Property Tax Abatements in Multifamily Development

A real estate tax reduction can offer a developer a significant advantage when considering new construction projects. Real estate taxes are the most pertinent operating expense for which a property owner must account. Seeing a discounted property tax bill could help make a project feasible and spur economic development.

The local government or municipality can offer incentives such as a tax abatement program that provides investors with a total exemption of real estate taxes for a defined number of years. I've also seen programs where the property tax exemption only applies to improvements. The developer would still be on the hook for the tax payment on the assessed value of the land.

I've seen abatement periods range from a few years up to twenty. I'll discuss abatement timing later, as it can impact the investment outlook.

Tax Abatement Real Estate Contents

Multifamily Property Tax Exemption

A tax abatement is a type of property tax exemption that reduces property tax expense for an investor. Therefore, it can be considered an income stream because it will increase the investors’ net operating income (NOI) while active, thanks to a reduced property tax bill.

In real estate, investors tend to cap income streams to determine the property's value. This rationale gets muddled when temporary tax incentives are involved as they are only temporary.

Real Estate Tax Abatement Example

You are developing a building with a projected stabilized NOI of $1,000,000 with a 10-year tax abatement. Property tax is $0 for the entirety of your investment hold. You estimate selling the property at a 5% cap rate in five years for $20,000,000.

The thought process laid out above is inaccurate. The next buyer will not give you full credit for an income stream that will eventually end. The underwriting analysis needs to be more thoughtful. What happens when the tax abatement ends?

Underwriting Real Estate Tax Abatements

How you underwrite a tax abatement will depend primarily on the tax abatement timing.

10-Year Tax Abatement or Less = Much Easier to Underwrite

> 10-Year Tax Abatement = More Difficult to Underwrite (but still doable)

Most underwriting models, including Tactica's Development Model, only account for a maximum holding period of ten years, which can be a factor when dealing with longer-term tax exemptions.

Fewer than 10-Year Tax Abatement

Tax abatement underwriting becomes more manageable when the abatement agreement specifies the benefit running out during the investment hold.

Tax Abatement Scenario

Let's say we will develop a 90-unit property benefitting a 10-year tax abatement. However, the reduction is only on the real property (buildings/improvements). We would still be responsible for the tax payment on the land portion of the value each year.

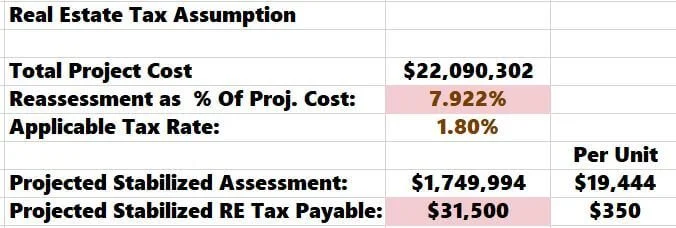

In the Tactica Development Model, stabilized property taxes payable are determined by two inputs:

The applicable tax rate

The stabilized assessment (as a % of total construction cost)

Typically, I'll use submarket comps and back into an appropriate assessment and taxes payable per unit. We will revisit the tax comps in a moment.

Online, we see the local assessor values the land at $1,749,994.

While researching tax comps in the general vicinity of the project, the applicable tax rate is 1.80%.

I will plug 1.80% into the model and toggle the "Reassessment as % of project cost" (pink cell) to back into the assessor's valuation of $1,749,994

Our property tax burden annually will start at:

$1,749,994 x 1.80% = $31,500 (pink cell)

