Multifamily Asset Classes (A, B, C, D) Investment Strategies

Multifamily real estate investments generally follow a “classification code” system depending on the attributes of a given property (as A, B, C, D). This article strives to accomplish two things:

Define the various multifamily asset classes

Detail how each asset class will require different underwriting techniques

Commercial real estate investors, lenders, and brokers may have different definitions of the asset classes, so bear in mind that depending on whom you’re talking to, there may be wiggle room with the precise terminology.

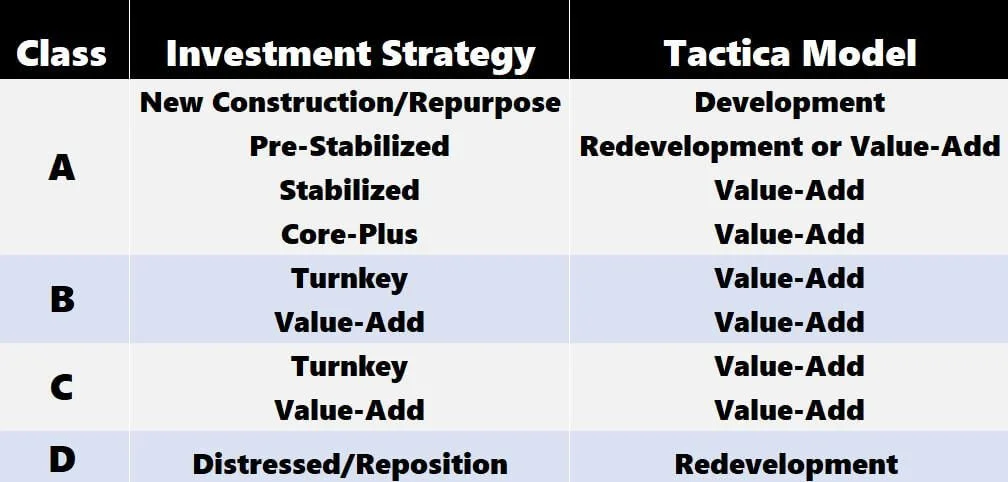

Regarding the analysis techniques, I think each underwriting each asset type as a “task,” and the Tactica financial models tools as a “Swiss Army Knife.” You wouldn’t use needle-nose pliers to hammer in a nail, just as you wouldn’t use a Development Model to underwrite a value-add investment strategy.

Using the correct analysis tool for investment opportunities will lead to more efficient and thorough proforma underwriting.

Contents

Class A Properties

Class A apartments are generally newly constructed luxury rentals in top-tier locations. They are heavily amenitized in communal spaces and units. These buildings command the highest rents as they target high-earning residents in areas near the central business district (CBD).

Multifamily investors target Class A buildings for a “de-risked” yield. Cash flow depends on keeping occupancies high, raising rents at lease expirations, and predominantly stable cap rates when it comes time to sell.

Due to the project's newness and the limited need for capital improvements, there are generally few upside opportunities (with a caveat of “core plus”).

Class A Characteristics

Built within the last 7 - 10 years

Phenomenal location with A+ walkability

Highly amenetized (pool, fitness center, business center, pet amenities, clubhouse, etc.)

Exceptional finish levels in rental units (quartz surfaces, stainless steel appliances, tile backsplash, oversized cabinets, modern plumbing fixtures, solid-core doors, elevated ceilings, optimized floorplan layouts)

No deferred maintenance

Underground parking

Highest rents in the market

Often, the property includes ground-level commercial such as a restaurant, brewery, bar, or other establishments that enhances the neighborhood.

Class A Subcategories

There are a few different “subcategories” within the Class A definition. What I described above is a stabilized property. However, you can think of Class A as a spectrum, and there are various multifamily investment strategies within this spectrum. The subcategories are in chronological order:

Development/Construction

Pre-Stabilized

Stabilized

Core Plus

Each bullet above is a unique niche that requires particular expertise and varying proforma analysis procedures.

Development & Construction

Before a Class A complex comes to fruition, a developer needs to build it. Ground-up development is arguably the riskiest type of real estate investment, as construction can take years. Risks are numerous, including:

Increasing cost outputs

Changing renter preferences

Economic

Full recourse on construction financing.

