Exploring Preferred Equity in the Real Estate Capital Stack

If you've ever used a Tactica proforma model, you know there is an assortment of partnership distribution models, but none will split cash flow distributions between:

Common Equity

Preferred Equity

Today I will discuss the mechanics of preferred equity and offer a solution for those wanting to incorporate it into their proforma analysis.

Contents

The Most Common Real Estate Capital Stack

The investment capital stack summarizes all the different sources an investor will use to fund a real estate project. Most commonly, the capital stack will consist of the following:

Equity

Debt

For example, if a newly constructed apartment complex costs $10,000,000 and is financed with a 65% LTV loan, the remaining 35% would need to come from the investor.

The loan (65% of the capitalization) is a higher priority in the capital stack, meaning it gets paid off before the equity investor. In other words, if the project doesn't perform well enough to pay off the loan, the equity investors will not get their initial investment returned. Therefore the senior debt is less risky and less expensive as the lender is paid back first.

If the project profitability is sufficient to pay off the senior mortgage, the deal sponsor could determine with their attorney and accountant how they plan to divvy up the ownership splits for investors funding the 35% of required equity. Some examples are:

The previous example (65/35) above works as intended for most sponsors, but what if they want to establish two classes of equity holders? Instead of all investors grouped into the 35% bucket, maybe they want to specify the following:

25% as Class B Equity

10% as Class A Equity (Preferred)

"Class A" and "Class B" will have different incentives and profitability agreements.

Now the capital stack has more complexity and is beyond what Tactica tools offer in their baseline state (with some caveats).

What is Preferred Equity?

Preferred equity can be an excellent middle ground between debt and common equity. It can offer investors a fixed rate of return on their investment capital and be less risky than the common equity.

Let's continue with our previous $10,000,000 capital stack example. A project could have the following:

25% Common Equity

10% Preferred Equity (middle)

65% Senior Debt

The senior debt is a fixed 5.75% payment each month. The preferred equity receives a 9% fixed payment (with no upside). The common equity holder has no fixed payments stipulated but will share in the deal's upside if it sells for a profit at the end of the investment hold. Let’s estimate that upside to be between 13% - 16% IRR.

Preferred Equity vs. Common Equity

As an investor, the benefits of investing as a preferred equity holder are:

More Safety - Get paid before the common equity holder

Consistency - Generally, the agreement will stipulate a fixed rate you should receive (depending on the asset class, the interest payment may be made monthly, quarterly, or accrue).

A rational investor must also look at the downside.

Subordination - Pref is still a lower priority than the senior debt, and losing 100% of the investment is still possible in distress.

No Upside - In a successful business plan, you'd leave profits on the table that only the common equity holder will reap.

Shorter-Term - Sponsors are often motivated to take out pref equity investors upon executing the business plan (usually via refi) and replace them with cheaper senior debt.

Over the years, I've seen a few deals cross my desk with a preferred equity class. Typically, it's a smaller chunk of the total equity requirement and caters to more conservative investors looking for consistency and tax benefits (depreciation).

It's common to see an "A Shares" and "B Shares" allocation

"A" Shares = Preferred equity investors

"B" Shares = Common equity investors

The sponsor's operating agreement will detail the order of distributions meticulously, but generally speaking, "A" shares are paid first monthly or quarterly.

However, a project with a significant renovation and little cash flow early in the investment hold often stipulates that interest owed to preferred equity investors will accrue until a capital event (such as a refinance when the project stabilizes).

In a typical year of cash flow, the common equity holder collects payment after the following:

The senior lender collects payment in full on all principal and interest payment

The preferred equity investor receives their dividend

During a capital event (such as a sale), the common equity holder collects payment after the following:

The sponsor pays off the senior loan balance along with any past unpaid principal and interest payment

The preferred equity investor is reimbursed for their initial investment and paid any accrued and unpaid dividends

Preferred Equity vs. Mezzanine Financing

Another capital stack source is mezzanine financing or "mezz" financing. I've noticed it can often get confused with preferred equity because there are a lot of similarities, including:

Subordinate to the senior financing

In front of common equity in the payback pecking order

No upside beyond the pre-determined interest payment

Short-term (and generally taken out with a refinance, although mezzanine financing will have a defined term similar to any loan)

I've never seen a deal with both a mezz and preferred equity tranche. From a financial modeling perspective, both would underwrite very similarly, but mezz is paid before ANY equity payments (preferred or common).

Mezzanine financing is structured as a pledge of ownership interest in the entity that owns the investment property. In a sense, it's a hybrid debt/equity instrument but still subordinate to the senior mortgage.