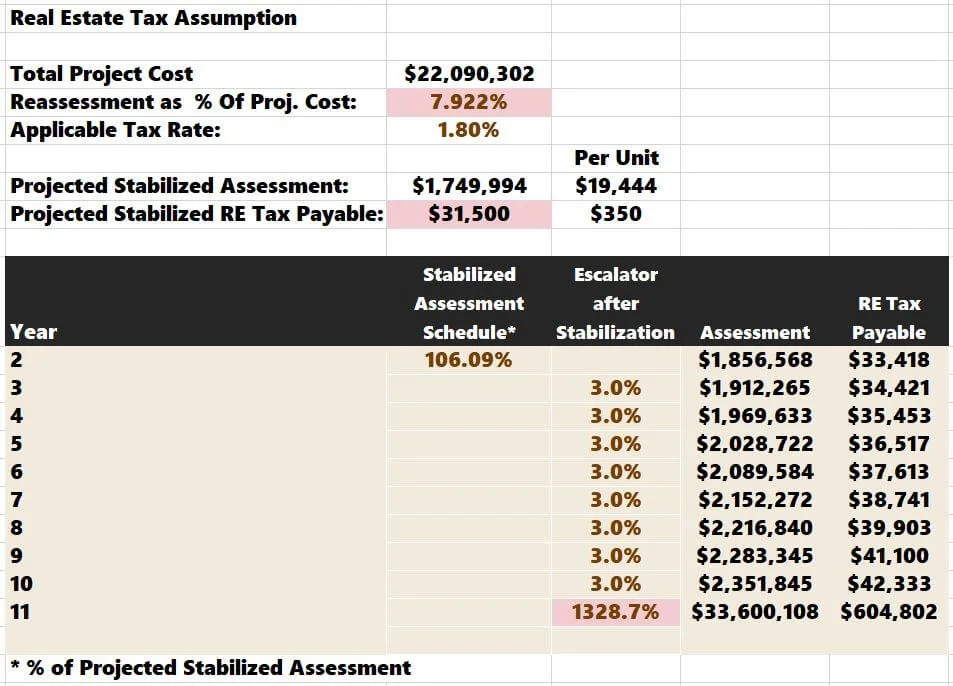

I assume the property assessment will increase by 3% annually until Year 10, when the tax abatement falls off.

Right-Sizing Taxes in Year 10

Property tax expense will normalize in Year 10. Below is how I calculate the local property tax hike.

Remember the tax comps we investigated? After evaluating a handful of comparable properties, we determined that $5,000/unit in property taxes is a reasonable estimate for our property (if it didn't have abatement eligibility).

We've been growing the land basis at 3% per year. Let's apply this same escalator to the $5,000 per unit of the comp set.

$5,000 x 1.03 ^10 = $6,720

After Year 10, our projected property tax would increase to:

$6,720 x 90 units = $604,800

Our tax burden started at $31,500 and has been increasing 3% annually up to this point.

