Preferred Returns in Multifamily Investment

A preferred return in real estate investment is one of the most common multifamily investment return structures between a general partner (GP) and limited partners (LPs). GPs will use a preferred rate of return as a carrot to attract and persuade investors to invest. When competition is fierce for commercial real estate investment capital, a preferred return can be the sweetener that ultimately sways capital to your project.

Preferred Rate of Return Primer

How the Preferred Return Works

A crucial component of the preferred return distribution method is deciding on the annual preferred return. Typically, this range ranges from 6% - 12% on invested capital. If an equity investor were to contribute $100,000 into the deal, paying a 6% preferred return, they could reasonably expect to yield $6,000 annually (but it’s never guaranteed).

Let's see an example and how this would look in a real-life investment opportunity.

Multifamily Investment Returns: Preferred Return Case Study

If you read our IRR Distribution Waterfall article, we will use the same sample project as our case study here. The opportunity is a value-add multifamily building requiring a $3,691,00 capital raise. The GP will contribute 10% of the equity and look to raise the other 90% from LPs. To entice investors, the GP has decided to pay an 8% preferred return (not to be confused with preferred equity) for any year the LP receives its entire 8%, and all remaining distributions above 8% payout 30%/70% between the GP and the LP. The holding period will be seven years.

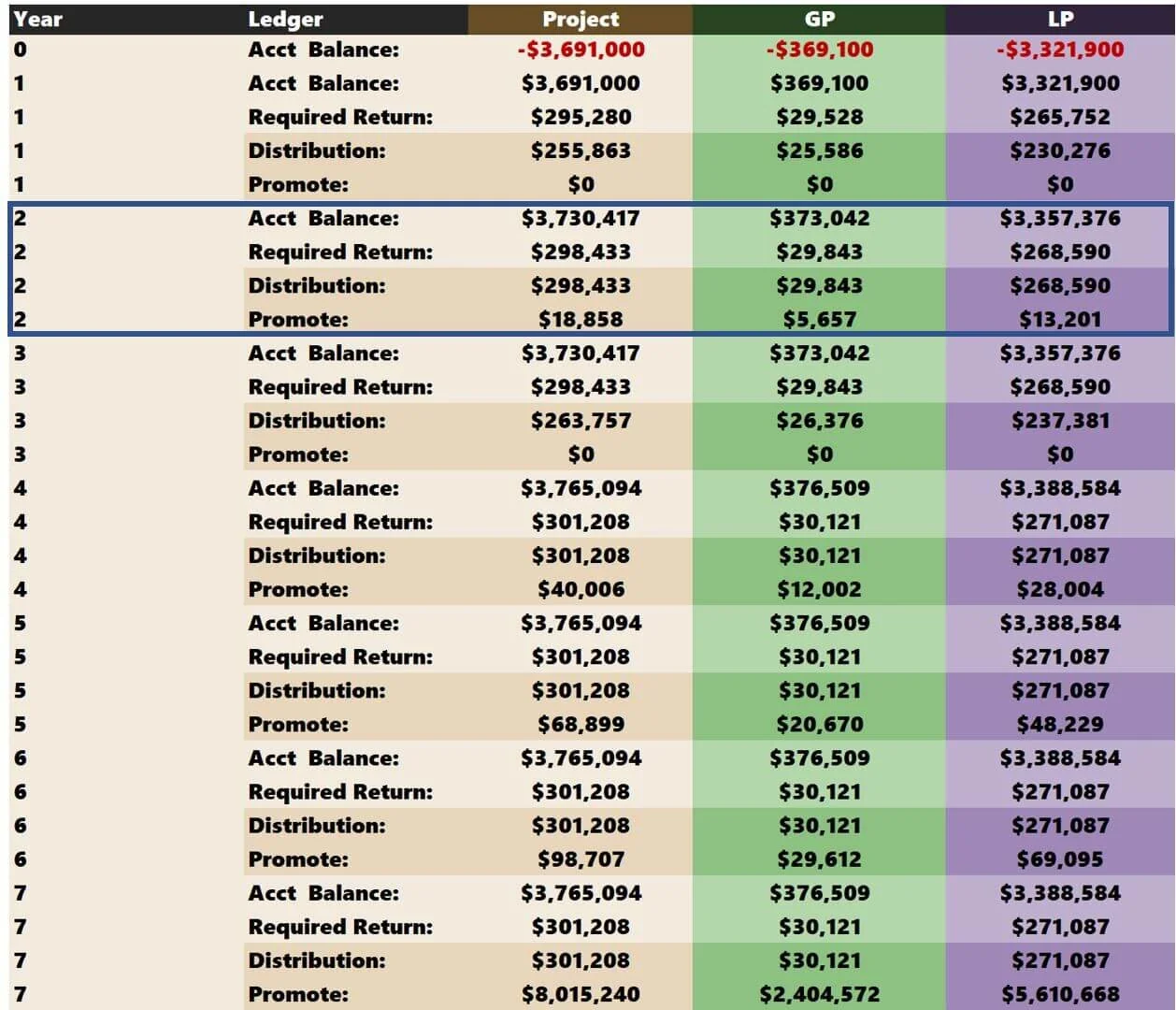

Putting these terms into the model would look like this:

With the terms set, the project-level cash flows (beige) are divvied up between the GP/LP:

Without seeing these distributions itemized, it's hard to understand what is going on. Let’s take a look.

