Multifamily Value-Add: Stressing Apartment Renovation Plan

Success will hinge on executing the apartment modeling plan for many multifamily value-add investors. When acquiring apartment buildings, much of the diligence will be spent figuring out the renter's desires, what kind of rental premium upgrades would be justified, and at what cost.

I think there are five significant factors a real estate investor must look at when determining the feasibility of a value-add strategy.

Project Returns

Investment Hold Period

Apartment Remodeling Premiums

Apartment Remodeling Capital Spend

Apartment Renovation Timeframe

The framework I'm about to uncover should be used as a guide to stress the upsides and downsides of a real estate renovation business plan.

Apartment Remodeling Sensitivity Test

I use a process that stresses the investment returns by holding everything constant except for the renovation plan. For the bullets below, all assumptions will stay the same.

Purchase Price

Operations

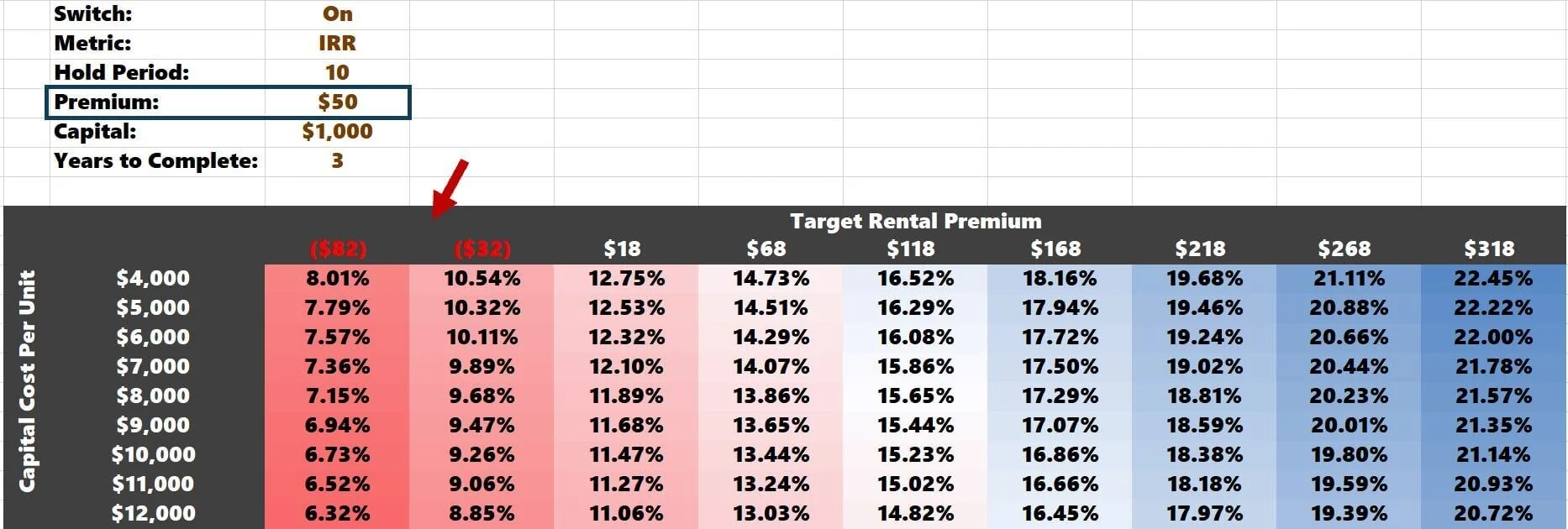

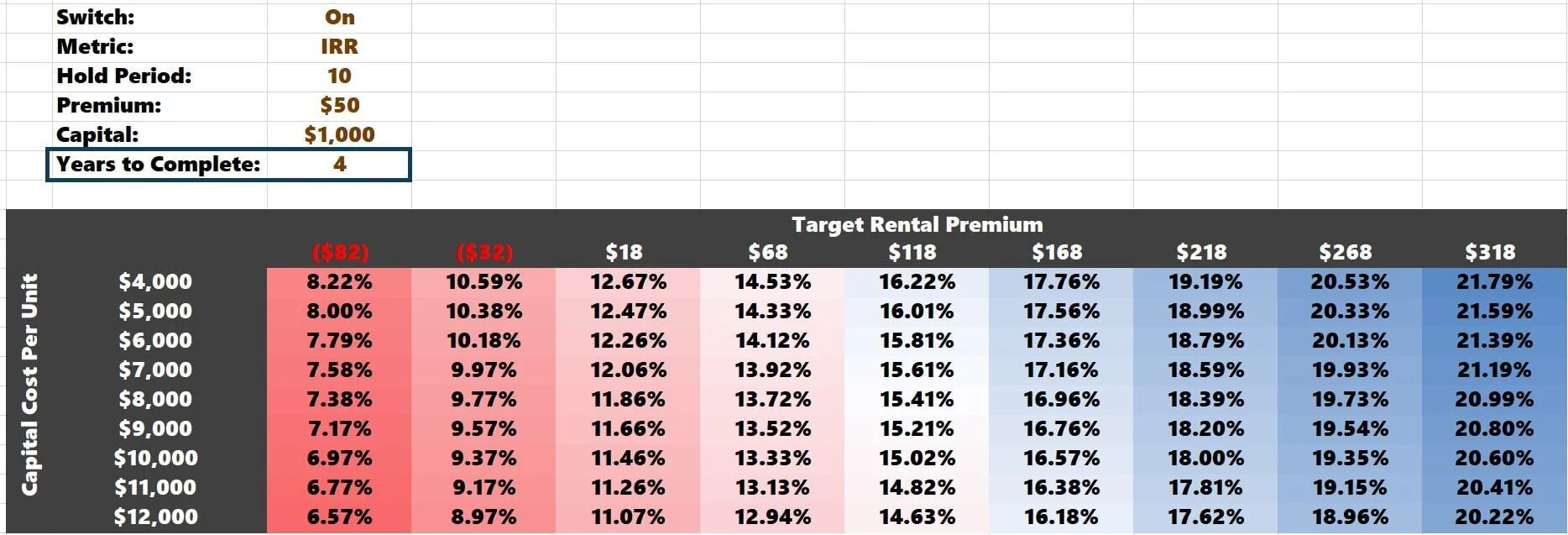

I will then begin digging into the renovation project and see how the best and worst-case scenarios will affect overall investment returns. To analyze this most effectively, I use an Excel data table. It is a matrix that will display rent premium on the horizontal axis and capital spending on the vertical axis. I can see the total project IRR at various capital and premium levels.

Project Returns

The numbers that populate the matrix in the image above are IRRs at various Premium and Capital thresholds. I am an IRR guy. It is the investment metric I feel the most comfortable with. However, I also like to look at equity multiple and annual returns.

These three investment metrics will help me feel more comfortable with what the value-add upside brings to the table regarding returns.

The matrix below shows that the absolute best-case scenario (highest premium with lowest capital spend) produces a 19.88% IRR. Worst-case (lowest premium with highest capital spend) has a 13.77% IRR.

Capital spending and premiums are just two variables in the equation. How long it takes to complete the renovation process and the total investment hold will also affect the return metrics, which we will discuss.

Investment Hold Period

Underwriting a more prolonged investment hold will give you a much higher error margin. In any investment, time is always your ally. Many investors will want to tear through the renovation as quickly as possible, raise rents, and sell the property for a higher price than they paid. IRR is a time-sensitive metric, so the faster you can get in and out of an investment, the higher the returns.

This can become problematic if the rehab strategy doesn't go as planned. Maybe the post-reno units are not getting the interest, or perhaps a global pandemic stymies demand. Running a 10-year hold instead of a 5-year hold will help smooth out the returns and give you more flexibility to recover from an adverse blip in the proforma. The 10-year IRR will usually be lower than a shorter hold; however, committing to a longer investment horizon can smooth out unforeseen circumstances.

5-Year Investment Hold

10-Year Investment Hold

Apartment Remodeling Premiums

The premium assumption will have the most significant impact on the investment outlook. The premium of $118 (in the middle) flows in from the “Renovation” tab of the model. You control the axis interval on this tab.

It's paramount that you review your rent comps and make sure your premium assumption is attainable. I would also recommend setting your interval on the horizontal axis to an amount that will lead to a negative premium. You would never move forward with a value-add acquisition if you thought the rental premium could be negative. However, it's best to conceptualize the worst-case scenarios and their impact on the returns.