$31,500 x 1.03^10 = $42,333

Now, we must enter our assessment increase into the model of

$604,800 / $42,333 - 1 = 1,328.67%

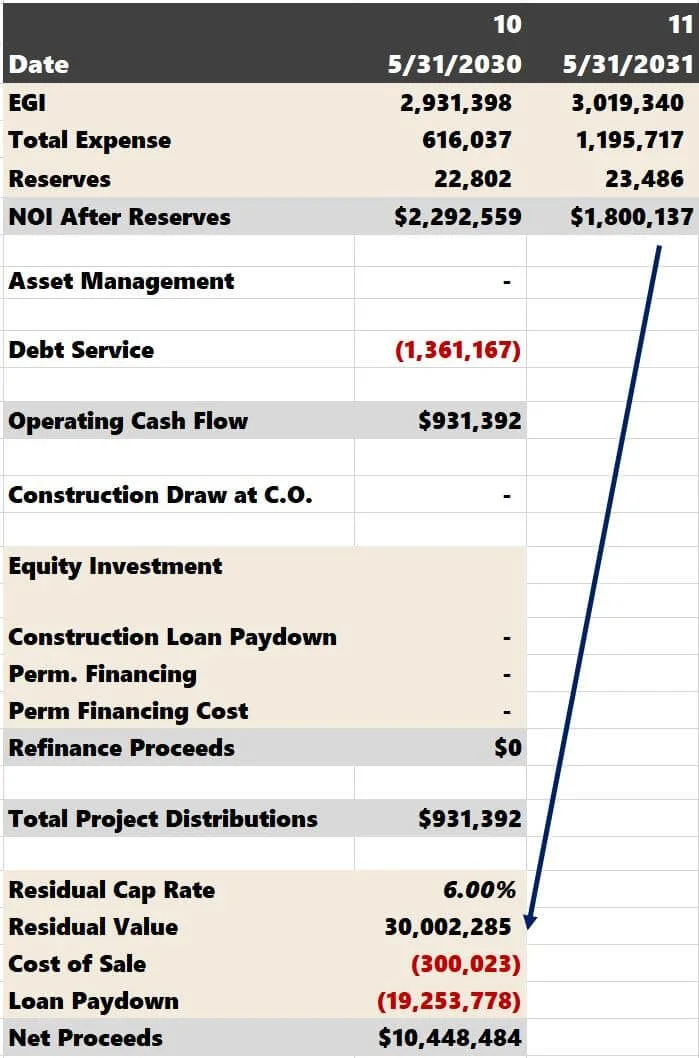

While this abrupt increase (from $42,333 to $604,802) may be a tough pill to swallow, this increased tax payable amount is now factored into the residual sale NOI.

NOI drops drastically in the image above once the tax abatement falls off—the residual sales value of $30,002,285 accounts for ending the abatement and normalizing property taxes.

Warning: If you run this scenario but plug a 5-year investment hold period into the model, this would be inaccurate if you still imply the tax reduction finishes in Year 10 as we did above.

The NOI at sale in Year 5 would be overstated due to the tax abatement still in effect at the sale, and residual sale proceeds will also be magnified along with your investment return metrics.

If you sell in Year 5, you may get some premium from a buyer to account for five more years of reduced taxes, but you certainly won't get them to cap the savings like they would for other perpetual cash flows.

Be sure the investment hold period equals or exceeds the abatement period for the model to reflect an accurate residual sales value that is not overstated.

10+ Year Tax Abatement

If the incentive ends outside the timeframe of your investment hold, the analysis gets trickier and requires a bit more thought. While fully-baked property taxes would never affect your cash flows, the subsequent owners will see a massive property tax increase.

Cap Rate Adjustments

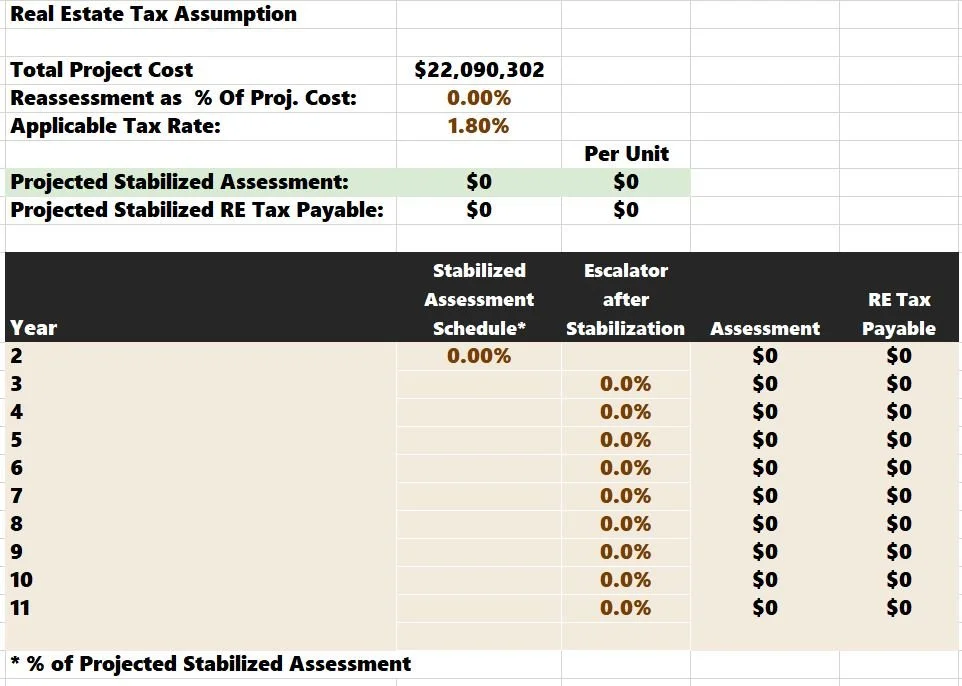

A reasonable action would be to make a residual cap rate adjustment. Let's run a scenario where there is a 12-year tax abatement. The tax reduction offers an exemption on both the land and the improvement. In other words, property tax will be $0 for 12 years.