In the case of a foreclosure, the mezz lender could potentially take over the property to rescue the deal in an attempt to be made whole. According to Smartland, most mezzanine lenders are experienced commercial real estate operators comfortable in this capacity, with knowledge, know-how, and resources to assist in turning around distressed assets.

Mezzanine financing and preferred equity are very similar strictly from a cash flow perspective IF the property performs. If a property falls on hard times and a foreclosure is possible, the mezzanine loan is higher than the preferred equity in the payback order. It also may offer the opportunity to the mezz lender to convert their debt interest into an ownership capacity and overtake day-to-day property operations.

Modeling Preferred Equity in the Value-Add Model

One of my favorite parts of selling proforma models to the public is that customers discover more ingenious ways to use them. As I mentioned earlier, Tactica Models include a handful of partnership distributions, but none of which will parse out equity between "preferred" and "common."

This year a Value-Add Model customer, Adam Felson, with Felson Companies out of Hayward, California, mentioned he found a way to account for preferred equity without any alterations. He used the second loan argument as a workaround to account for a preferred equity payment.

Note: Numbers are imaginary for the sake of example.

Let's say you have an agency mortgage. Below are the senior financing terms.

There's also a second loan section in the Value-Add Model. I intended the second loan assumption for supplemental loan inputs when an investor assumes a first mortgage but desires more leverage.

Adam figured out he could plug his first mortgage into the loan #1 section and his preferred equity terms into the loan #2 section. For example, we want to break up the 35% equity into 10% preferred equity and 25% common equity.

In the Loan #2 section, you’d first set the LTV to 10%. The interest rate is whatever the agreed-upon preferred equity rate is (in this case, 9%), and then you'd set the interest-only (IO) month assumption to "120" for "full-term." The term and amortization assumptions won’t impact the payment, and I will leave them as “10” and “30.” There is no “loan cost.”

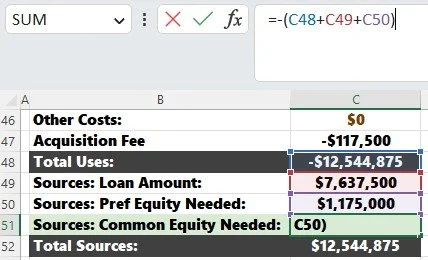

We can also make a couple of adjustments in the “Sources & Uses” section to clarify our new capital stack. The loan amount from above (= C17).

We’d then need to insert a row and create a line for preferred equity and grab the amount from above (= C30)

And finally, we’d need to adjust the common equity formula (in C51) to account for the new preferred equity

Now, if we grab a snapshot from the "Returns Summary," there's one minor alteration we'd need to make. The DSCR isn’t accurate because it’s calculating the “pref” equity as an amortizing loan (so it’s understated).

You’d need to grab the NOI in Year 1 ($655,863), divide it by cell $D$15 on the “Debt” tab, and drag the formula through Year 10. Make sure to lock cell D15.

Now when we look at the cash flows in Year 1, the order is as follows:

Principal & interest of the agency loan ($439k)

The preferred equity interest payment ($106k)

The $111k remaining is for the common equity holders.

If you were running a simple interest waterfall, that would be the cash flow remaining in Year 1 for the common equity investors.

If you were to sell the project in Year 7, the paydown order would go as follows:

The agency loan balance ($7.085 million)

The preferred equity balance ($1.175 million)

The remaining $6.85 million would be left for the simple interest waterfall.

The $7.15 million figure also accounts for the $297k in Year 7 cash flow paid to common equity investors in addition to the $6.85 million of sale proceeds. $297k + $6.85 million = $7.15 million

As you can see, using the Loan #2 assumption to account for preferred equity is creative and relatively painless. I may also include tutorial videos showing you how to do something similar in Tactica’s Multifamily Development and Multifamily Redevelopment models. At this juncture, I wouldn't want to make preferred equity a part of the permanent models (I would hate to overcomplicate), but a video tutorial showing how to go about it may be a nice touch in the future.

Video: Adding Pref Equity to the Redevelopment Model

Summarizing Preferred Equity

Preferred equity resides in the middle of the capital stack and can offer risk-averse investors more safety and consistency than a common equity position. It is subordinate to senior debt, there usually isn’t any upside beyond the negotiated annualized interest rate, and it tends to be a shorter-term investment.

Sponsors offering preferred equity investment positions is rarer in the private real estate space and tend to be more common in more sophisticated investment partnerships. While Tactica financial models don’t include a pref equity option, there are ways you can still creatively reflect a preferred equity investment tranche, as demonstrated in the Value-Add Model.