I also consider repurposing an old building as a multifamily development. An example would be converting a historic office building into an apartment. Properties gutted to the studs in premium locations can fetch the same rents as newly constructed Class A on a vacant lot. There’s a value proposition in that “old-time” charm and a subset of renters that actively seek that.

Generally, developers target higher return parameters to account for all risks. Leveraged IRRs on a development project will be more than double what an investment group targets by purchasing the asset when it’s stabilized (95%+ occupancy).

I discuss some crucial investment metrics a developer should stress when determining feasibility, such as “Return on Cost.”

Development Proforma Analysis

Tactica offers site visitors a financial model specifically for multifamily development that factors in various facets of the project. It’s a tool that effectively looks at the project from the cradle to the grave (construction to eventual sale).

Pre-Stabilized

A pre-stabilized property is when the building construction is complete, the property has received its certificate of occupancy, and the lease-up has begun.

Lease-up can be a grueling process that takes one year or more. It requires expertise, exceptional marketing, and sophisticated systems to determine the proper market rents.

Some developers may want to de-risk their investment and sell the property before hitting full occupancy. From their perspective, this could be beneficial because it allows for a faster sale (and likely higher IRR and potentially a higher promote) and relatively solid profit prospects.

From the buyer’s perspective, they will likely get a slight discount for purchasing the property with lease-up risk. Assuming they can successfully fill up the property with qualified renters, they will reap arbitrage compared to those who bought it at 95% occupancy.

Pre-Stabilized Proforma Analysis

I wrote a blog post discussing the art of evaluating pre-stabilized real estate. It may sound unintuitive, but the Value-Add and Redevelopment Models would be appropriate for pre-stabilized deals depending on your financing preferences and lease-up strategy.

Stabilized

The new apartment complex, humming and fully occupied, is a proper Class A investment. This investment is where you’ll see the lowest cap rates, as many institutional investors play in this space and purchase with cash. Investors in these assets are betting on the submarket fundamentals as much as on the property performance.

Stabilized Proforma Analysis

While it may feel unitive, Tactica’s Value-Add Model is great for underwriting new apartment complexes. There are a few minor adjustments you must account for in the proforma model, but overall, it’s a seamless exercise.

Core Plus

I consider “core plus” to be slightly aged Class A assets in phenomenal locations that exhibit the most in-demand communal amenities and whose units are still in excellent shape for the most part. Typically, core plus assets have modest opportunities to improve certain cosmetic aspects and raise rental rates.

For example, a Class A property is seven years old. It’s not ancient, but resident preferences have changed since construction, and there’s an opportunity for a modest value-add strategy. Some examples of fairly common core plus renovation scopes include:

Extending vinyl flooring into carpeted areas

Adding a tile backsplash in the kitchen

Changing the paint scheme

Upgrading kitchen/bathroom hardware

Adding technology like USB outlets or smart thermostats

Improving common area carpet or lighting

Clubhouse refresh

These minor enhancements aim to catch the property rents up to the newest properties built in the vicinity.

Core Plus Proforma Analysis

A core plus investment strategy is synonymous with “a ‘light’ value-add” plan. Tactica’s Value-Add Model is perfect for this investment strategy.

Summarizing Class A

The investor's perceived risk decreases as you move from development to stabilized properties. You’ll see this in cap rates. core plus is a little funky, as I’ve seen it priced more aggressively than stabilized core due to the upside prospects (lower cap rate). I’ve also seen core plus priced conservatively (higher cap rate) because it’s not as new and is slightly out of style.

You’d typically see a cap rate pattern for the various Class A multifamily properties:

*Cap Rate for development is a “return on cost,” which takes:

Projected Stabilized NOI / Total Construction Cost.

Class B Properties

Class B assets are the epicenter of the value-add investment strategy.

Class B Characteristics

Built between 10 and 40 years ago

Well-located, close to major thoroughfares

Strong local demographics

Interior units cosmetically “dated.”

Common areas lacking amenities of Class A comps

Potential for deferred maintenance

Potential for some functional obsolescence

Surface parking or detached garages

Moderate rents

Over the past decade, investors have salivated over Class B apartment buildings due to solid demographics, proximity to major employment centers, and the ability to raise rents substantially while still being materially cheaper than Class A properties. Investors love upgrading units to modern finish levels and adding communal amenities such as a clubhouse, dog park, business center, or swimming pool.