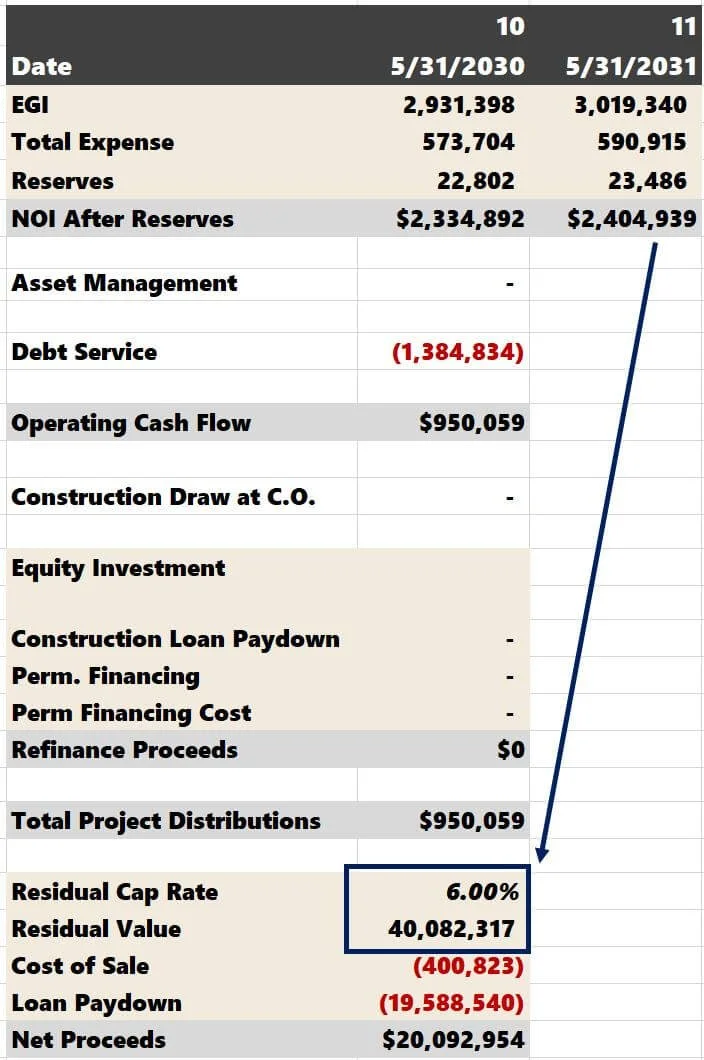

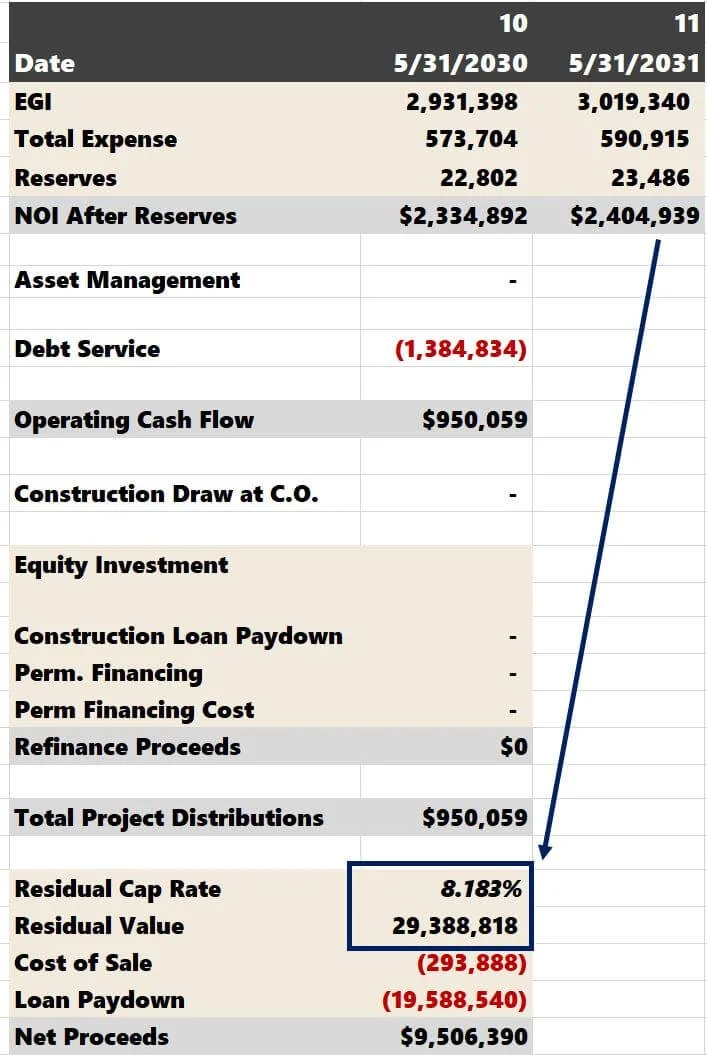

You're projecting a 6% residual cap rate in Year 10 when you'd ideally sell the asset.

When you sell the property in Year 10, the tax expense is $0. However, the buyer will be on the hook to pay the entire property tax burden once they've owned the property for two years. They will likely discount the cap rate to account for this reduced NOI.

Tax Abatement Adjustment Process

Ideally, you'd want to study the comps and figure out what taxes per unit would be today for the comp set. Let's use the same example as above. Today, property taxes would be $5,000/unit without abatement. Again, we'd want to apply some annual escalator to this amount, but this time, instead of forecasting ten years out, we'd use 12 years.

$5,000 x 1.03 ^12 = $7,129

After Year 12, our projected property tax would increase to:

$7,129 x 90 units = $641,610

This number is a ballpark estimate of the future tax burden. Unfortunately, the further out we get, the harder this number will be to predict.

We need to use this estimate to make a residual cap rate adjustment.

We use the Year 11 NOI to calculate the Year 10 Residual Sale Value.

We project that the future buyer would pay a 6% cap rate for $2.4 million in NOI. But we know that $2.4 million will decrease by a lot (about $641,610).

$2,404,939 - $641,610 = $1,763,329 in tax-adjusted NOI

Now let's apply the 6% cap to that figure:

$1,763,329 / 6% = $29,388,817 in tax-adjusted price.

Now, for the cap rate to plug into the model:

$2,404,939 / $29,388,817 = 8.183%

