Partnership Distribution Structures in Multifamily Real Estate

There are six different partnership distribution structures built into the Tactica proforma models. The following article will detail some of the most common real estate partnership structures I’ve encountered and describe how they work within the Tactica financial model framework.

Real Estate Partnerships & Splits

GP/LP real estate partnership structures and their respective splits come in many forms. In a real-life application, you can customize partnership structures for the project's investors (and their preferences). A qualified attorney and accountant must detail the partnership arrangements, profit (loss) splits, and tax consequences. Variations in distribution terms between GPs and LPs are limitless as long as all parties agree.

Real Estate Partnerships

Some more complicated structures will have separate blog posts providing a thorough explanation. I also offer active investors a free partnership distribution template. Don’t forget to check out the video at the bottom of this page explaining each structure.

Pari Passu

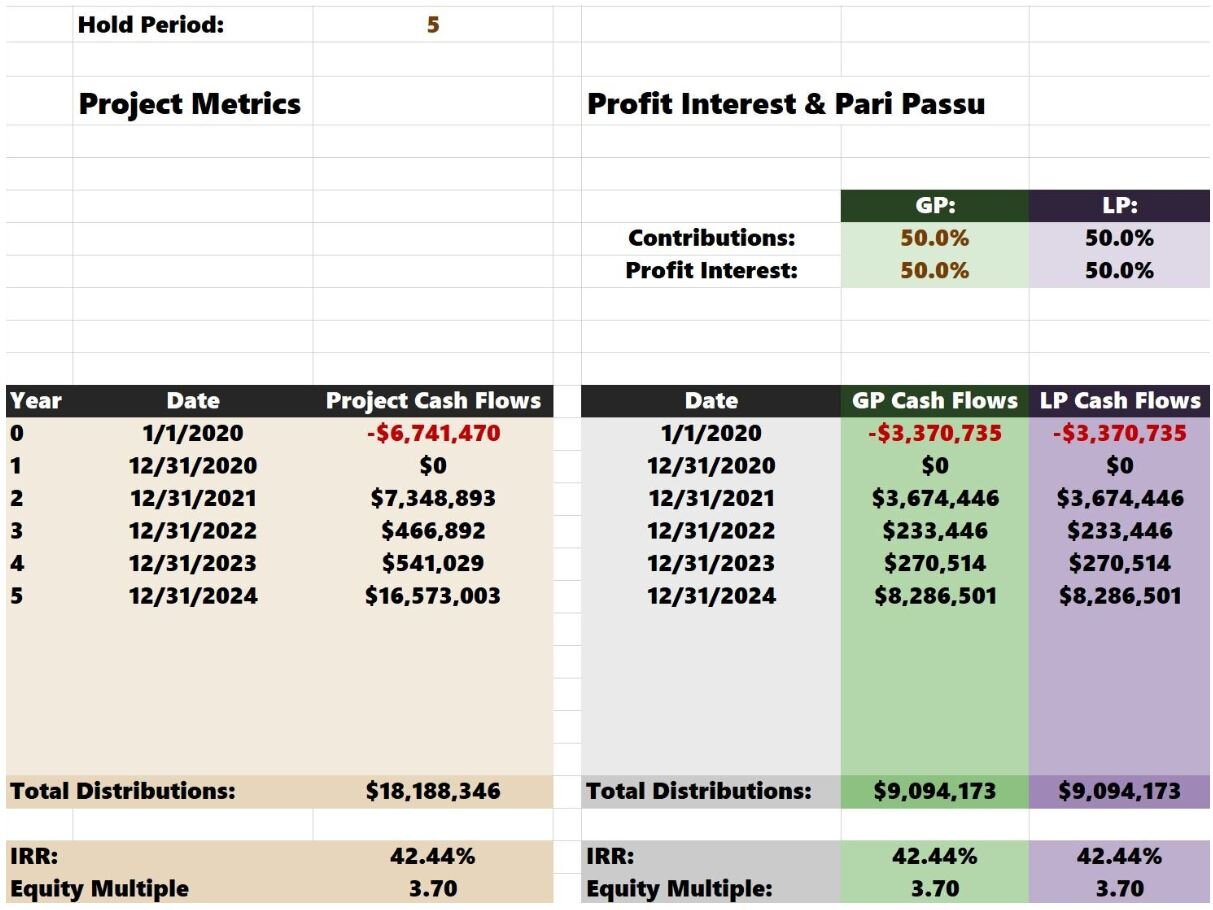

Pari Passu is Latin for "equal portion." This structure is for a deal in which investors' returns are commensurate with what they contribute to the investment. For example, if you and a partner were each putting in 50% of the initial equity, you would split the distributions 50/50 for the hold duration. The distributions would be the following:

The Project IRR to the left (beige background) is the same for each investor (the GP/LP ). There can be multiple investors, too. I've used this model for developments where four or five investors will contribute. It's easy to add a few extra columns to account for the number of investors involved in the deal.

You can also adjust the hold period and see how it affects the distributions.

Note: I refer to the deal sponsor as GP (general partner) and LP (limited partner(s)) as the passive investor (for sponsors syndicating private equity). These partnership models will also service joint venture (JV) structures.

Profit Interest

Some GPs will structure distributions with a profit split. Perhaps they will raise 100% of the necessary equity but maintain a 20% interest in all distributions. The distributions for this arrangement would be the following:

Note: When a GP is not putting money into the deal, they cannot technically measure an IRR or Equity Multiple. In these instances, the model will default to 100.

