New Apartment Complex Underwriting Tips

I am occasionally asked what underwriting model would best fit a new Class “A” apartment building. Across the United States and Canada, thousands of new apartment homes are being delivered, and more real estate investors will likely consider investing in apartment buildings built this decade.

There’s a lot to like about brand-new apartment rentals. A turnkey apartment community has its perks in the current environment, where skilled labor shortages, supply chain interruptions, and rampant inflation of material costs (like lumber, paint, and metals) make executing a business plan difficult.

A new property with modern floor plans and state-of-the-art communal amenities (leasing office, fitness center, pet-friendly areas, business center, etc.) has built-in benefits. It could allow landlords to focus solely on leasing units and maximizing the value of the existing apartment living experience without the headache of coordinating complex renovation logistics.

On a personal note, I love modern construction in tertiary markets and see it as an undervalued asset class.

Investing in New Apartment Complexes

The model I use for class “A” proforma underwriting is the Tactica Value-Add Model. I think about the quality/condition of apartments on a sliding scale. “Value-Add” doesn’t mean the model can only handle Value-Add properties. It means it is helpful on any assets ranging from turnkey to value-add.

For new construction, we offer the Development Model. For properties in total disrepair, we offer the Redevelopment Model.

Pre-Stabilized Note: I wrote a blog post about strategies for underwriting pre-stabilized apartment buildings. This blog post assumes that a new apartment building is mainly leased up or is close to being entirely inhabited (90% + occupancy).

Unit Mix Tab

Even though the unit mix inputs are hosted on a tab called “Renovations,” you aren’t forced to incorporate any rehab/reno plan. The first step is entering $0 in the capital and premiums columns.

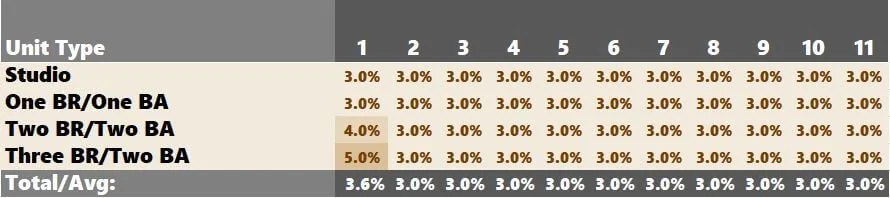

You can control the baseline rent rental increase for each floor plan off to the right.

There may be an opportunity to increase the larger floor plans (three and two-bedroom apartments) more than the smaller, one-bedroom units in this example.

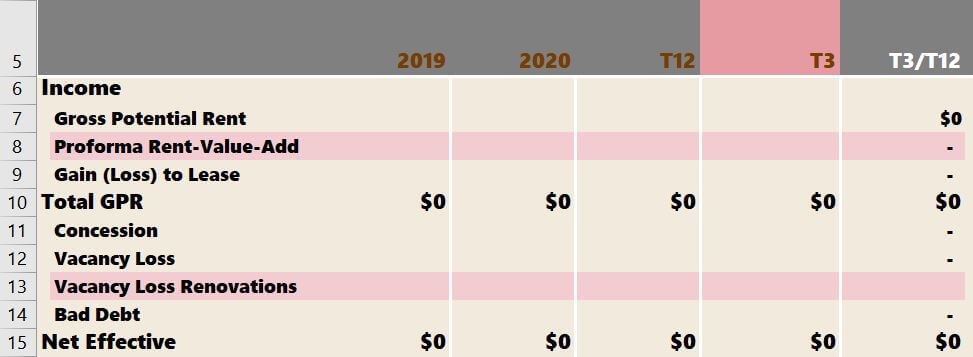

Now you can go to the “Financials” tab and hide the rows dedicated to:

Renovations Premiums

Renovation Vacancy

The model now accurately depicts a turnkey project with no renovation premiums or rehab vacancies.

Rental Upside

What if there is more rental upside? For example, you’re confident there is a rental premium on all units on top of the general baseline rent growth per the comps in the submarket. There are a few steps to follow:

First, you need to put in the premium upside. I’ll use $50 across all unit types. Notice that capital costs are still $0.

Below, you need to phase in these premiums just as you would in a value-add scenario. I do this in the image below:

Type: Upside

I set the type as “Upside.” This flows into the financials tab strictly as a label (it doesn’t affect any numbers).

Reno Start: 1

Ideally, you will start phasing in the $50 premium immediately as renters’ leases expire.

Year to Accomplish: 1

Assuming most leases are one-year, you’d hopefully phase in all $50 premiums in Year 1 of the proforma.

Months Vacant: 0

Because there isn’t any construction, there won’t be excessive vacancy loss for improvements like updating countertops, flooring, and appliances. The “Renovation Vacancy” line can stay hidden on the “Financials” tab as it is “zeroed” out.

Ensure you unhide “Proforma Rent - Upside” if you underwrite a rental premium.

For a more intuitive model feel, you could switch the tab name from “Renovations” to “Unit Mix” or something more aligned with what this tab accomplishes.

Summarizing New Apartment Analysis

Many new units are coming online, and there may be opportunities to purchase apartment complexes built within the last decade that are less maintenance and labor-intensive. If you’re ever kicking tires on a newer turnkey property, the process is very similar to the value-add underwriting except for the unit mix assumptions we discussed above.