Another huge benefit of owning Class B properties is that they are still relatively “new-ish.” Typically, the need for cosmetic capital budgeting dramatically exceeds the cost of deferred maintenance. This distinction is vital because sinking money into cosmetic upgrades translates into more rental income while taking care of deferred maintenance is defensive and does not.

The most sought-after Class B assets I can recall were those where ownership took care of all deferred capital items (roofs, siding, HVAC, parking surfaces) but neglected the cosmetic upgrades. The subsequent ownership group could solely focus on the renter’s experience and bolster the rent roll.

After the renovation, I’ve seen a classic Class B building that feels similar to Class A, with rents still 10% -15 % lower than a valid Class A property. That is a massive value proposition for cost-conscious renters looking for functional units and a handful of excellent property management services.

Class B Proforma Analysis

Shocker: Tactica’s Value-Add Model is the perfect underwriting tool for Class B properties with or without value-add upside.

Class C Properties

Class C apartments have also been a popular asset class for multifamily value-add, albeit with a more modest scope.

Class C Characteristics

Garden Style (four floors or less)

Brownstones

Built before the 1980s

Smaller units and floorplans (typically)

Interior units cosmetically “dated”

No communal amenities

Deferred maintenance

Functional obsolescence

Diverse location rating

Lowest rents in the market

One of the most common syndication pitches is when they refer to a “Class C asset in an A+ neighborhood.”

You can find ClassC buildings in premium locations and less desirable neighborhoods, a sign of developers of past generations speculating on areas and cities. An investor’s renovation scope depends mainly on the community and the rental comp set.

Class C multifamily buildings generally have deferred maintenance and could have more recurring maintenance issues due to age and inefficiencies. They are also vulnerable to economic downturns as renters occupying these rental units tend to be working-class whose jobs are at risk during economic turmoil (as witnessed during the pandemic).

Class C properties tend to require more active management. One of investors' most significant mistakes is thinking they can convert a Class C property into a Class B or Class A. I’ve seen countless investments fall short of expectations.

While there is a value-add play in most Class C assets, it is typically a more subtle scope that focuses on modestly improving the living conditions instead of adding all the highest quality finish levels that are ultimately unnecessary. There is also significant functional obsolescence in these properties.

These impediments are very hard to overcome (if not impossible) within the renovation scope.

Class C Proforma Analysis

Tactica’s Value-Add Model is the perfect underwriting tool for Class C properties.

Class D Properties (Distressed)

When I think of Class D, I think of “Distressed.” These properties will require much effort to fix and operate.

Class D Characteristics

High vacancy

Deferred maintenance that violates local safety codes

High crime or other nefarious activities taking place on property premises

General neglect

Rental properties falling under Class D were commonly Class C before being severely mismanaged. However, due to neglect, I’ve seen assets that should qualify as Class B properties fall into the Class D bucket.

The biggest takeaway from Class D is that it is genuinely not operational. It will not function unless the next ownership group completely repositions the property. A new investor will take care of the deferred maintenance, resolve tenant issues, renovate units, and lease up the property (sometimes from scratch).

Redevelopment may feel similar to a pre-stabilized property once the renovations are complete. A full lease-up often must occur as the property sat vacant during the extensive repositioning.

Some of the most significant home runs I’ve seen in multifamily real estate investing have come from ambitious operators who take on a Class D property, successfully redevelop it, rebrand it, and lease it out.

Class D Proforma Analysis

Tactica’s Redevelopment Model is the correct tool for a distressed property needing a total repositioning effort. It can handle a considerable period of vacancy, extensive renovation plans, lease-up, and a refinance from bridge financing to a permanent loan once the property is stabilized post-renovation.

Summary of Multifamily Asset Classes

Class A, B, C, and D assets have distinguishing characteristics. The line may be blurry between specific properties and how they should be classified. This article should give you some ideas on the best action for underwriting them efficiently and accurately.

As a general guide:

The skill sets required for different asset classes can vary significantly for each operator. It’s common for investors to pick and stick to their niche because of how vastly different investment strategies can be along the “class spectrum.”