.

The land contributor would account for around 18% of the LP equity ($2,000,000 out of $11,319,308 in LP equity).

They'd get the same treatment as the other LP investors; in this scenario, the 5-year proforma projects a 2.11x equity multiple. These returns could be very enticing for a landowner looking to grow their investment basis by 22.08% annually (the IRR estimate).

Land Contribution as GP Investment

The landowner may want a more active role. They are willing to take on more risk but also want to grow their equity contribution more than in the LP scenario.

We're looking at Tactica's IRR waterfall distribution model in this example.

For example, the GP entity would fund 24% of the total equity or $3,018,482.

$2,000,000 of Land

$1,018,482 of Cash

The land contributor could reap the promote with the development sponsors. Because the sponsor is putting up more equity than in the previous example, they could offer different terms to the LP. The promote would kick in after the LP gets its capital back and a 12% annualized return, where the GP would then earn 55% of the total distributions.

On the GP side, they may offer the land contributor 49% of all distributions (this would happen via agreements outside the financial model's scope). If the landowner earned 49% of the net cash flows, they'd make $6,302,162 over the five years.

Total GP distributions from Years 2 - 5 = $12,861,556

$12,861,556 x 49% = $6,302,162 = Land Contributor Upside

The equity multiple is higher than the previous LP scenario:

$6,302,162 / $2,000,000 = 3.15x

However, if they participated on the GP side, they'd likely have a more active role and more liability.

Preferred Equity

Another option is to offer the land contributor a preferred equity tranche, which would pay a fixed interest rate on the $2,000,000 contribution and be lower (safer) on the capital stack than the common equity holder. This arrangement could offer an excellent middle ground between growing equity as much as possible (but with substantial risk) and earning a more steady and modest return on investment.

Tactica’s Development Model only accounts for a debt/equity capital stack in its baseline state. Still, it’s essential to know that a pref or mezz position could be an adequate solution.

Summarizing a Land Contribution in Multifamily Development

A land contribution would likely still be considered equity, but there would be a credit in the "sources" section accounting for it, meaning that less cash equity would be needed at the closing table.

The developer and the landowner could benefit from a land contribution vs. the developer purchasing the land outright. The potential developer benefits include the following:

Less Cash Required

Potential Time Savings

Partnership Synergies

Partnership Flexibility

For the landowner, contributing land could be beneficial for the following:

Greater Profitability Upside

Partnerhsip Synergies

Tax Benefits

Partnership Flexibility

Underwriting doesn't change when land is contributed vs. purchased; all project-level metrics will be the same. The impact will be more profound on the partnership distributions, depending on the preferences of both the developer and landowner and each risk tolerance.

Related: Underwriting tips if the land is purchased with investor equity before the construction loan funds.