Would it lead to a negative premium?

A global pandemic that leads to a widespread employment loss

Less demand than expected for upgraded units

If you've already conceptualized the worst-case scenarios, you can pivot your business plan and salvage the investment.

Apartment Remodeling Capital Spend

Capital spending is one of the more facile assumptions to underwrite. Before you close on the property, you can walk the living spaces with a general contractor and get a feel for renovation costs. Again, it will be crucial to understand the rent comp set and what other properties your apartment units will compete with. The capital cost per unit on the vertical axis is the blended average of all units flowing in from the “Renovation” tab of the model. You control the axis interval on this tab.

I like to allocate renovation costs by unit type. A studio apartment will tend to be cheaper than a one-bedroom or two-bedroom unit. Although all floorplans may undergo kitchen renovations, bathroom renovations, updated light fixtures, paint, trim, and flooring, the extra square footage of the larger floorplans will drive up the cost. Assume capital costs will run above budget significantly if you raise renovation capital from investors. You don't want to have to call your investors and request more funds halfway through the apartment remodeling.

And remember, you can always scale back the capital spending if things are not going as planned. You are not forced to follow through with your original proforma. If you are not getting the desired premiums, scale back the capital spending and shoot for a more conservative rent pop.

Apartment Renovation Time Frame

How fast can you knock out the renovation? Will you complete the rehab with a general contractor, in-house maintenance, yourself, or with a renovation services company? If it's a total gut renovation, where the property will sit vacant, and you can get into every unit at once, you may be able to knock it out in a matter of months.

If you’re renovating units as they become vacant with cosmetic improvements such as granite countertops, stainless steel appliances, and kitchen cabinets. It may take a few years to get through all the units.

The faster you can complete the renovations, raise rents, and lease the units, the higher the returns will be.

Note: It may be wise to push out your renovation start date. Delaying the value-add will lower the IRR. This analysis is outside this article's scope, and more can be read here.

1-Year Apartment Remodeling Plan

4-Year Apartment Remodeling Plan

The team you lean on to execute your business plan will significantly impact how quickly you can complete all the units. If you have one maintenance employee that you expect to handle this project, it will likely take them a while if they are also dealing with all the day-to-day repairs and upkeep.

Summarizing Apartment Renovation Analysis

To conclude the lesson on the “Renovation Stress Test,” you can review a quick video below discussing this specific analysis. This is meant to be super simple for the user. Please make no mistake; it is incredibly complicated behind the scenes. I had to build a second model that could run these scenarios.

If you dare to venture into the weeds, you can unhide the rows above the matrix to see all the working parts in motion! Due to the complexity of this analysis, it’s essential that you turn the “Switch” OFF when you are not using it. Otherwise, this data table will work constantly, which could slow down your Excel spreadsheet.

Check out the Ultimate Guide to Multifamily Value-Add Underwriting to learn about all the other critical components of proforma analysis.