The 6% we initially plugged in is an 8.183% tax-adjusted cap once we factor in the tax abatement ending.

Property Tax Exemption and the Buyer's Perspective

You may think, "What about the two years of free taxes the buyer gets (Years 11 and 12 of the abatement)? They didn't give any credit for this!"

Typically, a sophisticated buyer will estimate the tax savings for those two years, apply a discount rate, and offer the net present value (NPV). This way, they are giving you (the seller) some credit but aren't capping an income stream that will end in two years.

At this juncture, I think it's better to be conservative and assume you'd get no credit at the sale. Trying to figure out an NPV for 12 years in the future adds more complexity to the analysis and is far from a sure thing.

Summarizing Multifamily Property Tax Exemptions

Property tax exemptions come in all shapes and sizes. I gave you two different examples:

Tax abatement ends during investment hold (Year 10)

Tax abatement ends outside of the investment hold (Year 12)

It's essential to understand all the details of your tax abatement applications. Every program will be nuanced and different.

The key to underwriting tax abatements successfully is understanding that abatements eventually end. When a cash flow isn't perpetuated, you cannot cap it and assume somebody will pay you for that income stream.

It's best to adjust your NOI or the residual cap rate to reflect how the following ownership groups will view your project and its cash flows. Failing to do so could lead to an unpleasant surprise when it comes time to sell.