You should interpret the image above as the following:

Proforma years go from top to bottom

Project-level details are in beige

GP/LP-specific details are color-coded in green and purple

The dark rows are the actual distributions paid out

You can see in Year 0 that the capital accounts for the project, GP, and LP are negative and in red font.

For each year, there are four tracked items:

Beginning capital account balance

The required rate of return

Distributions

Promote (If distributions exceed the preferred return)

Until the complete 8% is achieved, distributions are paid out pari passu (equally) between the GP/LP. In the first year (Year 1), the distribution was not large enough to cover the preferred return. The payment of $255,853 is paid out proportionately to the GP/LP, in line with their initial equity contribution.

GP: $255,863 * 10% = $25,586

LP: $255,863 *90% = $230,276

The following year, the unpaid portion of the required return in Year 1 is added to the beginning account balance of Year 2.

Unpaid Portion = $295,280 - $255,863 = $39,417

Year 2 Beg. Account Balance = $3,691,000 + $39,417 = $3,730,417

The required rate of return will increase to reflect an 8% payment on this increased capital account balance. Therefore, unpaid preferred return amounts accrue and compound.

In Year 2, there is enough distribution cash flow to cover the required return of $298,433. As soon as the required return is paid in full, the remaining proceeds are split between the GP/LP 30%/70%, as stipulated earlier as the GP incentive.

GP: $18,858 * 30% = $5,657

LP: $18,585 *70% = $13,201

Caution: Distributions above the 8% preferred return are not utilized as a return of capital. The GP will see a more significant share of the profits before the LP is paid back in full. There are no lookback provisions or claw-back stipulations. Theoretically, the investment could cash flow a ton, pay the GP outsized returns, then sell for a loss and lose money. The GP would have no obligation to make the LP whole. The promotion is determined year-by-year and is not dependent on past or future years. Check out the “Trifold Alignment Tactic” to learn of a distribution structure more neutral between GPs/LPs with more emphasis on long-term investment success.

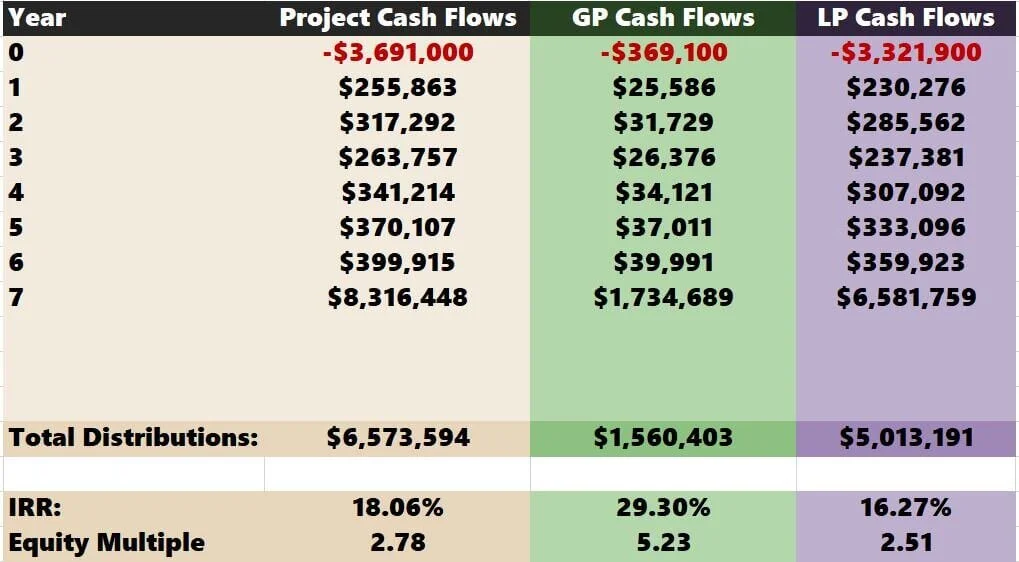

Preferred Return vs. IRR Waterfall

If you wanted to be more conservative, you could run a similar scenario where the LP pays back its original capital contributions before the GP gets into a promotion structure. You could plug the same assumptions into Tactica’s IRR distribution waterfall model to do this.

You would set it up as the following:

Notice that the Hurdle 2 Threshold is 100%, which I intend to be unobtainable. Any distributions over the preferred return of 8% will pay down the LP investor's capital account instead of flowing to the GP. The GP will only see 30% of the distribution after the LP:

Is paid back in full their initial equity investment

Earns an 8% annual return on their initial investment

This is a much more conservative way to structure the GP distribution incentive. If we summarize cash flows side by side, we can see how the returns will vary in both scenarios.

Preferred Investment Returns

IRR Waterfall Investment Returns

Summarizing the Preferred Return

As you can see, some nuances can affect the percentage returns significantly for GP and LP. You must do your due diligence as a passive investor, read the operating agreement thoroughly, and understand how distributions will flow from the project to the investors. For the GPs that put a deal together, you must settle on an incentive structure that is fair, attainable, and enticing to your prospective investors. Utilizing an experienced attorney who can articulate the distribution method in writing is paramount.

The preferred return model featured in this blog post is included in both the Tactica Multifamily Value-Add, Redevelopment, and Development financial models.