It’s pretty straightforward. The GP will have the right to 20% of all distributions. In the above example, a development project, they would see a sizable cash infusion in Year 2, when the project refinances from the construction loan.

Preferred Return + Profit Interest

Some GPs will take a profit interest only after their investors (LPs) have achieved a specified preferred return for a given year. This structure is not typical in new development deals. The "Pref" is a specific structure for a value-add business plan where there won't be long spells without cash flow.

I dedicated an article explaining the preferred return structure and detailing its popularity in the investment community.

Simple Interest Waterfall

The simple interest waterfall is very similar to the IRR waterfall but with one major exception:

The IRR waterfall's unpaid preferred return (return hurdle 1) will accrue and compound. The simple interest waterfall's delinquent preferred return will accrue (still owed to the LP) but will not compound.

IRR Waterfall

The IRR waterfall is a common partnership distribution structure that I've seen for new developments and is also popular in the value-add arena. An IRR waterfall allows there to be different profit interests for the GP dependent on different performance thresholds by the investment.

Investors like IRR waterfalls because they are:

Time Sensitive - The quicker the project is built, stabilized, refinanced, and sold will correlate with a higher IRR.

Conservative - The LP gets paid back before the GP reaps the promotion.

One of the downfalls of IRR waterfalls is that there are unlimited variations. I wrote a blog post about some of these structures' complexities and detailing how the IRR Waterfall in our financial models strives to keep distributions fair and straightforward.

I hope that Tactica’s IRR distribution waterfall accomplishes two things:

It is transparent

It doesn't skew distributions favorably to either the GP/LP.

Equity Multiple + Sale Kicker

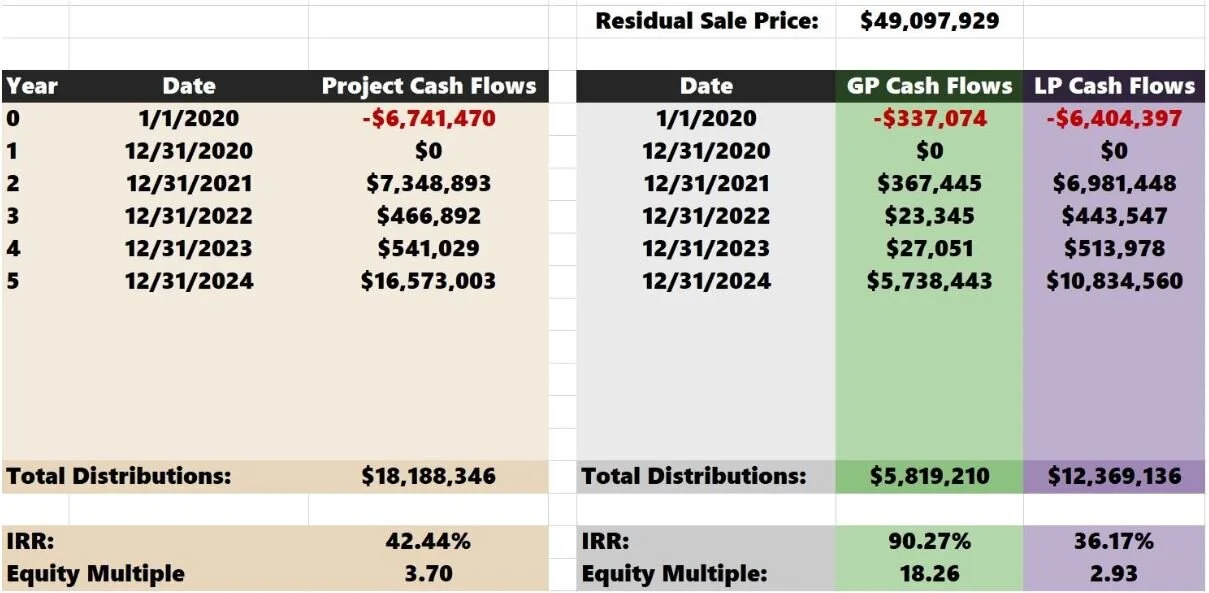

The project would distribute cash flows pari passu until the sale of the property. A back-end GP kicker would be determined depending on what equity multiple the project achieves.

The kicker would be as a percentage of the residual sales price. The GP would be incentivized based on how much they increase the initial equity investment. All incentive is on the back end.

In this example, if the project achieved an equity multiple of more than 3.00, the GP would take a 10% sales kicker. If it produced a 2.75 equity multiple, the kicker would be 6%. Until the sale, the GP earned 5% of the distributions, the original GP contribution.

Because the Project Equity Multiple is over 3.00, the GP would receive an additional 10% of the residual sales price of $49,097,929 (or $4,909,793). This sum is in addition to their 5% distribution of the $16,573,003 Year 5 cash flow.

5% * $16,573,003 = $828,650

Year 5 Distribution = $828,650 + $4,909,793 = $5,738,443

Summarizing Partnership Distribution Models

Finally, comparing all the options and seeing how the structures look from the GP and LP perspectives is nice. The Tactica financials models will allow you to seamlessly compare IRR and equity multiple returns for the GP and LP investors for all six structures mentioned above.

Different possibilities can be used when brainstorming distribution structures with your partners, including more exotic ones like preferred equity and mezzanine financing. The goal was to arm you with six conventional methods seen commonly. It's all about your experience, what you are comfortable with, and what your investors will accept.

If you’re reading this as an LP, vet the deal sponsor and the project.

The partnership distribution models featured above are included in our Multifamily Value-Add, Redevelopment, and Development financial models.